Nol Carryforward Schedule Form

What is the Nol Carryforward Schedule

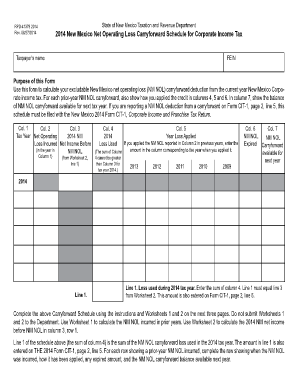

The nol carryforward schedule is a tax form used by businesses and individuals to report net operating losses (NOL) that can be carried forward to offset future taxable income. This schedule allows taxpayers to utilize losses incurred in previous years to reduce their tax liability in profitable years. Understanding the nol carryforward schedule is essential for effective tax planning and compliance with Internal Revenue Service (IRS) regulations.

How to Use the Nol Carryforward Schedule

To effectively use the nol carryforward schedule, taxpayers must first determine the amount of net operating loss available for carryforward. This amount is calculated based on the losses reported in prior tax years. Once the amount is established, it can be applied against taxable income in subsequent years, thereby lowering the overall tax burden. It is crucial to keep accurate records of losses and ensure that the correct amounts are reported on the schedule.

Steps to Complete the Nol Carryforward Schedule

Completing the nol carryforward schedule involves several key steps:

- Calculate the total net operating loss for the year in which the loss occurred.

- Determine the carryforward period based on IRS guidelines, which typically allows losses to be carried forward for up to 20 years.

- Fill out the schedule by entering the calculated loss amounts in the appropriate sections.

- Attach the completed schedule to the tax return for the year in which the carryforward is being claimed.

Legal Use of the Nol Carryforward Schedule

The nol carryforward schedule must be used in compliance with IRS regulations to ensure its legal validity. Taxpayers should be aware of the specific rules governing the carryforward of net operating losses, including limitations on the amount that can be carried forward each year. Proper documentation and adherence to filing deadlines are critical to avoid penalties and ensure that the losses are recognized by the IRS.

IRS Guidelines

The IRS provides detailed guidelines regarding the use of the nol carryforward schedule, including eligibility criteria and filing requirements. Taxpayers should familiarize themselves with IRS publications, such as Publication 536, which outlines the rules for net operating losses. Staying informed about changes in tax laws and IRS regulations is essential for accurate reporting and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the nol carryforward schedule align with the overall tax return deadlines. Typically, individual taxpayers must file their returns by April fifteenth, while corporations may have different deadlines based on their fiscal year. It is important to note that extensions may be available, but the carryforward must still be calculated accurately within the specified time frames to ensure compliance.

Quick guide on how to complete nol carryforward schedule

Complete Nol Carryforward Schedule effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Nol Carryforward Schedule on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to alter and eSign Nol Carryforward Schedule with ease

- Obtain Nol Carryforward Schedule and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Nol Carryforward Schedule and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nol carryforward schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nol carryforward schedule in relation to airSlate SignNow?

The nol carryforward schedule is a vital component in understanding how businesses can utilize their net operating losses effectively. With airSlate SignNow, you can seamlessly manage and eSign important documents related to your nol carryforward schedule, ensuring that your financial strategies are well-documented and easily accessible.

-

How does airSlate SignNow help with managing my nol carryforward schedule?

airSlate SignNow provides businesses with an intuitive platform to create, send, and manage documents associated with their nol carryforward schedule. This ensures that you can track your losses and decision-making processes efficiently while remaining compliant with tax regulations.

-

Is there a cost associated with creating documents for a nol carryforward schedule on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for managing your nol carryforward schedule. The pricing packages are designed to cater to businesses of all sizes, allowing you to select a plan that fits your budget and document management needs.

-

Can airSlate SignNow integrate with my accounting software for nol carryforward schedule management?

Absolutely! airSlate SignNow integrates with various accounting and financial software, making it easier to sync your nol carryforward schedule data. This integration allows for a seamless flow of information, ensuring your financial records are up-to-date and accurately reflect your business's tax situation.

-

What features does airSlate SignNow offer to assist with my nol carryforward schedule?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing your nol carryforward schedule. These tools help streamline your documentation processes, saving time and reducing the risk of errors.

-

How secure is my information when using airSlate SignNow for my nol carryforward schedule?

Security is a top priority for airSlate SignNow. When managing your nol carryforward schedule, your documents are protected by advanced encryption and secure storage protocols to ensure that sensitive information remains confidential and secure.

-

Can I access my nol carryforward schedule documents from any device with airSlate SignNow?

Yes, airSlate SignNow is compatible with various devices, allowing you to access your nol carryforward schedule documents from anywhere. Whether you're using a computer, tablet, or smartphone, you can easily manage and eSign your documents on-the-go.

Get more for Nol Carryforward Schedule

Find out other Nol Carryforward Schedule

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe