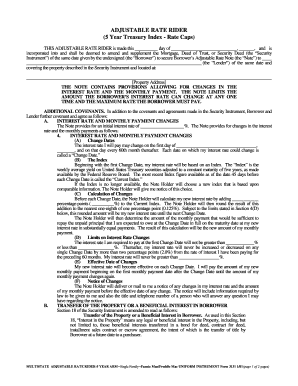

Adjustable Rate Rider Form

What is the Adjustable Rate Rider

The adjustable rate rider is a legal document that modifies the terms of a mortgage by allowing for changes in the interest rate over time. This rider is often attached to a fixed-rate mortgage, enabling borrowers to take advantage of fluctuating market rates. The adjustable rate rider specifies how and when the interest rate can change, providing clarity on the terms of the loan.

How to use the Adjustable Rate Rider

Using the adjustable rate rider involves understanding its terms and ensuring it aligns with your financial goals. Borrowers typically review the rider before signing the mortgage agreement. It is essential to comprehend how the interest rate adjustments will affect monthly payments and overall loan costs. Consulting with a financial advisor can help clarify the implications of using this rider.

Steps to complete the Adjustable Rate Rider

Completing the adjustable rate rider requires careful attention to detail. Follow these steps:

- Review the terms of the mortgage and the rider.

- Fill out the necessary information, including loan amount and borrower details.

- Specify the adjustment intervals and any caps on rate changes.

- Sign the document to acknowledge understanding and agreement.

- Submit the completed rider to your lender for processing.

Legal use of the Adjustable Rate Rider

The adjustable rate rider must comply with federal and state regulations to be legally binding. It is crucial that the document is executed properly, including obtaining necessary signatures and ensuring all parties understand the terms. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is also important for electronic versions of the rider.

Key elements of the Adjustable Rate Rider

Several key elements define the adjustable rate rider, including:

- Adjustment Period: The frequency at which the interest rate can change.

- Index: The benchmark used to determine rate changes.

- Margin: The percentage added to the index to calculate the new interest rate.

- Rate Caps: Limits on how much the interest rate can increase at each adjustment.

Examples of using the Adjustable Rate Rider

Borrowers may use the adjustable rate rider in various scenarios. For instance, a homeowner might choose this rider to benefit from lower initial interest rates, anticipating that rates will remain stable or decrease. Alternatively, investors may opt for an adjustable rate rider to maximize cash flow on rental properties, taking advantage of lower rates during the initial period.

Quick guide on how to complete adjustable rate rider

Complete Adjustable Rate Rider effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without complications. Handle Adjustable Rate Rider on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Adjustable Rate Rider effortlessly

- Find Adjustable Rate Rider and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you would like to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassles of lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Adjustable Rate Rider and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the adjustable rate rider

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an adjustable rate rider in the context of electronic signatures?

An adjustable rate rider is a feature that allows businesses to modify the terms of an agreement automatically as conditions change. In the context of electronic signatures, this feature ensures that all parties can seamlessly update their documents without needing to start the signing process from scratch.

-

How does airSlate SignNow support the adjustable rate rider feature?

AirSlate SignNow provides an easy-to-use platform that integrates an adjustable rate rider functionality, enabling users to adjust their agreement terms efficiently. This ensures that businesses can maintain accuracy and compliance as rates change, minimizing potential disruptions.

-

What are the benefits of using an adjustable rate rider in contracts?

Using an adjustable rate rider in contracts offers flexibility and responsiveness to changing economic conditions. It allows businesses to adapt quickly without renegotiating all terms, ultimately saving time and reducing administrative burdens.

-

Is there a pricing difference when utilizing the adjustable rate rider feature in airSlate SignNow?

The adjustable rate rider feature is included within the comprehensive pricing plans offered by airSlate SignNow. This cost-effective solution makes it easier for businesses to implement dynamic agreements without incurring additional fees.

-

Can I integrate the adjustable rate rider functionality with other tools?

Yes, airSlate SignNow offers seamless integrations with various business applications. This allows you to utilize the adjustable rate rider feature in conjunction with your existing tools, ensuring a smooth workflow across your business processes.

-

How does an adjustable rate rider improve the eSigning process?

An adjustable rate rider streamlines the eSigning process by allowing users to easily modify and sign documents based on current data. This eliminates delays associated with reissuing contracts, thereby improving overall efficiency in document management.

-

What types of documents commonly require an adjustable rate rider?

Documents such as loan agreements and leases frequently incorporate adjustable rate riders. These documents benefit from the ability to adapt terms over time, reflecting market changes and protecting the interests of all parties involved.

Get more for Adjustable Rate Rider

Find out other Adjustable Rate Rider

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors