Illinois Department of Revenue Eft 11 Form

What is the Illinois Department of Revenue EFT 11?

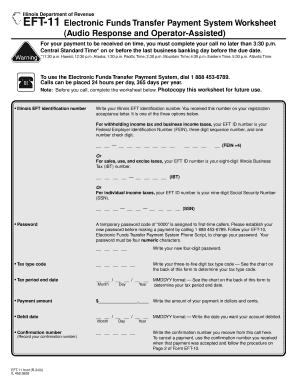

The Illinois Department of Revenue EFT 11 is a form used for electronic funds transfer (EFT) payments for various tax obligations. This form allows taxpayers to submit payments electronically, streamlining the process and ensuring timely compliance with state tax regulations. It is essential for businesses and individuals who prefer digital transactions over traditional paper-based methods.

How to use the Illinois Department of Revenue EFT 11

Using the Illinois EFT 11 worksheet involves a few straightforward steps. First, ensure you have the correct version of the form, which can be downloaded from the Illinois Department of Revenue website. Next, fill out the form with accurate information, including your taxpayer identification number, payment amount, and the tax type. Once completed, you can submit the form electronically through the designated online portal, ensuring that you follow any specific instructions provided for digital submissions.

Steps to complete the Illinois Department of Revenue EFT 11

Completing the Illinois EFT 11 requires careful attention to detail. Here are the steps to follow:

- Download the Illinois EFT 11 worksheet from the official website.

- Provide your taxpayer identification number accurately.

- Indicate the payment amount and the specific tax type you are addressing.

- Review all entries for accuracy to avoid any potential issues.

- Submit the completed form electronically via the Illinois Department of Revenue's online platform.

Legal use of the Illinois Department of Revenue EFT 11

The Illinois EFT 11 form is legally binding when completed and submitted according to the guidelines set by the Illinois Department of Revenue. To ensure its legal validity, it is crucial to comply with all electronic signature regulations and requirements. This includes using a secure platform that provides a digital certificate, which confirms the identity of the signer and maintains the integrity of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois EFT 11 worksheet vary depending on the type of tax being paid. It is essential to stay informed about these dates to avoid penalties. Generally, payments must be submitted by the due date specified for each tax type, which can be found on the Illinois Department of Revenue website. Mark your calendar to ensure timely submissions and avoid any late fees or interest charges.

Required Documents

When completing the Illinois EFT 11, certain documents may be required to support your submission. Typically, you will need your taxpayer identification number, details of the tax obligation, and any prior correspondence from the Illinois Department of Revenue that pertains to your account. Having these documents on hand will facilitate a smooth and efficient filing process.

Form Submission Methods (Online / Mail / In-Person)

The Illinois EFT 11 can be submitted through various methods, primarily online for efficiency. The online submission is encouraged for faster processing. Alternatively, if you prefer traditional methods, you can mail the completed form to the appropriate address provided by the Illinois Department of Revenue. In-person submissions are also an option, but it is advisable to check the current protocols and hours of operation before visiting.

Quick guide on how to complete illinois department of revenue eft 11

Effortlessly prepare Illinois Department Of Revenue Eft 11 on any device

The management of documents online has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Illinois Department Of Revenue Eft 11 on any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric procedures today.

How to modify and eSign Illinois Department Of Revenue Eft 11 with ease

- Find Illinois Department Of Revenue Eft 11 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Decide how you wish to share your form, whether by email, text (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Illinois Department Of Revenue Eft 11 to ensure clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue eft 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois EFT 11 worksheet?

The Illinois EFT 11 worksheet is a document used for electronic fund transfers in the state of Illinois. It simplifies the payment process for businesses by allowing them to execute transactions electronically, reducing paperwork and errors.

-

How can airSlate SignNow help with the Illinois EFT 11 worksheet?

airSlate SignNow provides an efficient platform for eSigning and sending your Illinois EFT 11 worksheet. With its easy-to-use interface, you can complete and manage your documents securely and quickly, ensuring timely payments.

-

Is there a cost associated with using airSlate SignNow for the Illinois EFT 11 worksheet?

Yes, while airSlate SignNow offers various pricing plans, many users find the value it provides for managing documents like the Illinois EFT 11 worksheet worth the investment. The plans are designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow include for handling the Illinois EFT 11 worksheet?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and real-time tracking for documents like the Illinois EFT 11 worksheet. These features enhance efficiency and simplify the signing process.

-

Can I integrate airSlate SignNow with other software for the Illinois EFT 11 worksheet?

Absolutely! airSlate SignNow integrates smoothly with various software solutions that your business might already be using. This capability ensures that you can easily manage the Illinois EFT 11 worksheet alongside other workflows.

-

What are the benefits of using airSlate SignNow for the Illinois EFT 11 worksheet?

Using airSlate SignNow to manage your Illinois EFT 11 worksheet provides multiple benefits, including increased efficiency, reduced processing times, and enhanced security. These advantages allow you to streamline your payment processes effectively.

-

Is electronic signing of the Illinois EFT 11 worksheet legally binding?

Yes, electronic signatures made through airSlate SignNow are legally binding for the Illinois EFT 11 worksheet. The platform complies with federal and state regulations, ensuring that your signed documents hold up in legal contexts.

Get more for Illinois Department Of Revenue Eft 11

- Tattoo license virginia form

- Cbp permit to proceed form

- Teas plus application pdf form

- Flrt form 3100a form

- Glasses prescription order form infab

- State of rhode island medicare premium payment mpp form

- Medicare premium payment program application ri department of dhs ri form

- Dental implant consent form onsitesurgicalcom

Find out other Illinois Department Of Revenue Eft 11

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free