Form 22c

What is the Form 22c

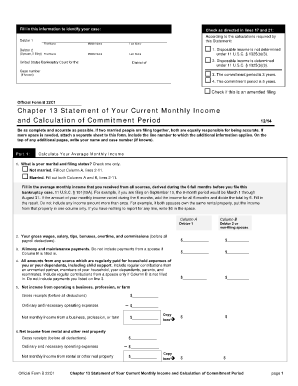

The form 22c is an income tax document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). It is essential for taxpayers who are required to disclose their income, deductions, and credits accurately. Understanding the purpose and requirements of this form can help individuals and businesses ensure compliance with federal tax laws.

How to use the Form 22c

Using the form 22c involves several steps to ensure accurate reporting of financial information. Taxpayers must first gather all necessary financial documents, including income statements and receipts for deductions. Once the required information is collected, the form can be filled out by entering relevant details in the designated fields. It is crucial to review the completed form for accuracy before submission to avoid any potential issues with the IRS.

Steps to complete the Form 22c

Completing the form 22c requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including W-2s and 1099s.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your total income accurately, including wages, interest, and dividends.

- List all deductions and credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 22c

The form 22c must be used in compliance with IRS regulations to ensure its legality. This includes providing accurate information and submitting the form by the established deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is important for taxpayers to understand their responsibilities when using this form to avoid any issues with their tax filings.

Filing Deadlines / Important Dates

Timely submission of the form 22c is crucial for compliance. The IRS typically sets specific deadlines for filing income tax forms, which may vary each year. Taxpayers should be aware of these dates to avoid late fees or penalties. Generally, the deadline for filing individual income tax returns falls on April fifteenth, unless an extension is requested. Keeping track of these important dates can help ensure a smooth filing process.

Required Documents

To complete the form 22c accurately, taxpayers need to gather several key documents. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements showing interest income

- Any other relevant financial documentation

Having these documents ready will facilitate the accurate completion of the form and support any claims made.

Form Submission Methods (Online / Mail / In-Person)

The form 22c can be submitted through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online submission through the IRS e-filing system

- Mailing a paper copy to the appropriate IRS address

- In-person submission at designated IRS offices

Each method has its own advantages, such as faster processing times for online submissions. Taxpayers should choose the method that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form 22c

Complete Form 22c effortlessly on any device

Web-based document management has become widely favored among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form 22c on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 22c with ease

- Find Form 22c and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 22c and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 22c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 22c and how does it work?

Form 22c is a specific document used for filing in certain legal and administrative processes. airSlate SignNow streamlines this process by allowing users to create, send, and eSign form 22c quickly and efficiently. Our platform simplifies document management and enhances compliance, making it easier for businesses to handle necessary paperwork.

-

How much does it cost to use airSlate SignNow for form 22c?

airSlate SignNow offers competitive pricing options for users looking to eSign and manage form 22c. We provide different subscription plans tailored to meet various needs, ensuring that you get the best value for your investment. Check our pricing page for detailed information about our packages and any available discounts.

-

What features does airSlate SignNow provide for handling form 22c?

Our platform includes a variety of features designed to enhance the handling of form 22c, such as customizable templates, real-time tracking, and automated reminders. Additionally, users can easily invite others to sign, ensuring a smooth eSigning process. These features optimize efficiency and improve the accuracy of your document management.

-

Can I integrate airSlate SignNow with other applications when working with form 22c?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage form 22c in conjunction with your existing tools. Whether you use CRM systems, email software, or cloud storage, our platform provides the flexibility to integrate and streamline your workflow. This ensures that you can work efficiently without having to switch between multiple applications.

-

Is airSlate SignNow secure for eSigning form 22c?

Absolutely! Security is a priority at airSlate SignNow, especially when it comes to sensitive documents like form 22c. We utilize industry-standard encryption and compliance protocols to ensure that your data and eSignatures are protected. You can trust us to safeguard your information while you efficiently manage your documents.

-

How does airSlate SignNow improve the signing process for form 22c?

airSlate SignNow enhances the signing process for form 22c by offering a user-friendly interface and expedited workflows. With features like one-click eSigning and the ability to send reminders, we minimize delays in document processing. Our platform is designed to make getting signatures faster and more straightforward.

-

Can I customize form 22c using airSlate SignNow?

Yes, airSlate SignNow allows you to customize form 22c to suit your specific business requirements. You can modify fields, add logos, and incorporate branding elements to ensure that the form reflects your company's identity. This level of customization enhances your professionalism and aligns with your business's image.

Get more for Form 22c

- Contingency bill form

- Da form 5840

- Backflow prevention form city of round rock roundrocktexas

- 5e lesson plan sample pdf form

- Weaving calculation excel sheet form

- Kendriya vidyalaya worksheets for class 3 evs form

- 16comheif recordbook template docx goliad agrilife form

- Ushering agency registration form 275681439

Find out other Form 22c

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding