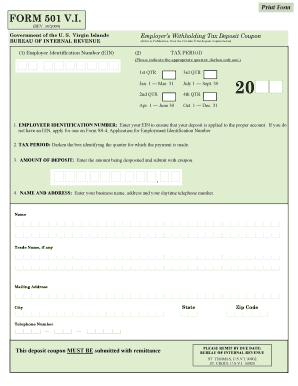

501 Vi Tax Form

What is the 501 Vi Tax Form

The 501 Vi tax form is a specific document used in the United States for reporting various tax-related information. It is primarily utilized by organizations to provide necessary details to the IRS. Understanding the purpose of this form is crucial for compliance with federal tax regulations. The 501 Vi tax form helps ensure that organizations accurately report their income and expenses, which is essential for maintaining transparency and accountability in financial dealings.

How to use the 501 Vi Tax Form

Using the 501 Vi tax form involves several steps that ensure accurate completion and submission. First, gather all relevant financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be filed electronically or mailed to the appropriate IRS office, depending on the specific instructions provided for the form.

Steps to complete the 501 Vi Tax Form

Completing the 501 Vi tax form requires attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including financial records and previous tax returns.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check for any errors or omissions before finalizing the form.

- Submit the form electronically through a secure platform or mail it to the designated IRS address.

- Keep a copy of the submitted form for your records.

Legal use of the 501 Vi Tax Form

The legal use of the 501 Vi tax form is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Compliance with tax laws is essential to avoid penalties or legal issues. Utilizing electronic signing solutions can enhance the validity of the submission, as they provide a secure method for signing and storing documents. This ensures that all parties involved can verify the authenticity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the 501 Vi tax form are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date each year, which may vary based on the organization’s fiscal year. It is important to stay informed about these deadlines to avoid penalties. Mark your calendar with important dates related to the form, including submission deadlines and any potential extensions that may apply.

Form Submission Methods (Online / Mail / In-Person)

The 501 Vi tax form can be submitted through various methods, providing flexibility for organizations. Options include:

- Online Submission: Many organizations opt to file electronically, which can expedite processing times and reduce the risk of errors.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate IRS office.

- In-Person Submission: Some organizations may choose to submit the form in person at designated IRS locations, although this is less common.

Quick guide on how to complete 501 vi tax form 37318791

Complete 501 Vi Tax Form seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle 501 Vi Tax Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign 501 Vi Tax Form effortlessly

- Locate 501 Vi Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from a device of your choice. Modify and electronically sign 501 Vi Tax Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 501 vi tax form 37318791

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 501vi and how does it relate to airSlate SignNow?

501vi refers to a specific regulatory framework that many nonprofit organizations adhere to. airSlate SignNow provides an excellent solution for these organizations by allowing them to eSign documents and manage their paperwork efficiently, ensuring compliance with 501vi guidelines.

-

How much does airSlate SignNow cost for users in the 501vi sector?

airSlate SignNow offers competitive pricing tailored for the 501vi sector, ensuring that nonprofit organizations can access our eSigning solutions without breaking the budget. There are various plans available, catering to organizations of all sizes, with options that include affordable packages designed specifically for nonprofit needs.

-

What key features does airSlate SignNow offer for 501vi compliance?

airSlate SignNow includes several key features that support 501vi compliance, such as secure document storage, audit trails, and customizable templates. These features ensure that all eSigned documents meet regulatory requirements, providing peace of mind to nonprofit organizations.

-

Can airSlate SignNow integrate with other tools that help manage 501vi documentation?

Absolutely! airSlate SignNow offers seamless integrations with various tools commonly used in the 501vi sector, such as CRM systems, project management software, and accounting tools. These integrations enhance workflow efficiency and keep all documentation organized within one ecosystem.

-

What benefits does airSlate SignNow provide for organizations that need to adhere to 501vi regulations?

By using airSlate SignNow, organizations focused on 501vi compliance can signNowly reduce paperwork, save time, and improve overall efficiency. The platform's easy-to-use interface also allows teams to quickly eSign and send documents, streamlining communications within the organization.

-

Is airSlate SignNow suitable for small nonprofits working under 501vi?

Yes, airSlate SignNow is an ideal solution for small nonprofits under 501vi because it offers a cost-effective way to manage eSigning and document workflows. Our platform is designed to accommodate organizations of all sizes, providing essential features without overwhelming technical requirements.

-

How does airSlate SignNow ensure the security of documents for 501vi organizations?

airSlate SignNow prioritizes document security, implementing state-of-the-art encryption and secure access controls to protect sensitive information. This commitment helps 501vi organizations maintain the confidentiality and integrity of their documentation as they navigate regulatory obligations.

Get more for 501 Vi Tax Form

- Kissimmee little league form

- Tsca template form

- School refusal assessment scale printable form

- Althafer senior placement and referral services althafer assisted form

- Temple university letterhead form

- Example of promissory note for baptism for not yet marriage form

- Buying or selling a vehicle in illinois form

- Imm 5782 e application to voluntarily renounce permanent resident status imm5782e pdf form

Find out other 501 Vi Tax Form

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free