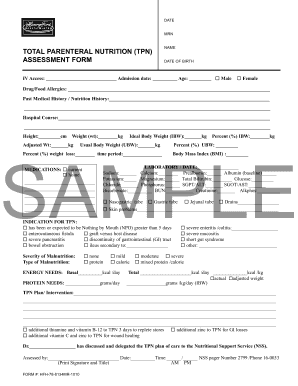

Tpn Form

What is the TPN Form

The TPN form, or Third Party Notification form, is a document used primarily in the context of tax administration. It allows taxpayers to designate a third party to receive notifications regarding their tax accounts. This form is particularly useful for individuals who may require assistance managing their tax obligations, such as the elderly or those with disabilities. By completing the TPN form, taxpayers can ensure that important tax information is communicated effectively to someone they trust.

How to Use the TPN Form

Using the TPN form involves several straightforward steps. First, download the form from the appropriate tax authority's website or obtain a physical copy. Next, fill in the required information, including the taxpayer's details and the designated third party's information. It is essential to provide accurate contact information for the third party to ensure they receive notifications. After completing the form, submit it according to the instructions provided, either online or via mail, to ensure proper processing.

Steps to Complete the TPN Form

Completing the TPN form requires careful attention to detail. Here are the steps to follow:

- Download the TPN form from the tax authority's website.

- Fill in the taxpayer's name, address, and Social Security number.

- Provide the third party's name, address, and contact information.

- Sign and date the form to authorize the third party to receive notifications.

- Submit the completed form as directed, ensuring it is sent to the correct address.

Legal Use of the TPN Form

The TPN form is legally binding once it is completed and submitted according to the guidelines set forth by the tax authority. It complies with relevant tax laws and regulations, allowing the designated third party to receive critical information about the taxpayer's account. It is important to ensure that both the taxpayer and the third party understand their rights and responsibilities under this arrangement, which can help avoid any potential misunderstandings.

Required Documents

When completing the TPN form, certain documents may be necessary to support the submission. Typically, these include:

- A valid form of identification for the taxpayer, such as a driver's license or Social Security card.

- Proof of the relationship between the taxpayer and the third party, if applicable.

- Any previous correspondence from the tax authority that may be relevant to the request.

Examples of Using the TPN Form

The TPN form can be utilized in various scenarios. For instance, an elderly taxpayer may fill out the form to allow their child to receive tax notifications on their behalf. Similarly, a person with a disability might designate a trusted friend or caregiver to manage their tax communications. These examples highlight the form's flexibility in accommodating different taxpayer needs while ensuring that essential information is conveyed efficiently.

Quick guide on how to complete tpn form

Prepare Tpn Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can find the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Tpn Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign Tpn Form with ease

- Obtain Tpn Form and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Tpn Form to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpn form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tpn full form and how does it relate to airSlate SignNow?

The tpn full form refers to 'Total Parenteral Nutrition.' While this term is more commonly associated with healthcare, at airSlate SignNow, we focus on empowering businesses to streamline their document signing processes. Understanding various terms like 'tpn full form' is essential for effective communication in many industries.

-

How can airSlate SignNow help businesses with electronic signatures related to tpn full form?

airSlate SignNow provides a simple way to eSign documents, such as medical forms associated with the tpn full form. Our platform allows for secure and legally-binding signatures, enhancing the efficiency of documentation in any industry, including healthcare.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Whether you are looking for basic features or comprehensive solutions, you can find an option that fits your budget. Visit our pricing page to see detailed plans, including features related to document management and eSigning.

-

What features does airSlate SignNow provide?

airSlate SignNow includes a range of features designed to simplify document workflows. Key features include document templates, automatic reminders, and integration with various platforms to ensure a seamless experience. These tools can enhance the processing of forms related to the tpn full form.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow allows businesses to save time and reduce paperwork. The ability to eSign documents securely means faster turnaround times, which is crucial for time-sensitive documents. This efficiency can be particularly beneficial in situations requiring knowledge of terms like 'tpn full form'.

-

Can airSlate SignNow integrate with other platforms?

Yes, airSlate SignNow seamlessly integrates with various third-party applications including CRMs, cloud storage, and productivity tools. This flexibility allows users to connect their existing systems to enhance document signing processes, thus providing a comprehensive solution that accommodates specific needs including those related to 'tpn full form'.

-

Is airSlate SignNow secure for handling sensitive information?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to ensure your documents are protected. Features such as encryption and secure cloud storage mean that even sensitive information related to the tpn full form can be shared and signed safely.

Get more for Tpn Form

Find out other Tpn Form

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online