Minnesota Tax Court Form 7

What is the Minnesota Tax Court Form 7

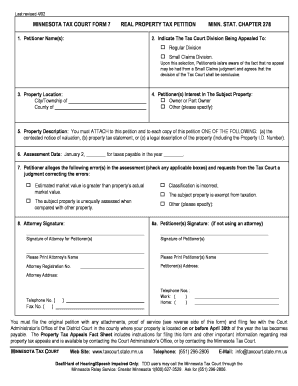

The Minnesota Tax Court Form 7 is a specific document used for appealing property tax assessments in Minnesota. This form allows taxpayers to formally contest the valuation placed on their property by local assessors. It is essential for individuals or businesses who believe their property has been overvalued or improperly assessed, as it initiates the legal process for review by the Minnesota Tax Court.

How to use the Minnesota Tax Court Form 7

To effectively use the Minnesota Tax Court Form 7, taxpayers must complete the form accurately, providing all required information regarding their property and the reasons for the appeal. This includes details such as the property address, the assessed value, and any supporting evidence that demonstrates why the assessment is incorrect. Once completed, the form must be filed with the appropriate court to initiate the appeal process.

Steps to complete the Minnesota Tax Court Form 7

Completing the Minnesota Tax Court Form 7 involves several key steps:

- Gather necessary information, including property details and assessment notices.

- Fill out the form, ensuring all sections are completed with accurate data.

- Attach supporting documentation, such as photographs, comparable property assessments, or expert appraisals.

- Review the form for completeness and accuracy before submission.

- Submit the form to the Minnesota Tax Court within the designated filing period.

Legal use of the Minnesota Tax Court Form 7

The Minnesota Tax Court Form 7 is legally binding once it is properly filled out and submitted. It serves as the official record of the taxpayer's appeal and must adhere to specific legal requirements set forth by Minnesota law. This includes filing within the appropriate time frame and providing sufficient evidence to support the appeal. Failure to comply with these legal standards may result in the dismissal of the appeal.

Required Documents

When filing the Minnesota Tax Court Form 7, several documents are typically required to support the appeal. These may include:

- A copy of the property tax statement.

- Documentation of the property's assessed value.

- Any relevant appraisal reports or assessments from comparable properties.

- Evidence supporting the claim of overvaluation or incorrect assessment.

Form Submission Methods

The Minnesota Tax Court Form 7 can be submitted through various methods. Taxpayers may choose to file the form online, via mail, or in person at the appropriate court location. Each method has its own guidelines, so it is important to follow the specific instructions provided by the Minnesota Tax Court to ensure timely processing of the appeal.

Quick guide on how to complete minnesota tax court form 7

Complete Minnesota Tax Court Form 7 effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to generate, modify, and eSign your documents swiftly without delays. Manage Minnesota Tax Court Form 7 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Minnesota Tax Court Form 7 effortlessly

- Find Minnesota Tax Court Form 7 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to misplaced or lost files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Minnesota Tax Court Form 7 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota tax court form 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota Tax Court Form 7?

The Minnesota Tax Court Form 7 is a specific form used to appeal property tax assessments in Minnesota. It serves as a formal request to challenge the valuation of your property, providing a structured format for presenting your case to the tax court.

-

How can airSlate SignNow help me with the Minnesota Tax Court Form 7?

airSlate SignNow simplifies the process of completing and submitting the Minnesota Tax Court Form 7 by allowing users to eSign documents quickly. The platform offers templates and intuitive tools to ensure that your form is filled out accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Minnesota Tax Court Form 7?

Yes, there is a pricing model for using airSlate SignNow, but it is designed to be cost-effective for users needing to submit forms like the Minnesota Tax Court Form 7. Various subscription plans are available to accommodate different user needs, ensuring you only pay for what you use.

-

What features does airSlate SignNow offer for managing the Minnesota Tax Court Form 7?

airSlate SignNow offers several features to streamline the management of the Minnesota Tax Court Form 7, including customizable templates, document tracking, and secure eSigning. These features allow you to complete your form efficiently and keep track of its status throughout the submission process.

-

Can I integrate airSlate SignNow with other tools for processing the Minnesota Tax Court Form 7?

Absolutely! airSlate SignNow seamlessly integrates with various business tools, including cloud storage and management software. This allows you to easily manage and store your Minnesota Tax Court Form 7 alongside other important documents.

-

What are the benefits of using airSlate SignNow for the Minnesota Tax Court Form 7 compared to traditional methods?

Using airSlate SignNow for the Minnesota Tax Court Form 7 offers several benefits, including faster turnaround times and reduced paper usage. The digital format helps streamline the entire process, making it easier to sign and submit your form quickly and efficiently.

-

Is airSlate SignNow secure for filing the Minnesota Tax Court Form 7?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including the Minnesota Tax Court Form 7, are protected with advanced encryption. Your data is safe during transfer and storage, complying with best practices in digital security.

Get more for Minnesota Tax Court Form 7

Find out other Minnesota Tax Court Form 7

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA