Form Ct 706 Nt Fillable0624 Final PDF CT Gov

Understanding the Form CT 706 NT

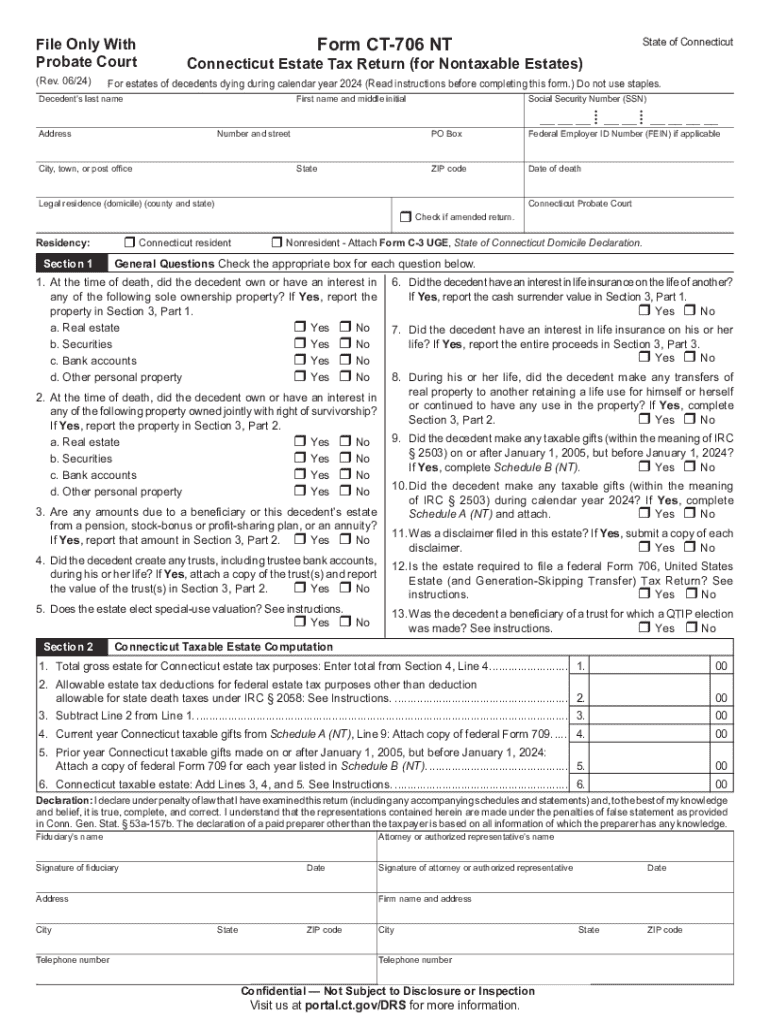

The Form CT 706 NT is the Connecticut estate tax return form used for reporting the estate of a deceased individual. This form is specifically designed for estates that are not subject to federal estate tax but may still owe state estate taxes. It is essential for executors and administrators of estates to understand the requirements of this form to ensure compliance with Connecticut state laws.

Steps to Complete the Form CT 706 NT

Completing the Form CT 706 NT involves several key steps:

- Gather necessary information: Collect details about the decedent's assets, liabilities, and any applicable deductions.

- Fill out the form: Input the required information accurately, ensuring all sections are completed. This includes details about the estate's value and any exemptions.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties or delays.

- Submit the form: File the completed form with the Connecticut Department of Revenue Services by the specified deadline.

Filing Deadlines for Form CT 706 NT

It is crucial to adhere to the filing deadlines for the Form CT 706 NT to avoid penalties. The form must be filed within nine months of the decedent's date of death. If additional time is needed, a six-month extension may be requested, but it is important to file the extension request before the original deadline.

Required Documents for Form CT 706 NT

When completing the Form CT 706 NT, certain documents are necessary to support the information provided. These may include:

- Death certificate: A certified copy of the decedent's death certificate.

- Asset documentation: Records of all assets owned by the decedent, including real estate, bank accounts, and investments.

- Liabilities: Documentation of any debts or obligations that the estate must settle.

- Appraisals: Professional appraisals for high-value assets to establish fair market value.

Form Submission Methods for CT 706 NT

The Form CT 706 NT can be submitted through various methods:

- Online: Some forms may be filed electronically through the Connecticut Department of Revenue Services website.

- Mail: The completed form can be mailed to the appropriate address provided by the state.

- In-person: Executors may also choose to deliver the form in person to the local tax office.

Legal Use of Form CT 706 NT

The Form CT 706 NT serves a legal purpose in the estate settlement process. It ensures that the state receives the appropriate estate tax revenue and provides a formal record of the estate's financial standing. Executors must ensure that the form is filled out correctly to avoid legal complications or disputes among heirs.

Handy tips for filling out Form ct 706 nt fillable0624 final pdf CT gov online

Quick steps to complete and e-sign Form ct 706 nt fillable0624 final pdf CT gov online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant service for optimum straightforwardness. Use signNow to e-sign and send out Form ct 706 nt fillable0624 final pdf CT gov for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 706 nt fillable0624 final pdf ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ct 706 nt instructions for using airSlate SignNow?

The ct 706 nt instructions for airSlate SignNow provide a comprehensive guide on how to effectively utilize our eSignature platform. These instructions cover everything from setting up your account to sending documents for signature. Following these guidelines ensures a smooth experience when managing your documents.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses. We offer different tiers that cater to various needs, ensuring you get the best value for your investment. For detailed pricing information, refer to our website or contact our sales team.

-

What features are included in the ct 706 nt instructions?

The ct 706 nt instructions include features such as document templates, automated workflows, and real-time tracking of signatures. These features are designed to streamline your document management process and enhance productivity. By following these instructions, you can maximize the benefits of our platform.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow. Popular integrations include CRM systems, cloud storage services, and productivity tools. The ct 706 nt instructions provide guidance on how to set up these integrations effectively.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. The ct 706 nt instructions highlight how these advantages can transform your document signing process. Businesses can save time and resources while ensuring compliance.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. We implement advanced encryption and authentication measures to protect sensitive information. The ct 706 nt instructions detail our security protocols, ensuring you can trust our platform for all your document signing needs.

-

How can I get support for using airSlate SignNow?

Support for airSlate SignNow is readily available through various channels, including live chat, email, and a comprehensive knowledge base. Our team is dedicated to helping you navigate the ct 706 nt instructions and resolve any issues you may encounter. We aim to provide timely assistance to enhance your experience.

Get more for Form ct 706 nt fillable0624 final pdf CT gov

- Form e 500 sales and use tax return general instructions

- Download ilovepdf for windows free 3220 digital trendsdownload ilovepdf for windows free 3220 digital trendsdownload ilovepdf 623803708 form

- Pdf to word convert pdf to word online for free ilovepdf form

- Handypdfcompdfaffidavit of non dealeraffidavit of non dealer transfers of motor vehicles and boats form

- Financialservicesarizonaedutax servicesubitunrelated business income tax ubitfinancial services form

- Revenuesupporttngovhcen usvtr 29 temporary tag feetennessee department of revenue form

- Tdt owner application v20210701pdf form

- Fae173 fae173 application for extension of time to file franchise excise tax return form

Find out other Form ct 706 nt fillable0624 final pdf CT gov

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast