FormPW1Wisconsin Nonresident Income or Franchise T

Understanding the Wisconsin PW-1 Form

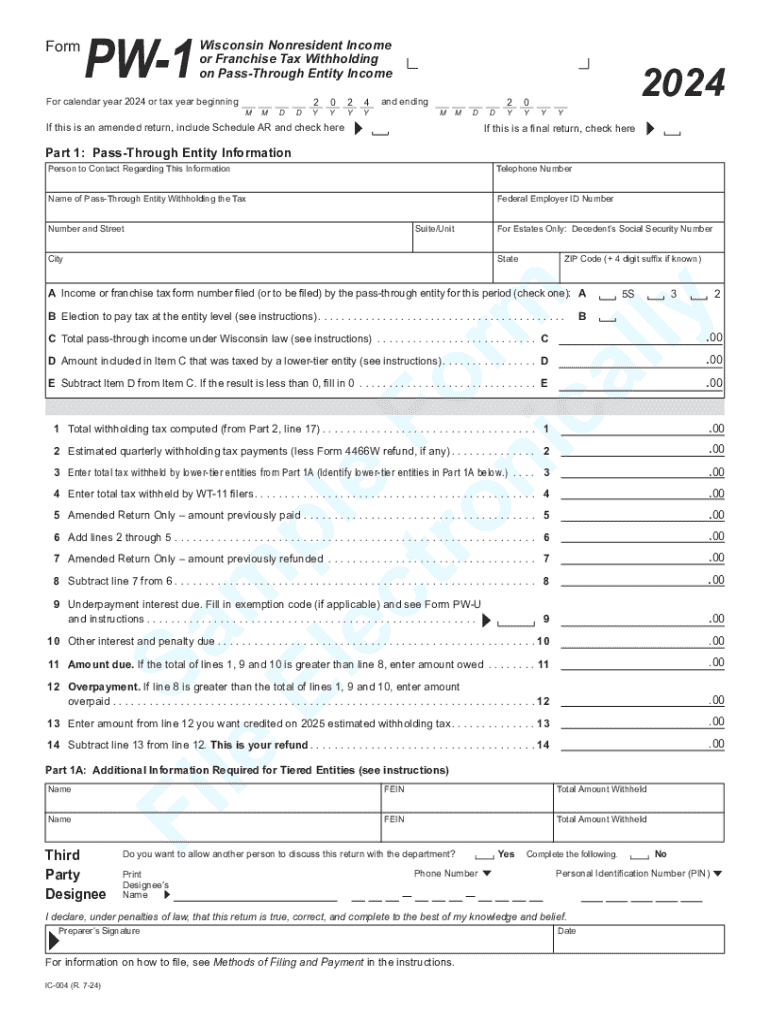

The Wisconsin PW-1 form, also known as the Wisconsin Nonresident Income or Franchise Tax form, is essential for nonresidents who earn income in Wisconsin. This form is used to report income derived from Wisconsin sources and to calculate any applicable franchise taxes. It is particularly relevant for individuals and businesses that operate in Wisconsin but are not residents of the state. Understanding the purpose of this form is crucial for compliance with state tax regulations.

How to Access the Wisconsin PW-1 Form

Obtaining the Wisconsin PW-1 form is straightforward. The form can be downloaded directly from the Wisconsin Department of Revenue's website. It is available in a fillable PDF format, allowing users to complete it electronically before printing. Additionally, physical copies can be requested from local tax offices or by contacting the Wisconsin Department of Revenue. Ensuring you have the most current version of the form is important to avoid any issues during submission.

Steps to Complete the Wisconsin PW-1 Form

Completing the Wisconsin PW-1 form involves several key steps:

- Gather all necessary documentation, including income statements and any relevant tax documents.

- Fill in personal information, including your name, address, and Social Security number.

- Report your Wisconsin source income accurately, ensuring all figures are correct.

- Calculate any franchise tax owed based on the income reported.

- Review the completed form for accuracy before submitting it.

Following these steps carefully will help ensure that your form is completed correctly and submitted on time.

Key Elements of the Wisconsin PW-1 Form

Several key elements must be included when completing the Wisconsin PW-1 form:

- Personal Information: This includes your name, address, and Social Security number.

- Income Reporting: Clearly state the income earned from Wisconsin sources.

- Franchise Tax Calculation: Accurately calculate any taxes owed based on reported income.

- Signature: Ensure the form is signed and dated to validate the submission.

Each of these elements plays a critical role in ensuring that the form is processed correctly by the Wisconsin Department of Revenue.

Filing Deadlines for the Wisconsin PW-1 Form

It is essential to be aware of the filing deadlines for the Wisconsin PW-1 form to avoid penalties. Generally, the form must be filed by the due date for your federal income tax return. If you are a nonresident who has earned income in Wisconsin, timely submission is crucial to remain compliant with state tax laws. Be sure to check for any specific deadlines that may apply to your situation, as these can vary based on individual circumstances.

Penalties for Non-Compliance with the Wisconsin PW-1 Form

Failure to file the Wisconsin PW-1 form on time can result in significant penalties. These may include fines and interest on any unpaid taxes. Additionally, noncompliance can lead to further scrutiny from the Wisconsin Department of Revenue, potentially resulting in audits or additional legal action. It is important to understand the implications of not filing this form to ensure that you remain in good standing with state tax authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formpw1wisconsin nonresident income or franchise t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Wisconsin PW 1 and how does it relate to airSlate SignNow?

Wisconsin PW 1 is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily send, sign, and store Wisconsin PW 1 documents, ensuring compliance and streamlined workflows.

-

How much does airSlate SignNow cost for managing Wisconsin PW 1 documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. For managing Wisconsin PW 1 documents, you can choose from various subscription options that provide cost-effective solutions tailored to your needs.

-

What features does airSlate SignNow offer for Wisconsin PW 1 document management?

airSlate SignNow provides a range of features for Wisconsin PW 1 document management, including customizable templates, secure eSigning, and real-time tracking. These features enhance efficiency and ensure that your documents are handled securely.

-

Can I integrate airSlate SignNow with other tools for Wisconsin PW 1 processing?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your Wisconsin PW 1 processing. You can connect it with CRM systems, cloud storage, and other business tools to streamline your document workflows.

-

What are the benefits of using airSlate SignNow for Wisconsin PW 1 documents?

Using airSlate SignNow for Wisconsin PW 1 documents offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform simplifies the signing process, making it easier for businesses to manage their documents.

-

Is airSlate SignNow user-friendly for handling Wisconsin PW 1 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to handle Wisconsin PW 1 documents. The intuitive interface allows users to navigate the platform effortlessly, even without prior experience.

-

How does airSlate SignNow ensure the security of Wisconsin PW 1 documents?

airSlate SignNow prioritizes the security of your Wisconsin PW 1 documents by implementing advanced encryption and compliance with industry standards. This ensures that your sensitive information remains protected throughout the signing process.

Get more for FormPW1Wisconsin Nonresident Income Or Franchise T

Find out other FormPW1Wisconsin Nonresident Income Or Franchise T

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document