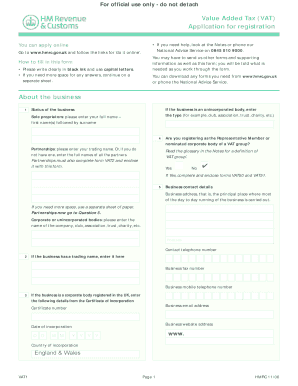

Vat1 Form

What is the Vat1 Form

The Vat1 form is a tax-related document used primarily for reporting and claiming Value Added Tax (VAT) refunds in the United States. This form is essential for businesses that have incurred VAT on purchases and wish to recover those costs. It serves as a formal request to the tax authorities, detailing the amounts eligible for refund. Understanding the purpose and function of the Vat1 form is crucial for businesses to ensure compliance and maximize their tax benefits.

How to Obtain the Vat1 Form

To obtain the Vat1 form, individuals and businesses can visit the official website of the tax authority or relevant government agency. The form is typically available for download in PDF format, allowing users to print and fill it out manually. Additionally, some tax software solutions may offer the Vat1 form as part of their services, enabling users to complete it digitally. It is important to ensure that the version downloaded is the most current to avoid any compliance issues.

Steps to Complete the Vat1 Form

Completing the Vat1 form involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant financial documents, including invoices and receipts that detail the VAT paid.

- Fill Out Personal and Business Details: Enter your name, business name, address, and tax identification number at the top of the form.

- Detail VAT Amounts: Clearly list the amounts of VAT you are claiming for refund, including any supporting calculations.

- Review for Accuracy: Double-check all entries for correctness to avoid delays in processing.

- Sign and Date: Ensure that the form is signed and dated before submission.

Legal Use of the Vat1 Form

The Vat1 form is legally binding when completed and submitted according to the guidelines set forth by the tax authority. It must be filled out accurately and truthfully to avoid penalties or legal repercussions. The form serves as a formal declaration of the VAT amounts being claimed and must be supported by appropriate documentation. Understanding the legal implications of submitting the Vat1 form is essential for businesses to maintain compliance and protect their interests.

Filing Deadlines / Important Dates

Filing deadlines for the Vat1 form can vary based on the specific tax year and the regulations set by the tax authority. It is important for businesses to be aware of these dates to ensure timely submission. Typically, the deadlines align with the end of the fiscal year or specific reporting periods. Missing these deadlines may result in the denial of refund claims or penalties. Keeping a calendar of important dates related to the Vat1 form can help businesses stay organized and compliant.

Form Submission Methods

The Vat1 form can be submitted through various methods, including online, by mail, or in person, depending on the regulations of the tax authority. Online submissions are often encouraged for their speed and efficiency, allowing for quicker processing times. If submitting by mail, it is advisable to use a trackable service to ensure that the form is received. In-person submissions may be available at designated tax offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete vat1 form

Complete Vat1 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Handle Vat1 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign Vat1 Form without any hassle

- Obtain Vat1 Form and click Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes necessitating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Vat1 Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT 1 form, and why is it important?

The VAT 1 form is an official document used for VAT registration within the EU and other regions. It is important because it helps businesses accurately report their VAT obligations, ensuring compliance with tax regulations and avoiding potential penalties.

-

How can airSlate SignNow help me with VAT 1 forms?

airSlate SignNow simplifies the process of completing and submitting VAT 1 forms by providing an easy-to-use digital signing and document management platform. You can quickly create, edit, and eSign your VAT 1 forms, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for VAT 1 forms?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. With competitive pricing, it provides a cost-effective solution for managing and eSigning VAT 1 forms without the hassle of paper-based processes.

-

What features does airSlate SignNow offer for managing VAT 1 forms?

airSlate SignNow offers features like document templates, real-time collaboration, secure storage, and mobile access, all designed to streamline your VAT 1 form management. These features enhance productivity and ensure your forms are processed efficiently.

-

Can I integrate airSlate SignNow with other applications for VAT 1 forms?

Yes, airSlate SignNow seamlessly integrates with numerous applications such as CRMs and document management systems. This allows you to easily manage your VAT 1 forms alongside other business processes for a more streamlined workflow.

-

How secure is airSlate SignNow when handling VAT 1 forms?

Security is a priority at airSlate SignNow. When dealing with VAT 1 forms, your data is protected with encryption and secure storage, ensuring that your sensitive VAT information is safe from unauthorized access.

-

Can I track the status of my VAT 1 forms in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your VAT 1 forms in real-time. This helps you stay organized and ensures that no important deadlines are missed during the submission process.

Get more for Vat1 Form

- Sme direct form new and maintenance mashreq

- Daily safety task instruction examples form

- Wett inspection checklist form

- By the waters of babylon questions pdf form

- Oklahoma tax exempt form pdf

- Adult sentence completion form

- United states department of homeland security wikipediaunited states department of homeland security wikipediaunited states form

- Form i 942 instructions instructions for request for reduced fee

Find out other Vat1 Form

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later