Oregon Lb 50 2014

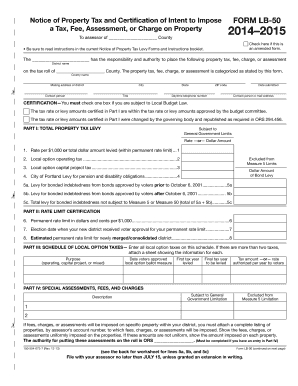

What is the Oregon LB 50?

The Oregon LB 50 is a tax form used by businesses in Oregon to report and pay the state's business income tax. This form is essential for various business entities, including corporations, partnerships, and limited liability companies (LLCs). It provides a structured way for businesses to disclose their income, deductions, and tax liability to the state. Understanding the purpose and requirements of the LB 50 is crucial for compliance and to avoid potential penalties.

How to Use the Oregon LB 50

Using the Oregon LB 50 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise details regarding your business's income and allowable deductions. It is important to review the instructions carefully, as each section requires specific information. Once completed, the form must be submitted to the appropriate state agency by the designated deadline.

Steps to Complete the Oregon LB 50

Completing the Oregon LB 50 involves a systematic approach:

- Collect all relevant financial documents for the reporting period.

- Fill in your business's identifying information, including the name, address, and tax ID number.

- Report total income and allowable deductions accurately.

- Calculate the tax owed based on the provided instructions.

- Review the form for any errors or omissions.

- Submit the completed form by the deadline, either online or by mail.

Legal Use of the Oregon LB 50

The Oregon LB 50 is legally binding when completed and submitted according to state regulations. Businesses must ensure that all information provided is accurate and truthful to avoid legal repercussions. Compliance with the state's tax laws is essential, as failure to file or inaccuracies in reporting can lead to penalties, interest, or audits. Utilizing reliable digital tools can enhance the legal standing of the submitted form by ensuring proper signatures and secure data transmission.

Required Documents

To complete the Oregon LB 50, businesses must gather specific documents, including:

- Financial statements, including profit and loss statements.

- Records of all business income and expenses.

- Previous tax returns, if applicable.

- Any supporting documentation for deductions claimed.

Form Submission Methods

The Oregon LB 50 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Oregon Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at designated state revenue offices, if necessary.

Quick guide on how to complete oregon lb 50

Complete Oregon Lb 50 easily on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Oregon Lb 50 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The simplest way to modify and electronically sign Oregon Lb 50 without hassle

- Locate Oregon Lb 50 and click Get Form to begin.

- Make use of the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Oregon Lb 50 and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon lb 50

Create this form in 5 minutes!

How to create an eSignature for the oregon lb 50

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form lb 50 oregon?

The form lb 50 oregon is a tax form used for reporting business income and expenses in the state of Oregon. It is essential for ensuring compliance with local tax regulations. By correctly completing and submitting the form lb 50 oregon, businesses can accurately report their financial performance.

-

How can airSlate SignNow help with submitting the form lb 50 oregon?

airSlate SignNow provides an efficient platform for digitally signing and sending the form lb 50 oregon. With our user-friendly interface, you can fill out the form, eSign it, and send it directly to the appropriate authorities. This streamlines the submission process and ensures compliance with Oregon's requirements.

-

What are the pricing options for using airSlate SignNow for the form lb 50 oregon?

airSlate SignNow offers flexible pricing plans to suit various business needs when dealing with forms like the form lb 50 oregon. Our cost-effective solution provides value for any organization, from small startups to large enterprises. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specific to the form lb 50 oregon in airSlate SignNow?

Yes, airSlate SignNow includes features tailored specifically to enhance the workflow for the form lb 50 oregon. Our platform allows users to easily access templates, set up reminders, and track the status of their submission. These features ensure that businesses can manage their tax documents efficiently.

-

What are the benefits of using airSlate SignNow for the form lb 50 oregon?

Using airSlate SignNow for the form lb 50 oregon streamlines the entire process, saving you time and money. Our platform allows for quick eSigning and document management, reducing the hassle of paper-based workflows. Additionally, you gain increased security and compliance assurance with every submission.

-

Can I integrate airSlate SignNow with other software when processing the form lb 50 oregon?

Absolutely! airSlate SignNow offers various integrations with popular software tools that can assist you in processing the form lb 50 oregon. This means you can seamlessly connect your CRM, accounting, or project management tools for a more streamlined workflow.

-

Is the form lb 50 oregon only for Oregon-based businesses?

Yes, the form lb 50 oregon is specifically designed for businesses operating in Oregon. It is critical for compliance with the state’s tax laws. However, businesses outside of Oregon should consult their local regulations regarding similar forms.

Get more for Oregon Lb 50

Find out other Oregon Lb 50

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU