Fatca Declaration Form

What is the FATCA Declaration

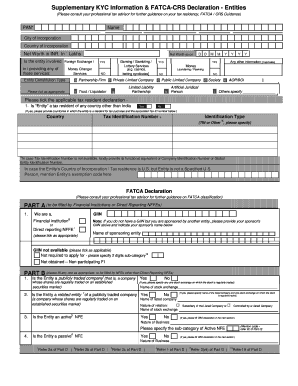

The FATCA declaration is a crucial form used by U.S. taxpayers to report foreign financial accounts and assets to the Internal Revenue Service (IRS). The acronym FATCA stands for the Foreign Account Tax Compliance Act, which was enacted to combat tax evasion by U.S. taxpayers holding accounts outside the United States. This declaration is essential for ensuring compliance with U.S. tax laws and helps the IRS track foreign financial assets effectively. The FATCA declaration is often required by financial institutions to determine the tax status of their clients.

Steps to Complete the FATCA Declaration

Completing the FATCA declaration involves several important steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information, including personal identification details and information about foreign accounts.

- Fill out the FATCA form PDF accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, depending on the submission method.

- Submit the form to the appropriate financial institution or the IRS, as required.

Legal Use of the FATCA Declaration

The FATCA declaration holds legal significance as it is a requirement under U.S. law for taxpayers with foreign financial interests. Failure to submit this declaration can lead to severe penalties, including fines and increased scrutiny from the IRS. The declaration must be completed truthfully and accurately to avoid legal repercussions. It is essential for individuals and businesses to understand their obligations under FATCA to ensure compliance with federal regulations.

Required Documents

When preparing to complete the FATCA declaration, several documents are typically required to provide necessary information. These may include:

- Government-issued identification, such as a passport or driver's license.

- Tax identification number (TIN) or Social Security number (SSN).

- Details of foreign bank accounts, including account numbers and bank names.

- Financial statements or documentation that verifies the existence of foreign assets.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the FATCA declaration. Typically, the deadline for submitting the FATCA declaration coincides with the annual tax filing deadline for U.S. taxpayers. For most individuals, this is April 15th. However, extensions may be available, and specific deadlines may vary for businesses. Staying informed about these dates is crucial to avoid penalties and ensure timely compliance.

Form Submission Methods

The FATCA declaration can be submitted through various methods, depending on the requirements of the financial institution or the IRS. Common submission methods include:

- Online submission through a secure portal provided by the financial institution.

- Mailing a physical copy of the completed form to the IRS or the relevant financial institution.

- In-person submission at designated locations, if applicable.

Quick guide on how to complete fatca declaration

Accomplish Fatca Declaration effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow supplies you with all the resources required to create, modify, and eSign your documents rapidly without delays. Manage Fatca Declaration on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Fatca Declaration with ease

- Obtain Fatca Declaration and then click Obtain Form to get started.

- Utilize the tools we provide to complete your form.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and then click on the Complete button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Revise and eSign Fatca Declaration and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA full form?

The FATCA full form is the Foreign Account Tax Compliance Act. This U.S. law enforces tax reporting obligations on foreign financial institutions regarding U.S. account holders, helping to combat tax evasion.

-

How does airSlate SignNow help with FATCA compliance?

airSlate SignNow simplifies the document eSigning process, which can be crucial for organizations needing to maintain FATCA compliance. By using our secure platform, businesses can ensure that necessary documents related to foreign accounts are clearly signed and stored.

-

What features are included in airSlate SignNow for FATCA-related documents?

airSlate SignNow offers features like customizable templates, real-time document tracking, and secure cloud storage, making it easier to manage FATCA-related documents efficiently. These features help streamline the signing process while ensuring compliance with legal requirements.

-

Are there any pricing tiers for airSlate SignNow that cater to FATCA reporting needs?

Yes, airSlate SignNow provides various pricing tiers to accommodate different business needs, including those focused on FATCA reporting. You can choose a plan that offers the necessary features for document management while remaining budget-friendly.

-

Can airSlate SignNow integrate with other tools for FATCA reporting?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and finance tools, making it easier to handle FATCA reporting requirements. This integration streamlines the documentation process, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for FATCA processes?

Using airSlate SignNow for FATCA processes provides benefits such as increased efficiency, secure document management, and compliance assurance. By digitizing the eSigning process, businesses save time and reduce the risk of errors in paperwork.

-

Is airSlate SignNow user-friendly for employees handling FATCA documents?

Yes, airSlate SignNow is designed with user-friendliness in mind. Employees can quickly learn how to eSign and manage FATCA documents without extensive training, thanks to our intuitive interface.

Get more for Fatca Declaration

Find out other Fatca Declaration

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online