Ifta Fuel Tax Report 9610012100 Form

What is the Ifta Fuel Tax Report 9610012100

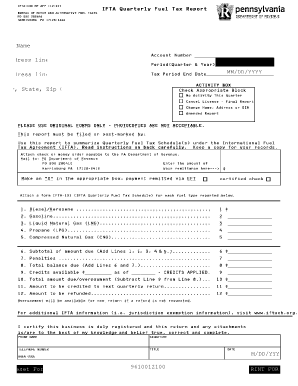

The IFTA Fuel Tax Report 9610012100 is a crucial document for interstate commercial vehicle operators in the United States. It serves as a means to report fuel usage and calculate the taxes owed to various states under the International Fuel Tax Agreement (IFTA). This report consolidates fuel tax information for vehicles that operate in multiple jurisdictions, allowing for a streamlined process of tax reporting and payment. By filing this report, businesses ensure compliance with state regulations and contribute to road maintenance and infrastructure funding.

Steps to Complete the Ifta Fuel Tax Report 9610012100

Completing the IFTA Fuel Tax Report 9610012100 involves several key steps:

- Gather all necessary data, including total miles driven in each state and total fuel purchased.

- Calculate the total fuel consumption for each jurisdiction where the vehicle operated.

- Determine the tax owed for each state based on the fuel consumed and the applicable tax rates.

- Complete the report by entering all calculated figures into the appropriate sections of the form.

- Review the completed report for accuracy before submission.

Using a digital platform can simplify this process, ensuring that all calculations are accurate and that the form is filled out correctly.

Key Elements of the Ifta Fuel Tax Report 9610012100

The IFTA Fuel Tax Report 9610012100 includes several essential components:

- Identification Information: This section requires the carrier's name, address, and IFTA account number.

- Mileage Records: Total miles driven in each state must be documented, distinguishing between taxable and non-taxable miles.

- Fuel Purchases: A detailed account of fuel purchases in each jurisdiction is necessary, including gallons purchased and the type of fuel.

- Tax Calculation: The report must include calculations for taxes owed based on the fuel consumed in each state.

- Signature: A signature is required to certify that the information provided is accurate and complete.

Legal Use of the Ifta Fuel Tax Report 9610012100

The IFTA Fuel Tax Report 9610012100 is legally binding when completed and submitted in accordance with state laws. It must be filed quarterly by all IFTA-registered carriers to maintain compliance. Failure to file or inaccuracies in the report can lead to penalties, including fines and potential audits. It is essential to ensure that the report is filled out correctly and submitted by the deadline to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Fuel Tax Report 9610012100 are typically set on a quarterly basis. The deadlines are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

It is important for carriers to keep track of these dates to ensure timely submission and avoid late fees.

Form Submission Methods

The IFTA Fuel Tax Report 9610012100 can be submitted through various methods, including:

- Online Submission: Many states offer online portals for electronic filing, which can expedite the process and provide immediate confirmation.

- Mail: Carriers can also send the completed form via postal service to the appropriate state agency.

- In-Person: Some jurisdictions allow for in-person submission at designated offices.

Choosing the right submission method can enhance efficiency and ensure that the report is received on time.

Quick guide on how to complete ifta fuel tax report 9610012100

Complete Ifta Fuel Tax Report 9610012100 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources required to create, alter, and eSign your documents quickly and without complications. Manage Ifta Fuel Tax Report 9610012100 on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Ifta Fuel Tax Report 9610012100 with ease

- Locate Ifta Fuel Tax Report 9610012100 and then click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Ifta Fuel Tax Report 9610012100 and ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta fuel tax report 9610012100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IFTA 100 form PA used for?

The IFTA 100 form PA is used to report fuel use by motor carriers operating across states. This form ensures compliance with the International Fuel Tax Agreement and helps businesses calculate their fuel tax liabilities.

-

How can airSlate SignNow assist with the IFTA 100 form PA?

airSlate SignNow simplifies the process of completing and eSigning the IFTA 100 form PA. You can efficiently fill out the required information and ensure that your documents are compliant and securely stored.

-

Is there a cost associated with using airSlate SignNow for the IFTA 100 form PA?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and submission of the IFTA 100 form PA efficiently.

-

What features does airSlate SignNow offer for the IFTA 100 form PA?

airSlate SignNow includes features such as customizable templates for the IFTA 100 form PA, real-time tracking of document status, and secure eSigning options. These features make it easy for businesses to manage their tax documents effectively.

-

Can I store my IFTA 100 form PA securely using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for your IFTA 100 form PA and any other documents. This ensures that your important tax information is safe and accessible whenever you need it.

-

Does airSlate SignNow integrate with other tools for managing the IFTA 100 form PA?

Yes, airSlate SignNow offers integrations with various business tools, enhancing the workflow for managing the IFTA 100 form PA. This allows you to streamline processes like accounting and document management seamlessly.

-

How does eSigning the IFTA 100 form PA benefit my business?

eSigning the IFTA 100 form PA through airSlate SignNow eliminates the hassle of printing and mailing documents. It speeds up the process, ensuring you meet compliance deadlines without unnecessary delays.

Get more for Ifta Fuel Tax Report 9610012100

Find out other Ifta Fuel Tax Report 9610012100

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy