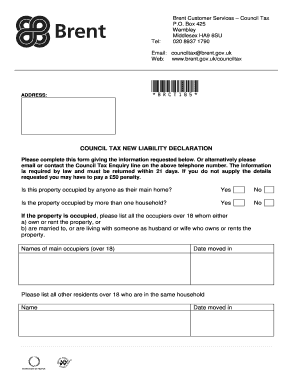

Counciltax Brent Gov Uk Form

What is the Counciltax Brent Gov Uk

The Counciltax Brent Gov Uk refers to the local taxation system implemented by the Brent Council in the United Kingdom. This tax is levied on residential properties and is used to fund local services such as education, transportation, and public safety. Each household is assessed based on the property’s value, and the amount owed can vary depending on the property band assigned by the council.

How to use the Counciltax Brent Gov Uk

Using the Counciltax Brent Gov Uk involves understanding your tax band, calculating your liability, and making payments. Residents can access their council tax information online through the Brent Council website, where they can view their tax band, payment options, and any discounts or exemptions they may qualify for. It is important to keep records of payments and any correspondence with the council regarding your tax status.

Steps to complete the Counciltax Brent Gov Uk

To complete the Counciltax Brent Gov Uk form, follow these steps:

- Gather necessary information, including your property details and personal identification.

- Visit the Brent Council website to access the online form.

- Fill out the required fields, ensuring all information is accurate.

- Review your submission for any errors before finalizing.

- Submit the form electronically and retain a copy for your records.

Legal use of the Counciltax Brent Gov Uk

The legal use of the Counciltax Brent Gov Uk is governed by local regulations that dictate how the tax is assessed and collected. Residents are required to pay their council tax based on the property they occupy, and failure to comply can result in penalties. It is essential to understand your rights and responsibilities under local law to ensure compliance and avoid legal issues.

Key elements of the Counciltax Brent Gov Uk

Key elements of the Counciltax Brent Gov Uk include:

- Property banding: Determines the tax rate based on property value.

- Payment schedules: Options for monthly or annual payments.

- Discounts and exemptions: Available for certain groups, such as students or those on low income.

- Enforcement measures: Actions taken by the council for non-payment.

Required Documents

When completing the Counciltax Brent Gov Uk form, you may need to provide various documents, including:

- Proof of identity, such as a driver's license or passport.

- Proof of residency, such as a utility bill or lease agreement.

- Financial documents if applying for discounts or exemptions.

Quick guide on how to complete counciltax brent gov uk

Complete Counciltax Brent Gov Uk effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Counciltax Brent Gov Uk on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign Counciltax Brent Gov Uk without hassle

- Find Counciltax Brent Gov Uk and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Counciltax Brent Gov Uk and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the counciltax brent gov uk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the benefit of using airSlate SignNow for council tax processes?

Using airSlate SignNow streamlines council tax processes by allowing you to eSign necessary documents quickly and easily. The system is designed to meet the needs of users dealing with council tax matters, making it an ideal choice for efficiently managing your paperwork. Visit counciltax brent gov uk to see how eSigning can simplify your experience.

-

How does airSlate SignNow handle security for council tax documents?

Security is a top priority for airSlate SignNow, ensuring that all your council tax documents are protected with industry-leading encryption. The platform complies with the necessary regulations to keep your data safe while allowing you to eSign documents conveniently. For more guidance on security, you can refer to counciltax brent gov uk.

-

Are there any costs associated with using airSlate SignNow for council tax documentation?

airSlate SignNow offers a range of pricing plans to suit different needs, including options specifically for handling council tax documentation. Whether you’re an individual or a business, the cost-effective solutions provided can help you manage your eSigning needs efficiently. Check counciltax brent gov uk for any guidelines on documentation costs.

-

Can I integrate airSlate SignNow with other applications for council tax management?

Absolutely! airSlate SignNow allows for seamless integrations with various applications, enhancing your council tax management experience. This means you can connect your existing tools and systems to streamline workflows and improve efficiency. For specific integrations available, head over to counciltax brent gov uk.

-

What features does airSlate SignNow offer to assist with council tax submissions?

airSlate SignNow provides several features tailored for council tax submissions, including document templates, automated reminders, and tracking options. These features ensure that you remain organized and on top of your submissions, making it easier to handle your council tax obligations. For more resources, visit counciltax brent gov uk.

-

Is airSlate SignNow suitable for both individuals and businesses managing council tax?

Yes, airSlate SignNow is designed to cater to both individuals and businesses handling council tax matters. Its user-friendly interface and powerful features make it suitable for various users, from homeowners to large corporations. Explore more by visiting counciltax brent gov uk.

-

How does the eSigning process work with airSlate SignNow for council tax documents?

The eSigning process with airSlate SignNow is simple and straightforward. Users upload their council tax documents, add the required signers, and send them for eSignature without the hassle of printing or scanning. For detailed guidance on the eSigning process, check out counciltax brent gov uk.

Get more for Counciltax Brent Gov Uk

Find out other Counciltax Brent Gov Uk

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast