Form FC TRS Declaration Regarding Transfer of Shares

What is the Form FC TRS Declaration Regarding Transfer Of Shares

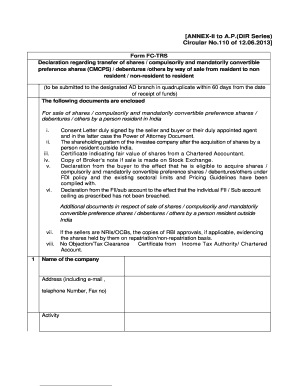

The Form FC TRS Declaration Regarding Transfer Of Shares is a legal document used in the United States to declare the transfer of shares from one party to another. This form is essential in maintaining accurate records of share ownership and ensuring compliance with relevant regulations. It serves as a formal acknowledgment of the transfer, detailing the parties involved, the number of shares being transferred, and any conditions tied to the transfer. Proper execution of this form helps to prevent disputes and provides a clear legal framework for the transaction.

How to use the Form FC TRS Declaration Regarding Transfer Of Shares

Using the Form FC TRS Declaration Regarding Transfer Of Shares involves several key steps. First, gather all necessary information about the parties involved in the transfer, including names, addresses, and the number of shares. Next, accurately fill out the form, ensuring that all details are correct and complete. It is important to have the form signed by all relevant parties to validate the transfer. Once signed, the completed form should be filed with the appropriate regulatory body, if required, to ensure that the transfer is officially recognized.

Steps to complete the Form FC TRS Declaration Regarding Transfer Of Shares

Completing the Form FC TRS Declaration Regarding Transfer Of Shares requires careful attention to detail. Follow these steps:

- Collect the necessary information about the transferor and transferee.

- Determine the number of shares being transferred and any conditions associated with the transfer.

- Fill out the form accurately, ensuring all fields are completed.

- Obtain signatures from both parties to validate the transfer.

- Submit the form to the relevant authority, if applicable.

Key elements of the Form FC TRS Declaration Regarding Transfer Of Shares

Several key elements must be included in the Form FC TRS Declaration Regarding Transfer Of Shares to ensure its validity. These elements include:

- The names and addresses of the transferor and transferee.

- The number of shares being transferred.

- A clear statement indicating the intent to transfer shares.

- Any conditions or restrictions related to the transfer.

- Signatures of both parties, along with the date of signing.

Legal use of the Form FC TRS Declaration Regarding Transfer Of Shares

The legal use of the Form FC TRS Declaration Regarding Transfer Of Shares is crucial for ensuring that share transfers are recognized under U.S. law. This form acts as a binding agreement between the parties involved, outlining their intentions and the specifics of the transfer. To be legally enforceable, the form must be completed accurately, signed by both parties, and submitted as required by state or federal regulations. Failure to comply with these requirements may result in disputes or challenges to the validity of the share transfer.

Form Submission Methods

The Form FC TRS Declaration Regarding Transfer Of Shares can typically be submitted through various methods, depending on the requirements of the relevant authority. Common submission methods include:

- Online submission via a designated portal.

- Mailing the completed form to the appropriate office.

- In-person delivery to the relevant regulatory body.

Quick guide on how to complete form fc trs declaration regarding transfer of shares

Effortlessly prepare [SKS] on any device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed forms, allowing you to access the necessary documents and securely maintain them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your paperwork promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools available to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides expressly for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form FC TRS Declaration Regarding Transfer Of Shares

Create this form in 5 minutes!

How to create an eSignature for the form fc trs declaration regarding transfer of shares

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form FC TRS Declaration Regarding Transfer Of Shares?

The Form FC TRS Declaration Regarding Transfer Of Shares is a necessary document for foreign investors in India to declare their share transfer activities. This form ensures compliance with the Foreign Exchange Management Act (FEMA) regulations. Using airSlate SignNow, you can easily create, send, and eSign this form, streamlining your documentation process.

-

How can airSlate SignNow help with the Form FC TRS Declaration Regarding Transfer Of Shares?

airSlate SignNow provides an intuitive platform for preparing and executing the Form FC TRS Declaration Regarding Transfer Of Shares. With our eSigning features, you can quickly sign and send the document electronically, reducing manual paperwork and increasing efficiency. This helps businesses remain compliant while saving time.

-

Is there a cost associated with using airSlate SignNow for the Form FC TRS Declaration Regarding Transfer Of Shares?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan provides access to essential features, including eSigning and document management for the Form FC TRS Declaration Regarding Transfer Of Shares. You can choose a plan based on your frequency of use and the volume of documents you manage.

-

Can I integrate airSlate SignNow with my existing systems for handling the Form FC TRS Declaration Regarding Transfer Of Shares?

Absolutely! airSlate SignNow offers seamless integrations with various platforms such as CRM systems, cloud storage, and project management tools. This allows you to incorporate the Form FC TRS Declaration Regarding Transfer Of Shares into your existing workflows, enhancing productivity and ensuring that all documents are correctly managed.

-

What are the key features of airSlate SignNow for managing the Form FC TRS Declaration Regarding Transfer Of Shares?

Key features of airSlate SignNow include customizable templates, advanced eSigning options, and secure cloud storage. You can personalize the Form FC TRS Declaration Regarding Transfer Of Shares to fit your branding and compliance needs. Additionally, our platform ensures that all signed documents are stored securely for easy access.

-

What are the benefits of using airSlate SignNow for the Form FC TRS Declaration Regarding Transfer Of Shares?

Using airSlate SignNow for the Form FC TRS Declaration Regarding Transfer Of Shares offers numerous benefits, including increased efficiency and lower operational costs. Our platform simplifies the signing process, allowing for quicker turnaround times. Furthermore, it ensures compliance with legal requirements, giving you peace of mind.

-

Is it easy to create a Form FC TRS Declaration Regarding Transfer Of Shares with airSlate SignNow?

Yes, creating a Form FC TRS Declaration Regarding Transfer Of Shares is straightforward with airSlate SignNow. Our user-friendly interface provides guided templates and pre-defined fields, making it easy to fill out and customize the form. You can complete the process in just a few clicks.

Get more for Form FC TRS Declaration Regarding Transfer Of Shares

Find out other Form FC TRS Declaration Regarding Transfer Of Shares

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney