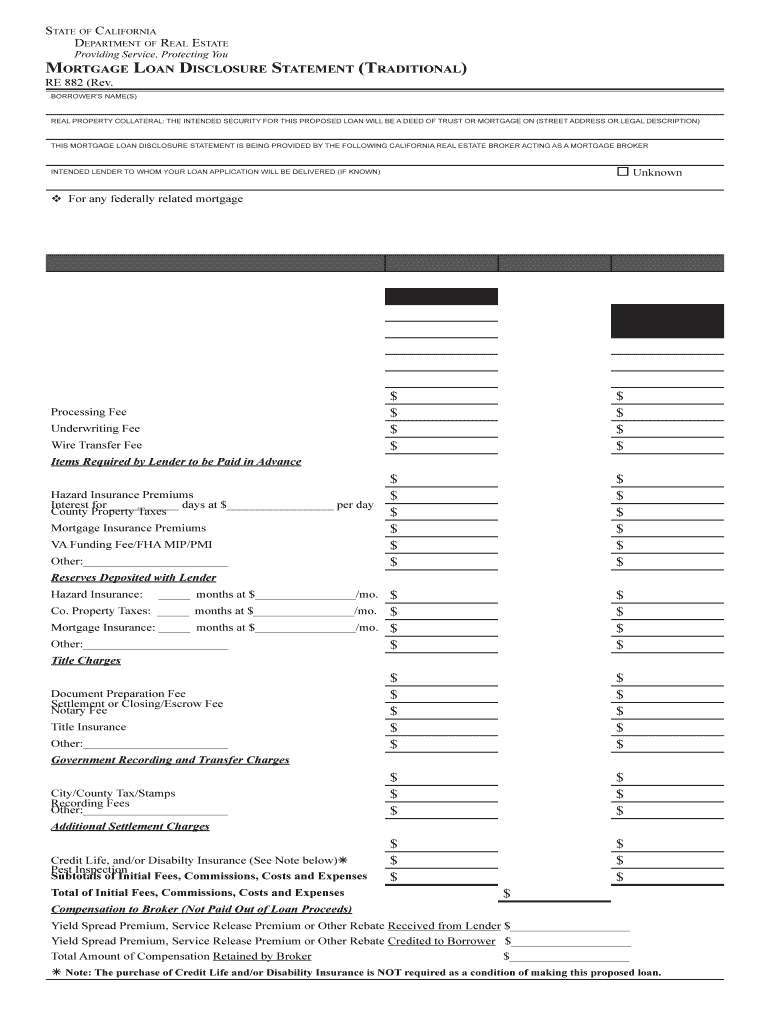

Mortgage Loan Disclosure 2010-2025 Form

What makes the california mortgage loan legally valid?

Real estate professionals deal with the buying and selling of property, therefore, all contracts and forms, which they prepare for their clients, must be properly drafted and be legally binding when executed. Such papers are legitimate if they include all information about both buyer and seller, identify the description of the property, its address and price, and contain dates of deal with signatures of all parties affirming they accept the terms. For electronic templates, there's also a requirement to generate and sign them with a compliant tool that totally fulfills eSignature and information security requirements.

To make your electronic mortgage statement example legally valid, use airSlate SignNow, a trustworthy eSignature platform that meets all key industry legal guidelines. Obtain the template from the forms catalog, include fillable fields for different types of data, assign Roles to them, and collect legitimate electronic signatures from your parties. All document transactions will be registered in the detailed Audit Trail.

How to protect your mortgage disclosure statement when completing it online

Many people still have concerns when dealing with electronic forms and signing them online, stressing about the safety of their records and signers' identification. To make them feel safer, airSlate SignNow provides users with supplementary methods of document protection. While preparing your ca 882 for an eSignature invite, use one of the following capabilities to prevent unauthorized access to your samples:

- Lock every template with a password and give it directly to your recipients;

- Ask signers to authenticate themselves with a phone call or text message code to confirm their identity before completing and signing your document;

- Set up the session duration after which a signer must re-login and authenticate themselves again.

Quick guide on how to complete ca loan disclosure statement

Cross your t's and dot your i's on Mortgage loan disclosure

Engaging in agreements, overseeing listings, coordinating gatherings, and viewings—realtors and property agents navigate a variety of responsibilities daily. Many of these tasks require numerous forms, such as mortgage loan disclosure statement, which must be handled according to designated deadlines and with utmost accuracy.

airSlate SignNow is an all-inclusive solution that enables professionals in real estate to ease the forms burden and allows them to focus more on their clients’ goals throughout the entire negotiation process, helping them secure the best conditions on the transaction.

How to complete california mortgage loan with airSlate SignNow:

- Access the mortgage statement example page or utilize our library’s search functionalities to locate the form you require.

- Select Get form-you’ll be swiftly directed to the editor.

- Begin filling out the document by selecting fillable fields and inputting your text into them.

- Add new text and modify its settings if needed.

- Select the Sign option in the upper toolbar to create your signature.

- Explore additional features used to annotate and enhance your document, such as drawing, highlighting, adding shapes, and more.

- Click on the note tab and make notes related to your document.

- Conclude the process by downloading, sharing, or forwarding your document to your specified recipients or entities.

Bid farewell to paper for good and enhance the homebuying experience with our intuitive and powerful solution. Experience increased convenience when completing mortgage disclosure statement and other real estate forms online. Give our solution a try!

Create this form in 5 minutes or less

Video instructions and help with filling out and completing California 882 Form

Instructions and help about california mortgage disclosure statement

Related searches to mortgage loan disclosure statement form

Create this form in 5 minutes!

How to create an eSignature for the california mortgage disclosure

How to create an electronic signature for your Re 882 Mortgage Loan Disclosure Statement Traditional Re 882 Mortgage Loan Disclosure Statement Traditional in the online mode

How to make an electronic signature for the Re 882 Mortgage Loan Disclosure Statement Traditional Re 882 Mortgage Loan Disclosure Statement Traditional in Google Chrome

How to make an electronic signature for signing the Re 882 Mortgage Loan Disclosure Statement Traditional Re 882 Mortgage Loan Disclosure Statement Traditional in Gmail

How to make an eSignature for the Re 882 Mortgage Loan Disclosure Statement Traditional Re 882 Mortgage Loan Disclosure Statement Traditional from your mobile device

How to make an eSignature for the Re 882 Mortgage Loan Disclosure Statement Traditional Re 882 Mortgage Loan Disclosure Statement Traditional on iOS devices

How to generate an electronic signature for the Re 882 Mortgage Loan Disclosure Statement Traditional Re 882 Mortgage Loan Disclosure Statement Traditional on Android devices

People also ask ca mortgage loan form

-

What is a mortgage loan disclosure?

A mortgage loan disclosure is a document that provides comprehensive details about the terms of a mortgage loan. This disclosure includes important information such as interest rates, fees, and the total cost of the loan, helping borrowers make informed decisions. Understanding your mortgage loan disclosure is crucial for a smooth mortgage process.

-

How does airSlate SignNow simplify the mortgage loan disclosure process?

airSlate SignNow streamlines the mortgage loan disclosure process by enabling users to electronically sign and send documents securely and efficiently. With its user-friendly interface, businesses can quickly prepare and share mortgage loan disclosures, reducing paper waste and expediting the closing process. Additionally, the platform provides a complete audit trail for all documents.

-

What are the benefits of using airSlate SignNow for mortgage loan disclosures?

Using airSlate SignNow for mortgage loan disclosures offers numerous benefits, including faster turnaround times and reduced errors in document handling. The platform’s eSignature feature ensures that all signatories can easily and securely sign documents from anywhere. This efficiency enhances customer satisfaction and can lead to higher conversion rates for loan providers.

-

Is airSlate SignNow compliant with mortgage loan disclosure regulations?

Yes, airSlate SignNow is designed to comply with all relevant regulations regarding mortgage loan disclosures. The platform adheres to industry standards and legal requirements, ensuring that documents are processed in accordance with compliance laws. Users can be confident that their electronic signatures and disclosures are legally binding.

-

What integrations does airSlate SignNow offer for mortgage loan disclosure management?

airSlate SignNow integrates with various popular CRM and document management systems, enhancing the management of mortgage loan disclosures. These integrations allow users to streamline workflows by connecting with platforms they already use, thus improving efficiency. This seamless connectivity helps mortgage professionals stay organized and responsive to client needs.

-

Can airSlate SignNow help manage multiple mortgage loan disclosures at once?

Absolutely! airSlate SignNow allows users to manage multiple mortgage loan disclosures simultaneously, making it an ideal solution for businesses handling high volumes of loans. The platform's batching features enable users to send out disclosures in bulk, saving time and effort. It’s a scalable solution that grows with your business needs.

-

What pricing options are available for airSlate SignNow users focusing on mortgage loan disclosures?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes looking to manage mortgage loan disclosures. Whether you are a small business or a large enterprise, there are affordable options available that provide access to essential features. Interested users can explore a free trial to experience the benefits firsthand before committing.

Get more for mortgage loan disclosure form

- Ausbildungsvertrag pdf form

- Rbs account closure form

- Notebook case file form

- United states refugee admissions program usrap pdf 199 kb uscis form

- Noc for sale paf officers fazaia housing scheme form

- Ficha de cadastro para professor nome nacionalidade antigo univille form

- Cop form pdf

- Checklist of self management skills form

Find out other ca mortgage loan statement

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Now

- eSignature South Dakota Government Contract Mobile

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Myself

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Free

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Secure

- eSignature South Dakota Government Contract Now

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Fast

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Simple

- How To eSignature South Dakota Government Claim

- eSignature South Dakota Government Contract Later

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Easy

- eSignature Kentucky Finance & Tax Accounting Confidentiality Agreement Safe

- eSignature South Dakota Government Contract Myself

- How Do I eSignature South Dakota Government Claim

- eSignature South Dakota Government Contract Free

- How To eSignature South Dakota Government Contract

- How Do I eSignature South Dakota Government Contract

- Help Me With eSignature South Dakota Government Claim

- Help Me With eSignature South Dakota Government Contract

- eSignature South Dakota Government Contract Secure