Form No 15h See Rule 29c1a for Senior Citizen How to Fill Detail

What is the Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail

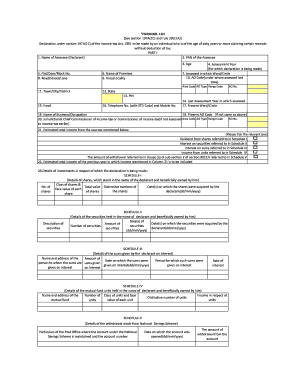

The Form No 15H, as referenced in Rule 29C1A, is a declaration form specifically designed for senior citizens in the United States. It allows eligible individuals to ensure that no tax is deducted from their income. This form is particularly relevant for those whose total income is below the taxable limit. By submitting this form, senior citizens can declare their income and avoid unnecessary tax deductions, thereby simplifying their financial management.

How to use the Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail

Using the Form No 15H involves a straightforward process. Senior citizens must first gather relevant financial information, including details of their income sources. Once the necessary information is collected, they can proceed to fill out the form accurately. It is essential to ensure that all details are correct to prevent any issues with tax authorities. After completing the form, it must be submitted to the relevant financial institution or authority that requires it.

Steps to complete the Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail

Completing the Form No 15H involves several key steps:

- Gather all necessary documents, including proof of income and identification.

- Fill out personal details, including name, address, and contact information.

- Provide information about your income sources, ensuring accuracy.

- Sign and date the form to validate your declaration.

- Submit the completed form to the appropriate institution or authority.

Legal use of the Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail

The legal use of Form No 15H is crucial for senior citizens to avoid tax deductions on their income. By accurately filling out and submitting this form, individuals comply with tax regulations while asserting their eligibility for non-deduction. It is important to keep a copy of the submitted form for personal records and future reference. This legal documentation can be vital in case of any inquiries from tax authorities.

Eligibility Criteria

To be eligible to use Form No 15H, senior citizens must meet specific criteria. Generally, individuals must be above a certain age, typically sixty years or older, and their total income should fall below the taxable threshold set by the IRS. It is essential to review the current tax guidelines to ensure compliance with the eligibility requirements before submitting the form.

Required Documents

When filling out Form No 15H, several documents are necessary to support the declaration. These may include:

- Proof of age, such as a birth certificate or government-issued ID.

- Income statements, including pension slips, bank statements, or other income proofs.

- Any previous tax returns that may be relevant to the current year.

Form Submission Methods (Online / Mail / In-Person)

Form No 15H can be submitted through various methods, depending on the requirements of the financial institution or authority. Options typically include:

- Online submission through the institution's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at the local office of the relevant authority.

Quick guide on how to complete form no 15h see rule 29c1a for senior citizen how to fill detail

Complete Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail smoothly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail effortlessly

- Find Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 15h see rule 29c1a for senior citizen how to fill detail

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form No 15h See Rule 29c1a For Senior Citizen?

Form No 15h is a declaration that senior citizens can use to ensure that no TDS is deducted on their interest income. It is crucial for individuals aged 60 and above who want to avoid unnecessary tax deductions. Understanding how to fill this form correctly can save you money and ensure compliance with tax regulations.

-

How do I fill out Form No 15h See Rule 29c1a For Senior Citizen?

To fill out Form No 15h, you need to provide your personal details, including your name, address, and PAN. Ensure that all information is accurate and truthful to facilitate the processing of your form. If you’re uncertain about any specifics, consider seeking assistance from a tax professional.

-

Are there any fees associated with filing Form No 15h See Rule 29c1a For Senior Citizen?

Filing Form No 15h is typically free of cost as it is a declaration submitted to your bank or financial institution. However, if you require assistance from financial advisors or tax consultants, their services may incur a fee. It's advisable to check for any hidden costs before proceeding.

-

Can airSlate SignNow help me with eSigning Form No 15h See Rule 29c1a For Senior Citizen?

Yes, airSlate SignNow offers a user-friendly platform for eSigning documents, including Form No 15h. You can easily upload, sign, and send your forms without needing to print them out, saving you time and resources. The process is secure, ensuring your information remains confidential.

-

What are the benefits of using airSlate SignNow for Form No 15h See Rule 29c1a For Senior Citizen?

Using airSlate SignNow to handle Form No 15h makes the submission process quicker and more efficient. The platform boosts productivity by minimizing paperwork and facilitating faster transactions. Additionally, it offers secure storage, which is crucial for sensitive documents like tax forms.

-

Does airSlate SignNow integrate with other tools when filling Form No 15h See Rule 29c1a For Senior Citizen?

Absolutely! airSlate SignNow integrates seamlessly with various business tools such as Google Drive, Dropbox, and CRM systems. This feature simplifies document management and enhances workflow efficiency, especially when dealing with Form No 15h for senior citizens.

-

What should I do if my Form No 15h See Rule 29c1a For Senior Citizen is rejected?

If your Form No 15h is rejected, review the reason for the rejection carefully and make the necessary corrections. Ensure that all details provided are accurate and complete. You may resubmit the form after rectifying the issues, or consult a tax professional for further guidance.

Get more for Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail

- Proper person certificate form

- An elemental tale the gold dust kid form

- Notice to enter dwelling form

- Aarp retirement budget worksheet excel form

- Modified checklist for autism in toddlers form

- Henry county business license application form

- Uncontested stipulated parentage judgment forms packet

- Biopsychosocial assessment clinton counseling center form

Find out other Form No 15h See Rule 29c1a For Senior Citizen How To Fill Detail

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile