Oklahoma Sales Tax Report FormSend

What is the Oklahoma Sales Tax Report FormSend

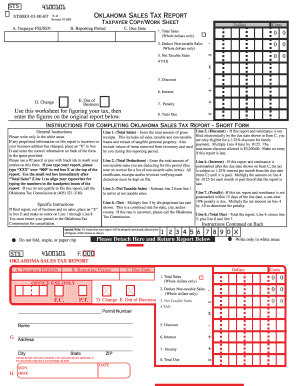

The Oklahoma Sales Tax Report FormSend is a crucial document used by businesses to report sales tax collected on taxable sales within the state of Oklahoma. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately report their sales tax liabilities. The form captures details such as total sales, exempt sales, and the amount of sales tax collected, providing a comprehensive overview of a business's tax obligations.

How to use the Oklahoma Sales Tax Report FormSend

Using the Oklahoma Sales Tax Report FormSend involves several straightforward steps. First, gather all necessary sales records for the reporting period, including total sales figures and any exempt sales. Next, access the digital form through a secure platform that supports eSigning. Fill in the required fields accurately, ensuring that all calculations reflect your sales data. Finally, review the completed form for accuracy before submitting it electronically or by mail to the appropriate state tax authority.

Steps to complete the Oklahoma Sales Tax Report FormSend

Completing the Oklahoma Sales Tax Report FormSend requires careful attention to detail. Follow these steps for a smooth process:

- Collect all sales records and receipts for the reporting period.

- Access the Oklahoma Sales Tax Report FormSend on a secure platform.

- Enter total sales figures in the designated sections of the form.

- Include any exempt sales and calculate the total sales tax collected.

- Review the form for accuracy and completeness.

- Sign the form electronically using a trusted eSignature solution.

- Submit the completed form to the Oklahoma Tax Commission by the due date.

Legal use of the Oklahoma Sales Tax Report FormSend

The legal use of the Oklahoma Sales Tax Report FormSend is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Electronic signatures are legally binding as long as they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature platform ensures that the form meets all legal requirements for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Sales Tax Report FormSend vary depending on the reporting period. Generally, businesses must file monthly, quarterly, or annually based on their sales volume. It is essential to be aware of these deadlines to avoid penalties. For monthly filers, the due date is typically the 20th of the month following the reporting period. Quarterly and annual filers should check with the Oklahoma Tax Commission for specific dates relevant to their filing frequency.

Penalties for Non-Compliance

Failure to file the Oklahoma Sales Tax Report FormSend on time can result in significant penalties. Businesses may incur late fees and interest on unpaid taxes, which can accumulate quickly. Additionally, persistent non-compliance may lead to further legal actions or audits by the Oklahoma Tax Commission. It is crucial for businesses to stay informed about their filing requirements and maintain accurate records to avoid these penalties.

Quick guide on how to complete oklahoma sales tax report formsend

Effortlessly Prepare Oklahoma Sales Tax Report FormSend on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Oklahoma Sales Tax Report FormSend across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to Modify and eSign Oklahoma Sales Tax Report FormSend with Ease

- Find Oklahoma Sales Tax Report FormSend and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Oklahoma Sales Tax Report FormSend to facilitate superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma sales tax report formsend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Sales Tax Report FormSend?

The Oklahoma Sales Tax Report FormSend is a streamlined tool provided by airSlate SignNow that allows businesses to generate, send, and eSign sales tax reports easily. This form simplifies the reporting process by ensuring all necessary information is collected and stored securely in one place, making compliance hassle-free.

-

How much does the Oklahoma Sales Tax Report FormSend cost?

Pricing for the Oklahoma Sales Tax Report FormSend varies based on the subscription plan you choose. airSlate SignNow offers flexible pricing options designed to meet the needs of various businesses, ensuring cost-effectiveness and value for your investment in managing sales tax reporting.

-

What features does the Oklahoma Sales Tax Report FormSend include?

The Oklahoma Sales Tax Report FormSend includes features such as customizable templates, electronic signature capabilities, and automatic reminders for submission deadlines. These features enhance efficiency, allowing you to focus more on your business rather than paperwork.

-

How does the Oklahoma Sales Tax Report FormSend benefit businesses?

Using the Oklahoma Sales Tax Report FormSend helps businesses save time and reduce errors associated with tax filings. By automating the reporting process and providing an easy-to-use interface, companies can ensure timely compliance while maintaining accuracy and organization.

-

Can I integrate the Oklahoma Sales Tax Report FormSend with other software?

Yes, the Oklahoma Sales Tax Report FormSend is compatible with various accounting and business management software. This integration allows for seamless data import and export, improving workflow efficiency and ensuring your financial reports are always up-to-date.

-

Is the Oklahoma Sales Tax Report FormSend secure for sensitive information?

Absolutely, the Oklahoma Sales Tax Report FormSend utilizes state-of-the-art security measures to protect sensitive information. airSlate SignNow follows industry-standard encryption protocols, ensuring that all data transmitted and stored is secure and compliant with regulations.

-

How do I get started with the Oklahoma Sales Tax Report FormSend?

Getting started with the Oklahoma Sales Tax Report FormSend is easy. Simply sign up for an account on the airSlate SignNow website, choose the Oklahoma Sales Tax Report FormSend template, and customize it to your business needs in just a few clicks!

Get more for Oklahoma Sales Tax Report FormSend

Find out other Oklahoma Sales Tax Report FormSend

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement