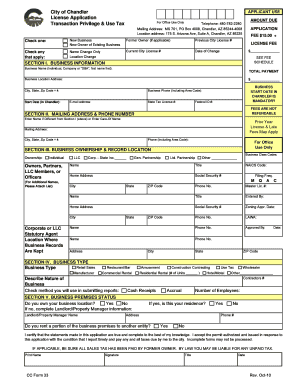

Chandler Transaction Privilege Tax Form

What is the Chandler Transaction Privilege Tax

The Chandler Transaction Privilege Tax (TPT) is a tax levied by the city of Chandler on the privilege of conducting business within its jurisdiction. Unlike a traditional sales tax, the TPT is imposed on the seller rather than the consumer. This means that businesses are responsible for collecting and remitting the tax to the city. The tax applies to various categories of business activities, including retail sales, rental of personal property, and certain services. Understanding the specifics of this tax is essential for compliance and effective business operations in Chandler.

How to complete the Chandler Transaction Privilege Tax Form

Completing the Chandler Transaction Privilege Tax form requires careful attention to detail. First, gather all necessary information about your business, including your business name, address, and tax identification number. Next, identify the type of business activity you are engaged in, as this will determine the applicable tax rate. Fill out the form by providing accurate figures for gross income and any deductions you may qualify for. Ensure that all sections are completed thoroughly to avoid delays in processing. Finally, review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Chandler Transaction Privilege Tax to avoid penalties. Typically, businesses must file their TPT returns on a monthly basis, with the due date falling on the last day of the month following the reporting period. For example, the return for January would be due by the end of February. Additionally, businesses should keep track of any changes in tax rates or regulations that may affect their filing requirements. Staying informed about these dates helps ensure compliance and avoids unnecessary fines.

Form Submission Methods

The Chandler Transaction Privilege Tax form can be submitted through various methods to accommodate different business needs. Businesses have the option to file online through the city’s tax portal, which provides a convenient and efficient way to complete the process. Alternatively, forms can be submitted via mail or in person at designated city offices. Each method has its own advantages, so businesses should choose the one that best fits their operational preferences. Ensure that you retain a copy of the submitted form for your records.

Penalties for Non-Compliance

Failure to comply with the Chandler Transaction Privilege Tax requirements can result in significant penalties. Businesses that do not file their TPT returns on time may incur late fees, which can accumulate over time. Additionally, the city may impose interest charges on any unpaid taxes. In severe cases, non-compliance can lead to legal actions or the revocation of business licenses. It is essential for businesses to understand these penalties and take proactive measures to ensure timely and accurate filings.

Legal use of the Chandler Transaction Privilege Tax

The legal framework surrounding the Chandler Transaction Privilege Tax is established by city ordinances and state laws. Businesses must adhere to these regulations to ensure that they are operating within the law. This includes correctly calculating the tax owed, filing returns on time, and maintaining accurate records of all transactions subject to the tax. Understanding the legal implications of the TPT helps businesses avoid potential disputes and ensures that they contribute appropriately to the city’s revenue.

Key elements of the Chandler Transaction Privilege Tax

Several key elements define the Chandler Transaction Privilege Tax and its application. These include the tax rate, which varies depending on the type of business activity, and the requirement for businesses to obtain a transaction privilege tax license. Additionally, businesses must keep detailed records of their gross income and any deductions claimed. Understanding these elements is vital for businesses to navigate the tax landscape effectively and maintain compliance with local regulations.

Quick guide on how to complete chandler transaction privilege tax

Complete Chandler Transaction Privilege Tax effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Chandler Transaction Privilege Tax on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Chandler Transaction Privilege Tax without any hassle

- Find Chandler Transaction Privilege Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Chandler Transaction Privilege Tax to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chandler transaction privilege tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Chandler privilege tax form?

The city of Chandler privilege tax form is a document used for reporting and paying the privilege tax for businesses operating within the city. This form helps ensure compliance with local taxation laws and regulations. By accurately completing the city of Chandler privilege tax form, businesses can avoid potential fines and penalties.

-

How can airSlate SignNow help with the city of Chandler privilege tax form?

airSlate SignNow simplifies the process of completing and eSigning the city of Chandler privilege tax form. With a user-friendly interface, you can easily fill out the form, collect necessary signatures, and store all related documentation securely. This streamlines the workflow and ensures that your submissions are timely and accurate.

-

Are there any costs associated with using airSlate SignNow for the city of Chandler privilege tax form?

airSlate SignNow offers cost-effective pricing plans tailored to meet the needs of various businesses. Users can choose from different subscription levels, which provide access to diverse features for managing documents, including the city of Chandler privilege tax form. All plans are designed to provide value while ensuring compliance and ease of use.

-

What features does airSlate SignNow offer for processing the city of Chandler privilege tax form?

airSlate SignNow includes several features that facilitate the processing of the city of Chandler privilege tax form, such as template creation, real-time collaboration, and eSignature functionality. These tools enable businesses to manage their tax forms efficiently and ensure they meet deadlines. Additionally, the platform offers secure cloud storage for all completed documents.

-

Is it easy to integrate airSlate SignNow with other business tools for managing the city of Chandler privilege tax form?

Yes, airSlate SignNow is designed to integrate seamlessly with a wide range of business applications, which can streamline the handling of the city of Chandler privilege tax form and other documents. Popular integrations include CRM systems, project management tools, and cloud storage platforms. This flexibility helps enhance your overall workflow and productivity.

-

Can I access the city of Chandler privilege tax form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile-responsive platform that allows users to access the city of Chandler privilege tax form on smartphones and tablets. This mobile capability enables you to complete, eSign, and send documents from anywhere, making it convenient and efficient for busy professionals.

-

What are the benefits of using airSlate SignNow for my city of Chandler privilege tax form process?

Using airSlate SignNow for your city of Chandler privilege tax form process offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced accuracy through eSignatures. The platform also provides tracking capabilities, allowing you to monitor the status of your submissions. Overall, it simplifies compliance and saves time for businesses.

Get more for Chandler Transaction Privilege Tax

Find out other Chandler Transaction Privilege Tax

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word