Ct 706 Nt Instructions Form

What is the Ct 706 Nt Instructions

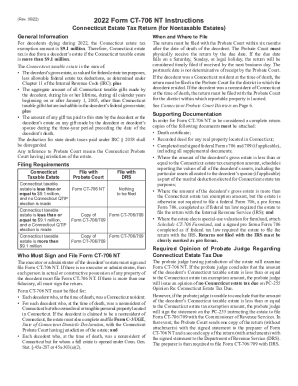

The Ct 706 Nt Instructions are designed to guide individuals and entities through the process of completing the Connecticut estate tax return, specifically for estates that exceed the exemption threshold. This form is crucial for ensuring compliance with state tax regulations. It provides detailed information on the necessary documentation, calculations, and reporting requirements needed to accurately file an estate tax return in Connecticut.

Steps to complete the Ct 706 Nt Instructions

Completing the Ct 706 Nt Instructions involves several key steps:

- Gather necessary documentation, including the decedent's financial records and asset valuations.

- Review the instructions carefully to understand the specific requirements for your estate.

- Complete the form accurately, ensuring all information is filled out as required.

- Double-check calculations and ensure all supporting documents are included.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the Ct 706 Nt Instructions

The legal use of the Ct 706 Nt Instructions is vital for ensuring that estate taxes are calculated and reported correctly. Adhering to the guidelines set forth in the instructions helps prevent legal issues related to tax compliance. It is essential for executors and administrators of estates to understand the legal implications of the information provided in the form to avoid potential disputes with the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706 Nt Instructions are critical to ensure compliance with Connecticut tax law. Generally, the estate tax return must be filed within six months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to be aware of these deadlines to avoid late fees and penalties.

Required Documents

When completing the Ct 706 Nt Instructions, several documents are required to support the information provided on the form. These may include:

- The decedent's death certificate.

- Financial statements detailing assets and liabilities.

- Appraisals for real estate and other significant assets.

- Previous tax returns, if applicable.

- Any relevant legal documents, such as wills or trusts.

Form Submission Methods

The Ct 706 Nt Instructions can be submitted through various methods, ensuring flexibility for filers. Options typically include:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at designated state offices, if necessary.

Quick guide on how to complete ct 706 nt instructions

Prepare Ct 706 Nt Instructions effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily find the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Ct 706 Nt Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to alter and eSign Ct 706 Nt Instructions effortlessly

- Find Ct 706 Nt Instructions and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal significance as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, boring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign Ct 706 Nt Instructions and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 706 nt instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the latest ct 706 nt instructions 2024 updates?

The ct 706 nt instructions 2024 have introduced several enhancements aimed at simplifying the filing process. Key updates include a streamlined layout and clarified guidelines, making it easier for users to understand their tax obligations. It's recommended to review these updates thoroughly to ensure compliance for the upcoming tax year.

-

How can airSlate SignNow assist with the ct 706 nt instructions 2024?

airSlate SignNow simplifies the document signing process, allowing users to eSign their submitted forms, including those related to ct 706 nt instructions 2024. Our platform ensures that all documents are securely signed and stored, giving you peace of mind as you manage your tax documents remotely.

-

What are the pricing options for using airSlate SignNow with ct 706 nt instructions 2024?

airSlate SignNow offers flexible pricing plans that cater to different business needs, whether you're an individual or a large organization. Our pricing plans are cost-effective and designed to provide value, especially for users working with ct 706 nt instructions 2024. Please visit our pricing page for detailed information on each option.

-

What features does airSlate SignNow provide for managing documents related to ct 706 nt instructions 2024?

With airSlate SignNow, users can enjoy features like document templates, in-app messaging, and advanced analytics. These features simplify the process of handling tax documents, including those necessary for ct 706 nt instructions 2024. Our user-friendly interface ensures that you'll be up and running in no time.

-

Are there any integration options for airSlate SignNow when handling ct 706 nt instructions 2024?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Microsoft Office, and CRM systems. This capability enhances the workflow for users dealing with ct 706 nt instructions 2024, enabling a smoother process for managing multiple documents and data sources in one place.

-

How does airSlate SignNow improve efficiency for users submitting ct 706 nt instructions 2024?

By automating the document signing process, airSlate SignNow signNowly reduces the time spent on paperwork for the ct 706 nt instructions 2024. This efficiency allows users to focus on more strategic tasks, streamlining their overall workflow while ensuring they meet compliance deadlines effectively.

-

Can I access airSlate SignNow from any device when dealing with ct 706 nt instructions 2024?

Yes, airSlate SignNow is designed to be accessible from any device, whether you're using a desktop, tablet, or smartphone. This flexibility is particularly beneficial for those working on ct 706 nt instructions 2024, as it allows you to manage and eSign documents anytime, anywhere.

Get more for Ct 706 Nt Instructions

- December 10 to all u s puerto rico direct purchasing form

- Notice of directors or notice of change of directo form

- Form 1399 replacement aircraft certificate of registration glider

- Form 1399 replacement aircraft certificate of registration glider 655093175

- Erf no township owner datesans 10400a ed form

- Sans 10400a edition 3 1national building regu form

- Commsec adviser services phone 1800 252 351 locke form

- Pdf format records research inc

Find out other Ct 706 Nt Instructions

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document