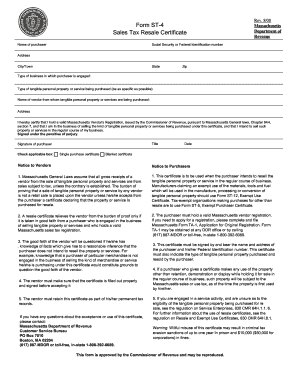

Form ST 4 Sales Tax Resale Certificate

What is the Form ST 4 Sales Tax Resale Certificate

The Form ST 4 is a Sales Tax Resale Certificate used in the United States, specifically in Massachusetts. This form allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. By presenting the ST 4 form to suppliers, businesses can avoid the upfront costs associated with sales tax, which can be beneficial for cash flow management.

The ST 4 form is essential for retailers and wholesalers who buy products to sell to consumers. It serves as proof that the purchaser is a registered vendor and is not the final consumer of the goods. This certificate is an important part of maintaining compliance with state tax regulations.

How to use the Form ST 4 Sales Tax Resale Certificate

Using the Form ST 4 involves several straightforward steps. First, ensure that your business is registered with the Massachusetts Department of Revenue and has a valid sales tax registration number. This number is crucial for completing the form accurately.

When making a purchase, present the completed ST 4 form to the supplier. The supplier will keep this certificate on file, which serves as documentation that the sale is exempt from sales tax. It is important to complete the form correctly to avoid any legal issues or penalties associated with improper use.

Steps to complete the Form ST 4 Sales Tax Resale Certificate

Completing the Form ST 4 requires careful attention to detail. Here are the steps to follow:

- Download the Form ST 4 from the Massachusetts Department of Revenue website or obtain a physical copy.

- Fill in your business name, address, and sales tax registration number in the appropriate fields.

- Provide the name and address of the seller from whom you are purchasing goods.

- Clearly state the type of property being purchased and confirm that it is for resale.

- Sign and date the form to validate it.

Once completed, present the form to your supplier during the purchase transaction.

Legal use of the Form ST 4 Sales Tax Resale Certificate

The legal use of the Form ST 4 is governed by state tax laws. It is important to understand that this form is only valid when used by registered vendors for the purpose of purchasing goods intended for resale. Misuse of the form, such as using it for personal purchases or for items not intended for resale, can result in penalties and back taxes owed.

To ensure compliance, businesses should maintain accurate records of all transactions where the ST 4 form is used. This includes keeping copies of the form and any related invoices. Regular audits may be conducted by the state to verify proper use of resale certificates.

Key elements of the Form ST 4 Sales Tax Resale Certificate

The Form ST 4 contains several key elements that must be accurately filled out to ensure its validity. These include:

- Business Information: The name and address of the purchasing business.

- Sales Tax Registration Number: A unique identifier assigned to the business by the state.

- Seller Information: The name and address of the seller from whom goods are being purchased.

- Description of Goods: A clear description of the items being purchased for resale.

- Signature: The signature of an authorized representative of the purchasing business, along with the date.

Accurate completion of these elements is crucial for the form to be accepted by suppliers and to maintain compliance with state regulations.

Examples of using the Form ST 4 Sales Tax Resale Certificate

There are various scenarios in which the Form ST 4 can be utilized effectively. For instance, a retail clothing store may use the ST 4 form when purchasing inventory from a wholesaler. By providing the form, the store can acquire clothing items without paying sales tax, allowing for better pricing strategies.

Another example includes a restaurant purchasing supplies such as utensils and kitchen equipment. By presenting the ST 4 form to the supplier, the restaurant can avoid sales tax on these items, which are essential for their operations and are not sold directly to consumers.

Quick guide on how to complete form st 4 sales tax resale certificate

Effortlessly Complete Form ST 4 Sales Tax Resale Certificate on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and secure it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents efficiently without unnecessary delays. Manage Form ST 4 Sales Tax Resale Certificate on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

How to Modify and Electronically Sign Form ST 4 Sales Tax Resale Certificate with Ease

- Obtain Form ST 4 Sales Tax Resale Certificate and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize critical sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form ST 4 Sales Tax Resale Certificate to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 4 sales tax resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to st 4?

airSlate SignNow is an electronic signature tool that simplifies document management. It allows users to send, sign, and store documents securely, making processes more efficient. The st 4 plan offers advanced features tailored for businesses, ensuring compliance and enhancing collaboration.

-

How much does the st 4 plan cost?

The st 4 plan pricing is designed to be affordable for businesses of all sizes. It includes an array of features that enhance document workflow and signing capabilities. For detailed pricing, please visit our pricing page or contact our sales team for a personalized quote.

-

What features are included in the st 4 plan?

The st 4 plan includes features like customizable templates, real-time tracking, and team management tools. Users can also integrate with various applications to streamline their workflow. This makes the st 4 plan a comprehensive solution for businesses looking to optimize document signing.

-

How can airSlate SignNow benefit my business with the st 4 plan?

The st 4 plan provides businesses with tools to increase efficiency, reduce turnaround time, and improve the customer experience. By using airSlate SignNow, teams can collaborate seamlessly on documents and ensure that all signatures are obtained quickly. This leads to faster business transactions and better overall productivity.

-

Is airSlate SignNow compliant with industry regulations in the st 4 plan?

Yes, airSlate SignNow ensures compliance with various industry standards and regulations, including eSign Act and GDPR. The st 4 plan is designed to adhere to these standards, providing peace of mind for users. This compliance is critical for businesses that handle sensitive information and require secure signing solutions.

-

What integrations does the st 4 plan support?

The st 4 plan supports a wide range of integrations, including popular applications like Google Drive, Salesforce, and Microsoft Office. This flexibility allows businesses to connect their existing tools and streamline workflows. You can easily automate processes by incorporating airSlate SignNow with other software used in your organization.

-

What is the customer support like for the st 4 plan?

With the st 4 plan, you gain access to comprehensive customer support, including live chat, email assistance, and a resource library. Our support team is dedicated to helping you make the most out of your airSlate SignNow experience. Whether you have questions about features or need troubleshooting assistance, we're here to help.

Get more for Form ST 4 Sales Tax Resale Certificate

- Clovis usd sports pre participation screening form

- Massachusetts certified payroll form

- Scholastic scope argument essay form

- Prohibition of ragging form

- Lego club lego club application smsk 8 form

- Application for a mb marriage document20190604eng pub form

- Society of hope application form

- Area lebanon u s department of veterans affairs form

Find out other Form ST 4 Sales Tax Resale Certificate

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document