Missouri Tire and Battery Tax Form

What is the Missouri Tire And Battery Tax Form

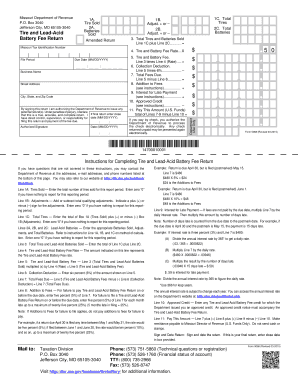

The Missouri Tire and Battery Tax Form, also known as Form 5068, is a tax document required for the collection of taxes on the sale of tires and batteries in Missouri. This form is essential for businesses that sell these products, as it ensures compliance with state tax regulations. The revenue generated from this tax is typically allocated to environmental initiatives and waste management programs.

How to use the Missouri Tire And Battery Tax Form

Using the Missouri Tire and Battery Tax Form involves several steps. First, businesses must accurately calculate the tax owed based on the number of tires and batteries sold. Next, the form must be filled out completely, including all required information such as the seller's details and the total amount of tax due. Once completed, the form can be submitted to the appropriate state tax authority, either electronically or via mail, depending on the business's preference.

Steps to complete the Missouri Tire And Battery Tax Form

Completing the Missouri Tire and Battery Tax Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary sales data for tires and batteries sold during the reporting period.

- Calculate the total tax owed based on the applicable tax rate.

- Fill out Form 5068, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the form to the Missouri Department of Revenue through the preferred method.

Legal use of the Missouri Tire And Battery Tax Form

The Missouri Tire and Battery Tax Form is legally binding when completed and submitted according to state regulations. It is essential for businesses to understand the legal implications of this form, as failure to comply with tax obligations can result in penalties or fines. Proper use of the form ensures that businesses contribute to state environmental efforts and adhere to tax laws.

Key elements of the Missouri Tire And Battery Tax Form

Several key elements must be included in the Missouri Tire and Battery Tax Form to ensure its validity:

- Seller Information: Name, address, and tax identification number of the business.

- Sales Data: Total number of tires and batteries sold during the reporting period.

- Tax Calculation: The total amount of tax owed based on sales.

- Signature: The form must be signed by an authorized representative of the business.

Form Submission Methods

The Missouri Tire and Battery Tax Form can be submitted in various ways. Businesses may choose to file electronically through the Missouri Department of Revenue's online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Each method has specific guidelines that must be followed to ensure successful submission.

Quick guide on how to complete missouri tire and battery tax form

Finalize Missouri Tire And Battery Tax Form seamlessly on any device

Digital document handling has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without interruptions. Manage Missouri Tire And Battery Tax Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Missouri Tire And Battery Tax Form effortlessly

- Obtain Missouri Tire And Battery Tax Form and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Missouri Tire And Battery Tax Form to ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri tire and battery tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri tire and battery tax form?

The Missouri tire and battery tax form is a document used by residents to report and pay taxes on tires and batteries purchased in the state. This tax helps fund environmental initiatives related to tire disposal and battery recycling. Understanding the requirements of this form is essential for compliance and avoiding penalties.

-

How can I obtain the Missouri tire and battery tax form?

You can obtain the Missouri tire and battery tax form from the Missouri Department of Revenue's website or your local tax office. It is also available for download online, making it easier to fill out and submit. Ensure you have the latest version to avoid any discrepancies.

-

What information do I need to fill out the Missouri tire and battery tax form?

To complete the Missouri tire and battery tax form, you will need details about your purchases, including the quantity of tires and batteries sold, the total sale amount, and your business information. Accurate documentation of these details is crucial for a smooth filing process. Always refer to the guidelines provided with the form for precise requirements.

-

Is there a deadline for submitting the Missouri tire and battery tax form?

Yes, the Missouri tire and battery tax form must be submitted by the deadline set by the Missouri Department of Revenue, generally aligning with standard tax filing dates. Late submissions may incur penalties and interest. Be sure to check for specific dates each year to remain compliant.

-

Can I eSign the Missouri tire and battery tax form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily eSign the Missouri tire and battery tax form, making your filing process more efficient and paperless. Our platform offers a user-friendly interface that allows for quick electronic signatures, ensuring you can submit your forms promptly.

-

What are the benefits of using airSlate SignNow for the Missouri tire and battery tax form?

Using airSlate SignNow for the Missouri tire and battery tax form streamlines the signing process, reduces paperwork, and saves time. Our platform offers robust tracking features, so you can monitor the status of your submissions. Additionally, it enhances compliance by providing secure document storage and management.

-

Are there any fees associated with filing the Missouri tire and battery tax form through airSlate SignNow?

There may be fees related to using airSlate SignNow, such as subscription costs for accessing our features. However, these fees are often outweighed by the time and money saved by simplifying document management and eSigning. We provide a cost-effective solution that caters to businesses of all sizes.

Get more for Missouri Tire And Battery Tax Form

Find out other Missouri Tire And Battery Tax Form

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now