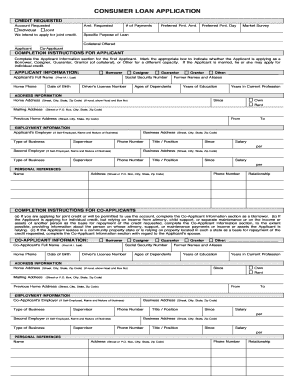

CONSUMER LOAN APPLICATION APPCENTER VERSION Form

What is the consumer loan application appcenter version?

The consumer loan application appcenter version is a digital form designed for individuals seeking to apply for a consumer loan. This form collects essential information from applicants, including personal details, financial history, and loan requirements. By using this digital format, applicants can streamline the process of securing a loan, making it more efficient and accessible. The appcenter version is specifically tailored to meet the needs of both borrowers and financial institutions, ensuring that all necessary data is captured for loan approval and processing.

How to use the consumer loan application appcenter version

Using the consumer loan application appcenter version involves several straightforward steps. First, access the form through the designated platform. Next, fill in the required fields with accurate information, including your name, address, income details, and the amount of loan requested. It is important to review all entries for accuracy before submission. Once completed, you can electronically sign the document to validate your application. This digital signature is legally binding, ensuring your application is processed promptly by the lender.

Steps to complete the consumer loan application appcenter version

Completing the consumer loan application appcenter version involves a series of clear steps:

- Begin by accessing the application through the appropriate platform.

- Enter your personal information, including full name, address, and contact details.

- Provide financial information, such as employment status, income, and existing debts.

- Specify the loan amount you wish to apply for and the purpose of the loan.

- Review all entered information for accuracy and completeness.

- Sign the application electronically to complete the process.

- Submit the application for review by the lender.

Legal use of the consumer loan application appcenter version

The consumer loan application appcenter version is designed to comply with U.S. laws governing electronic signatures and documentation. To ensure its legal validity, it adheres to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This compliance guarantees that the digital signatures and submissions are recognized as legally binding, similar to traditional paper forms. Users can confidently complete their applications, knowing they are protected under these legal frameworks.

Key elements of the consumer loan application appcenter version

Several key elements must be included in the consumer loan application appcenter version to ensure its effectiveness:

- Personal Information: Full name, address, and contact details.

- Financial Information: Employment status, income, and existing debts.

- Loan Details: Requested loan amount and purpose of the loan.

- Consent and Acknowledgment: Agreement to terms and conditions associated with the loan.

- Signature: An electronic signature to validate the application.

Eligibility criteria for the consumer loan application appcenter version

To qualify for a consumer loan through the appcenter version, applicants typically need to meet certain eligibility criteria. These may include:

- Being at least eighteen years old.

- Having a valid Social Security number or Tax Identification Number.

- Demonstrating a stable income source.

- Having a good credit history, although some lenders may offer options for those with less-than-perfect credit.

- Providing necessary documentation to support the application, such as proof of income and identification.

Quick guide on how to complete consumer loan application appcenter version

Complete CONSUMER LOAN APPLICATION APPCENTER VERSION effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage CONSUMER LOAN APPLICATION APPCENTER VERSION on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign CONSUMER LOAN APPLICATION APPCENTER VERSION without hassle

- Find CONSUMER LOAN APPLICATION APPCENTER VERSION and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign CONSUMER LOAN APPLICATION APPCENTER VERSION and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer loan application appcenter version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CONSUMER LOAN APPLICATION APPCENTER VERSION?

The CONSUMER LOAN APPLICATION APPCENTER VERSION is a specialized tool designed for businesses to streamline the process of applying for consumer loans. It allows users to create, send, and eSign loan applications efficiently, thus enhancing the customer experience and speeding up approval times.

-

What features are included in the CONSUMER LOAN APPLICATION APPCENTER VERSION?

The CONSUMER LOAN APPLICATION APPCENTER VERSION includes features like customizable templates, real-time tracking, automated workflows, and secure eSignature capabilities. These features work together to simplify the loan application process and ensure compliance with industry standards.

-

How does the CONSUMER LOAN APPLICATION APPCENTER VERSION improve my loan processing times?

By utilizing the CONSUMER LOAN APPLICATION APPCENTER VERSION, businesses can reduce the time needed for loan applications through automation and streamlined processes. This efficiency allows for faster approvals and improved customer satisfaction, as applicants can complete their applications quickly and conveniently.

-

Is the CONSUMER LOAN APPLICATION APPCENTER VERSION cost-effective?

Yes, the CONSUMER LOAN APPLICATION APPCENTER VERSION is designed to be a cost-effective solution for businesses of all sizes. With various pricing plans available, it offers scalability and features that provide signNow return on investment by cutting down on operational costs related to traditional loan processing.

-

Can the CONSUMER LOAN APPLICATION APPCENTER VERSION be integrated with other software?

Absolutely! The CONSUMER LOAN APPLICATION APPCENTER VERSION seamlessly integrates with various CRM and accounting software. This capability allows businesses to synchronize data, maintain workflow continuity, and enhance overall operational efficiency.

-

What benefits can users expect from the CONSUMER LOAN APPLICATION APPCENTER VERSION?

Users of the CONSUMER LOAN APPLICATION APPCENTER VERSION can expect improved efficiency in processing loan applications, enhanced customer engagement, and faster turnaround times. Additionally, the solution ensures that all documents are secure and compliant with regulations, reducing the risk of errors.

-

Is training required to use the CONSUMER LOAN APPLICATION APPCENTER VERSION?

While no extensive training is required, the CONSUMER LOAN APPLICATION APPCENTER VERSION offers user-friendly interfaces that facilitate an easy learning curve. We provide resources and support to ensure that users can quickly get up to speed and leverage all the features available.

Get more for CONSUMER LOAN APPLICATION APPCENTER VERSION

Find out other CONSUMER LOAN APPLICATION APPCENTER VERSION

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy