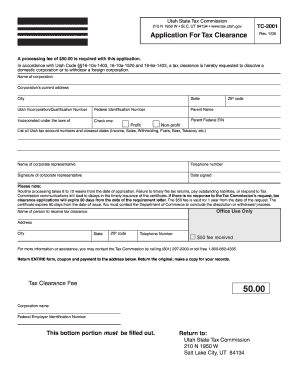

Utah Tc Form

What is the Utah TC Form

The Utah TC Form is a tax form used by residents of Utah to report their income and calculate their tax liability. This form is essential for individuals and businesses to ensure compliance with state tax laws. It collects information regarding income sources, deductions, and credits, which ultimately determine the amount of tax owed or refunded. Understanding the purpose and requirements of the Utah TC Form is crucial for accurate tax reporting.

How to obtain the Utah TC Form

The Utah TC Form can be obtained through several methods. It is available for download directly from the Utah State Tax Commission's website. Additionally, individuals can request a physical copy by contacting the tax commission office. Many tax preparation software programs also include the Utah TC Form, allowing users to fill it out electronically. It is advisable to ensure that the most current version of the form is used to comply with any recent changes in tax regulations.

Steps to complete the Utah TC Form

Completing the Utah TC Form involves several key steps:

- Gather all necessary documentation, including income statements, W-2 forms, and any relevant deductions.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, ensuring accuracy to avoid discrepancies.

- Include any applicable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Utah TC Form

The legal use of the Utah TC Form is governed by state tax laws. It must be completed accurately and submitted by the designated deadline to avoid penalties. The form serves as a legal document that can be used to verify income and tax obligations. Failure to use the form correctly may result in audits or additional tax liabilities. Therefore, it is essential to follow all instructions and ensure compliance with the relevant tax regulations.

Key elements of the Utah TC Form

The Utah TC Form includes several key elements that are essential for proper completion:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, dividends, and interest.

- Deductions and Credits: This section allows taxpayers to claim deductions and credits that may reduce their tax liability.

- Tax Calculation: The form includes a section for calculating the total tax owed or refund due based on the information provided.

Form Submission Methods

The Utah TC Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Taxpayers can file electronically using approved tax software or through the Utah State Tax Commission's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate tax commission address.

- In-Person Submission: Taxpayers may also submit the form in person at designated tax commission offices.

Quick guide on how to complete utah tc form

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure remarkable communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utah tc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utah Tc Form and how is it used?

The Utah Tc Form is a crucial document utilized for various transactions in Utah, especially in real estate. It is essential for ensuring a legal and efficient transfer of property. By using airSlate SignNow, you can easily complete and eSign the Utah Tc Form from anywhere, simplifying the process signNowly.

-

Is airSlate SignNow compatible with the Utah Tc Form?

Yes, airSlate SignNow is fully compatible with the Utah Tc Form. Our platform allows businesses to prepare, send, and eSign the form seamlessly. You can customize the document to meet your needs while ensuring compliance with Utah regulations.

-

What features does airSlate SignNow offer for completing the Utah Tc Form?

airSlate SignNow offers a variety of features specifically designed to enhance your experience with the Utah Tc Form. These include templates, in-app notifications, and advanced security measures. With our platform, you can efficiently manage all your documents, making the signing process quick and straightforward.

-

How much does airSlate SignNow cost for using the Utah Tc Form?

airSlate SignNow provides a cost-effective solution for managing the Utah Tc Form, with pricing plans suitable for businesses of all sizes. Our subscription options offer flexibility based on your needs, ensuring you only pay for what you use. Sign up today for a trial to explore our features at no cost.

-

Can I integrate airSlate SignNow with other applications to manage the Utah Tc Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms to manage the Utah Tc Form efficiently. Whether you use CRM software or cloud storage services, our integrations ensure that you can handle all your documents in one place.

-

What are the benefits of using airSlate SignNow for the Utah Tc Form?

Using airSlate SignNow for the Utah Tc Form streamlines the signing process, making it faster and more efficient. Our platform offers enhanced security features, saving you time and reducing the risk of errors. This allows you to focus on your business while we take care of your document needs.

-

Is electronic signing of the Utah Tc Form legally valid?

Yes, electronic signing of the Utah Tc Form using airSlate SignNow is legally valid and complies with Utah laws. Our platform adheres to E-Sign and UETA regulations, providing a secure environment for electronic signatures. This ensures that your documents are legally binding and recognized.

Get more for Utah Tc Form

- Warranty deed from individual to corporation vermont form

- Vt vehicle title form

- Quitclaim deed from individual to llc vermont form

- Warranty deed from individual to llc vermont form

- Petition to appoint a guardian for a minor or minors vermont form

- Petition guardian for form

- Guardianship spendthrift form

- Appoint guardian for form

Find out other Utah Tc Form

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement