Certificate of Rent Paid 2022

What is the Certificate of Rent Paid

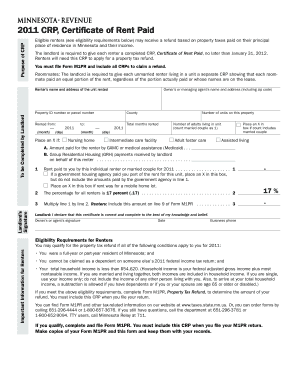

The Certificate of Rent Paid, often referred to as the CRP tax form, is a document provided by landlords to tenants in the United States. This form serves as proof of the rent paid during a specific tax year. It is particularly important for renters who may be eligible for certain tax credits or deductions related to their housing costs. The CRP form includes details such as the tenant's name, the rental property's address, the total amount of rent paid, and the landlord's information. This document is crucial for renters looking to claim benefits on their tax returns.

How to Use the Certificate of Rent Paid

To effectively use the Certificate of Rent Paid, tenants should ensure that they receive this document from their landlord at the end of the tax year. Once obtained, it should be carefully reviewed for accuracy. Renters can then use the information provided on the CRP form when filing their federal and state tax returns. This form can help substantiate claims for tax credits, such as the Minnesota Renters' Credit, which may reduce the overall tax liability. It is advisable to keep a copy of the CRP for personal records and future reference.

How to Obtain the Certificate of Rent Paid

Tenants can obtain the Certificate of Rent Paid by requesting it directly from their landlord or property management company. In many cases, landlords are required by law to provide this form to tenants who have paid rent during the year. It is recommended to make this request in writing, specifying the tax year for which the certificate is needed. If the landlord fails to provide the CRP form, tenants may need to keep their own records of rent payments, such as receipts or bank statements, to support their claims during tax filing.

Steps to Complete the Certificate of Rent Paid

Completing the Certificate of Rent Paid involves several straightforward steps. First, landlords should gather all relevant information, including tenant details, rental amounts, and property addresses. Next, they should fill out the CRP form accurately, ensuring that all figures reflect the actual rent paid. After completing the form, landlords should provide a copy to the tenant and retain one for their records. It is essential to ensure that the form is signed and dated, as this adds to its legitimacy as a legal document.

Legal Use of the Certificate of Rent Paid

The Certificate of Rent Paid is a legally binding document that can be used in various legal and tax-related contexts. For renters, it serves as proof of rental payments, which can be critical when applying for tax credits or in disputes regarding rental agreements. Landlords must ensure that the information on the CRP form is accurate and truthful, as providing false information can lead to legal repercussions. Additionally, the CRP form must comply with state regulations, which may vary, so it is important to be aware of local laws governing its use.

IRS Guidelines for the Certificate of Rent Paid

The IRS recognizes the Certificate of Rent Paid as an essential document for tenants seeking to claim deductions or credits related to rental payments. According to IRS guidelines, renters must report the total amount of rent paid, which can be substantiated by the CRP form. It is advisable for renters to consult IRS publications or a tax professional to understand how to properly incorporate this form into their tax filings. Following these guidelines ensures compliance and maximizes potential tax benefits.

Quick guide on how to complete certificate of rent paid

Prepare Certificate Of Rent Paid effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Certificate Of Rent Paid on any device with airSlate SignNow's Android or iOS applications and streamline your document-centered process today.

The easiest way to edit and eSign Certificate Of Rent Paid with ease

- Obtain Certificate Of Rent Paid and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Certificate Of Rent Paid and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certificate of rent paid

Create this form in 5 minutes!

How to create an eSignature for the certificate of rent paid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRP tax form and who needs to file it?

A CRP tax form, or Conservation Reserve Program tax form, is required for farmers who receive payments from the CRP. It helps to report income received from the U.S. Department of Agriculture (USDA) for land conservation efforts. Understanding what is a CRP tax form can aid farmers in accurately reporting income and complying with IRS regulations.

-

How does airSlate SignNow assist with managing a CRP tax form?

airSlate SignNow provides a straightforward way to create, send, and eSign the necessary documents for your CRP tax form. By utilizing our platform, you can streamline the process of gathering signatures and ensure that all related documents are properly handled. Discovering what is a CRP tax form is made easier with our intuitive features.

-

Are there any costs associated with using airSlate SignNow for CRP tax forms?

Yes, airSlate SignNow offers a range of pricing plans to suit any budget, from individual users to larger businesses. Each plan includes tools tailored for efficient document management, including eSigning CRP tax forms. Understanding what is a CRP tax form is crucial, and our pricing ensures that the solution is both effective and affordable.

-

What features does airSlate SignNow offer for handling CRP tax forms?

AirSlate SignNow includes features like template creation, document sharing, and secure eSignature capabilities, which are all beneficial for managing CRP tax forms. These features simplify the process of sending and receiving signed documents, making it easier to maintain compliance. Knowing what is a CRP tax form is just one part of ensuring effective document management.

-

Can airSlate SignNow integrate with accounting software for CRP tax forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms, enhancing the management of your CRP tax form. This integration ensures that all your financial documentation is easily accessible and organized. Understanding what is a CRP tax form becomes more actionable when paired with robust accounting tools.

-

Is it easy to eSign a CRP tax form using airSlate SignNow?

Absolutely! With airSlate SignNow, eSigning a CRP tax form is user-friendly and efficient. The platform guides users through the signing process, ensuring that your documents are signed quickly and securely. Learning what is a CRP tax form is even simpler when you have a reliable tool to manage it.

-

What are the benefits of using airSlate SignNow for CRP tax forms?

Using airSlate SignNow for CRP tax forms provides several benefits such as enhanced efficiency, security, and accessibility. It allows businesses to reduce paperwork, speed up the signing process, and ensures that all documents are stored safely. Understanding what is a CRP tax form is vital, but utilizing our platform enhances your overall experience.

Get more for Certificate Of Rent Paid

Find out other Certificate Of Rent Paid

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer