C20 Form

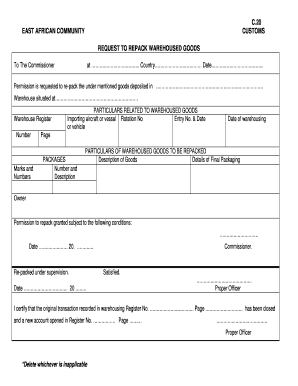

What is the C20 Form

The C20 form is a specific document used primarily for tax purposes in the United States. It serves as a formal application for certain tax-related benefits or exemptions. Understanding the C20 form is essential for individuals and businesses looking to navigate the complexities of the U.S. tax system effectively. This form is particularly relevant for those who need to report specific financial information to the Internal Revenue Service (IRS).

How to Use the C20 Form

Using the C20 form involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS or other authorized sources. Next, fill out the required fields accurately, providing all necessary information related to your tax situation. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority. Proper use of the C20 form can facilitate smoother processing of your tax benefits.

Steps to Complete the C20 Form

Completing the C20 form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as income statements and previous tax returns.

- Download or obtain a physical copy of the C20 form.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the required financial details, ensuring accuracy in reporting your income and deductions.

- Review the completed form for any mistakes or missing information.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Legal Use of the C20 Form

The C20 form holds legal significance in the context of tax compliance. When filled out correctly and submitted on time, it can serve as a legally binding document that ensures you receive the tax benefits for which you qualify. It is crucial to adhere to all regulations and guidelines set forth by the IRS to avoid any potential legal issues. Understanding the legal implications of the C20 form can help you maintain compliance and protect your rights as a taxpayer.

Required Documents

To successfully complete the C20 form, certain documents are essential. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous tax returns for reference.

- Any supporting documentation required for specific deductions or credits claimed.

Having these documents ready will streamline the process of filling out the C20 form and ensure that all necessary information is accurately reported.

Filing Deadlines / Important Dates

Filing deadlines for the C20 form are crucial to ensure compliance with tax regulations. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, specific circumstances may affect this date, such as extensions or special provisions for certain taxpayers. Staying informed about these deadlines is essential to avoid penalties and ensure timely processing of your application.

Quick guide on how to complete c20 form

Effortlessly prepare C20 Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documentation, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle C20 Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign C20 Form seamlessly

- Locate C20 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow manages all your document administration needs with just a few clicks from any device you prefer. Edit and eSign C20 Form and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c20 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a c20 form and how is it used?

The c20 form is a crucial document used in various business processes, particularly for signing and managing agreements electronically. With airSlate SignNow, you can easily create, send, and eSign c20 forms, streamlining your workflow and ensuring compliance.

-

How much does it cost to use the c20 form feature in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to features for managing c20 forms. Whether you are a solo entrepreneur or part of a large organization, you can choose a plan that fits your budget and allows you to efficiently handle c20 forms and other documents.

-

What features are included when using the c20 form with airSlate SignNow?

Using the c20 form with airSlate SignNow provides you with features like customizable templates, secure eSigning, document tracking, and integration with various applications. This makes it easier to manage your documents and ensures that your c20 forms are processed efficiently.

-

What benefits do I gain from using airSlate SignNow for c20 forms?

By utilizing airSlate SignNow for your c20 forms, you gain enhanced efficiency, reduced turnaround times, and improved accuracy in your document management processes. The intuitive platform helps you focus on your core business activities while ensuring your c20 forms are handled securely.

-

Can I integrate airSlate SignNow with other software for managing c20 forms?

Yes, airSlate SignNow offers integration capabilities with various third-party applications. This allows you to streamline your workflow when handling c20 forms and ensures your documents are accessible across platforms you may already be using.

-

How secure is the eSigning process for c20 forms in airSlate SignNow?

The eSigning process for c20 forms in airSlate SignNow is highly secure, employing encryption and other measures to protect your sensitive information. You can confidently send and sign c20 forms, knowing that your data is safeguarded throughout the process.

-

Is there customer support available if I have issues with my c20 form?

Absolutely! airSlate SignNow provides robust customer support to assist you with any questions or issues related to your c20 forms. Whether you need help with the signing process or document management, our team is ready to provide the assistance you need.

Get more for C20 Form

Find out other C20 Form

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document