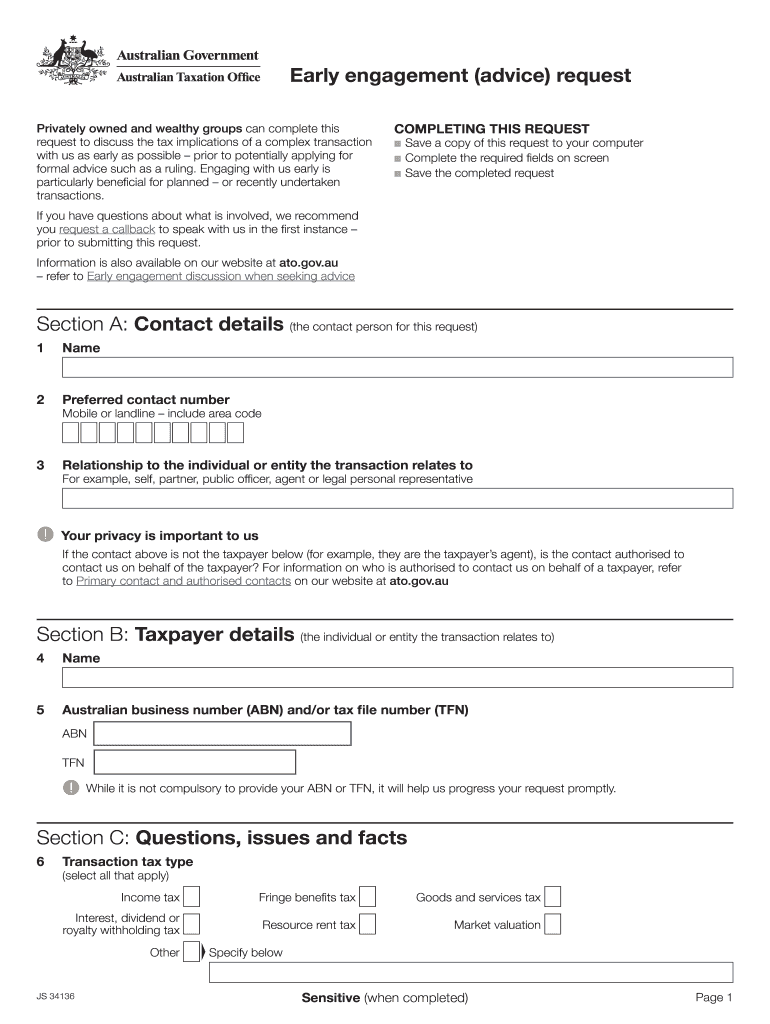

Ato Early Engagement Form

What is the Ato Early Engagement

The Ato Early Engagement, referenced by the form number 1300650286, is a formal request used by taxpayers to engage with the IRS at an early stage regarding specific tax matters. This form allows individuals and businesses to seek guidance on compliance issues, ensuring they meet their obligations under U.S. tax laws. It serves as a proactive approach to clarify uncertainties before they escalate into potential disputes or compliance failures.

Steps to Complete the Ato Early Engagement

Completing the Ato Early Engagement form requires careful attention to detail and adherence to specific guidelines. Here are the essential steps to follow:

- Gather necessary information, including your taxpayer identification number and relevant tax documents.

- Clearly define the issue or question you wish to address with the IRS.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, ensuring you retain a copy for your records.

Legal Use of the Ato Early Engagement

The Ato Early Engagement form is legally recognized within the framework of U.S. tax law. When used appropriately, it allows taxpayers to seek clarification and guidance from the IRS without the risk of penalties for non-compliance during the inquiry period. Proper use of this form ensures that taxpayers can address potential issues before they become significant problems, fostering a cooperative relationship with tax authorities.

Who Issues the Form

The Ato Early Engagement form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides this form as part of its commitment to assist taxpayers in understanding their obligations and navigating complex tax issues effectively.

Required Documents

To successfully complete the Ato Early Engagement form, taxpayers should prepare several key documents. These may include:

- Taxpayer identification number (TIN) or Social Security number (SSN).

- Previous tax returns related to the issue at hand.

- Supporting documentation that outlines the specific tax matter or question.

- Any correspondence with the IRS regarding the issue.

Application Process & Approval Time

The application process for the Ato Early Engagement involves submitting the completed form along with any required documents to the IRS. Once submitted, the IRS will review the request and typically responds within a specified timeframe. While response times can vary based on the complexity of the inquiry, taxpayers can generally expect a reply within several weeks to a few months, depending on the volume of requests and the nature of the issues presented.

Quick guide on how to complete ato early engagement

Prepare Ato Early Engagement effortlessly on any device

Online document administration has gained traction among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Ato Early Engagement on any platform with airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

The simplest way to alter and electronically sign Ato Early Engagement without effort

- Locate Ato Early Engagement and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Ato Early Engagement and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ato early engagement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary purpose of airSlate SignNow with the number 1300650286?

The primary purpose of airSlate SignNow, associated with the number 1300650286, is to provide businesses with an efficient way to send, sign, and manage documents electronically. This service enhances productivity by simplifying the signing process, ensuring that important documents are executed quickly and securely.

-

How does airSlate SignNow support remote work?

AirSlate SignNow, identified by 1300650286, is designed to facilitate remote work by allowing users to send and sign documents from anywhere. This cloud-based solution ensures that teams can collaborate effectively, regardless of their location, making it ideal for organizations transitioning to remote or hybrid models.

-

What are the pricing options available for airSlate SignNow users?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, which are easily accessible through the reference number 1300650286. Users can choose from various subscription tiers that fit their budget and requirements, ensuring that everyone can enjoy the benefits of electronic signing.

-

What features make airSlate SignNow a reliable choice for document management?

AirSlate SignNow, connected with the identifier 1300650286, includes several features that enhance document management, such as customizable templates, automated workflows, and real-time notifications. These functionalities ensure that businesses can manage their agreements effectively and track their progress easily.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow, identified by 1300650286, offers numerous integrations with popular software applications, allowing businesses to streamline their workflows. Whether it's CRM systems, cloud storage solutions, or project management tools, SignNow can seamlessly fit into existing processes.

-

What benefits does airSlate SignNow provide for businesses?

AirSlate SignNow provides various benefits, as highlighted by the reference number 1300650286, including increased efficiency, reduced operational costs, and improved security for document transactions. By adopting this tool, businesses can enhance their overall workflow and experience faster turnaround times.

-

Is airSlate SignNow user-friendly?

Absolutely, airSlate SignNow, associated with 1300650286, is designed with user-friendliness in mind. The intuitive interface allows users of all technical backgrounds to navigate the platform easily, making it accessible for everyone, from small business owners to large enterprise teams.

Get more for Ato Early Engagement

Find out other Ato Early Engagement

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document