Information About Wage LeviesInternal Revenue Service 2018-2026

Understanding the 668 W Form

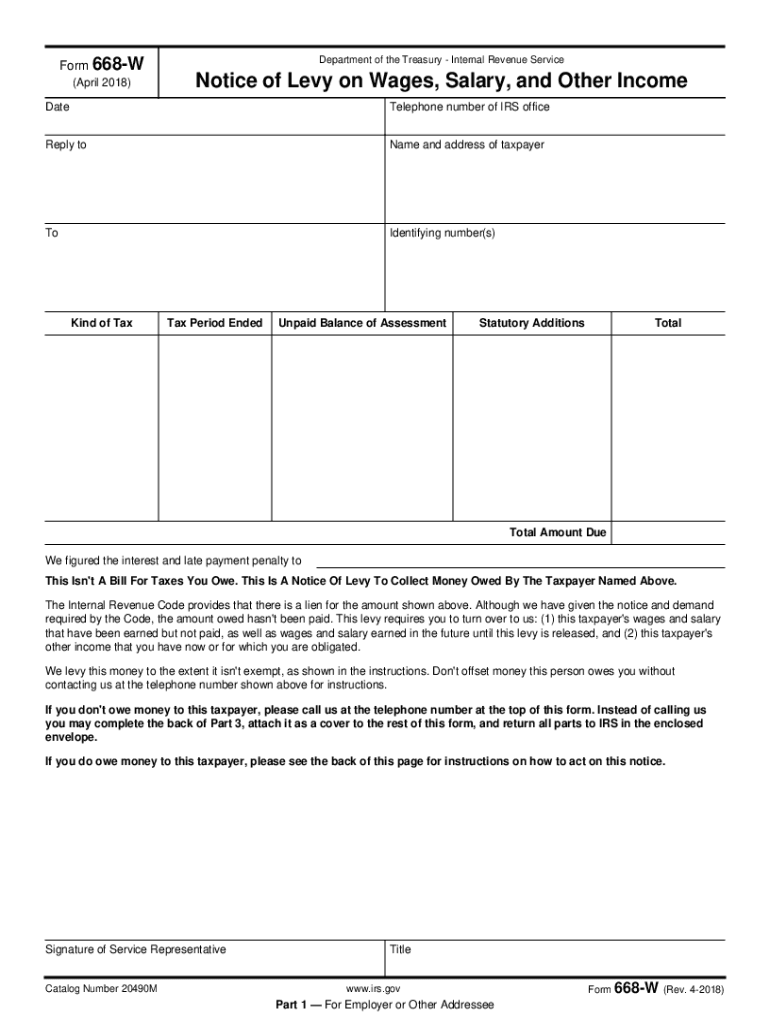

The 668 W form, officially known as the Information About Wage Levies, is a document issued by the Internal Revenue Service (IRS) to inform taxpayers about wage levies. This form is crucial for individuals who may have their wages garnished due to unpaid tax liabilities. It provides detailed information on how the levy will affect the taxpayer's income and outlines the rights and responsibilities of both the taxpayer and the employer.

Steps to Complete the 668 W Form

Completing the 668 W form involves several key steps:

- Gather necessary personal information, including your Social Security number and details about your employer.

- Review the instructions provided on the form to understand the specific requirements and implications of the wage levy.

- Fill out the form accurately, ensuring that all information is correct to avoid delays or complications.

- Submit the completed form to your employer as instructed, typically by providing a copy for their records.

Legal Use of the 668 W Form

The 668 W form is legally binding and must be adhered to by employers when processing wage levies. It is essential for employers to understand their obligations under the law, including the requirement to withhold a specific percentage of an employee's wages as indicated on the form. Failure to comply with the instructions on the 668 W can lead to legal consequences for the employer.

Filing Deadlines and Important Dates

While the 668 W form itself does not have a traditional filing deadline, it is important to act promptly upon receiving it. Taxpayers should ensure that their employer receives the form in a timely manner to avoid unnecessary wage garnishment. Additionally, taxpayers should be aware of any deadlines related to their overall tax situation, including payment deadlines for outstanding tax liabilities.

Examples of Using the 668 W Form

Common scenarios for the use of the 668 W form include:

- Taxpayers who have received a notice from the IRS regarding unpaid taxes and are subject to wage levies.

- Employers who need to understand how to process wage garnishments according to IRS guidelines.

- Individuals seeking to negotiate with the IRS regarding payment plans while managing their wage levies.

Eligibility Criteria for Wage Levies

To be subject to a wage levy, taxpayers must typically meet certain criteria, including:

- Having an outstanding tax liability that has not been resolved.

- Receiving a formal notice from the IRS regarding the levy.

- Failing to respond to previous communications from the IRS about the unpaid taxes.

Quick guide on how to complete information about wage leviesinternal revenue service

Complete Information About Wage LeviesInternal Revenue Service effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Information About Wage LeviesInternal Revenue Service on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Information About Wage LeviesInternal Revenue Service with ease

- Find Information About Wage LeviesInternal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Information About Wage LeviesInternal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information about wage leviesinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the information about wage leviesinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 668 w and how does it work?

Form 668 W is a notice of federal tax lien that can be filed against a taxpayer's property. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring that all necessary parties can review and approve it quickly. Our platform streamlines the process, making it efficient and user-friendly.

-

How can airSlate SignNow help with form 668 w?

airSlate SignNow provides a seamless way to manage form 668 W by allowing users to fill out, sign, and send the document electronically. This eliminates the need for physical paperwork and speeds up the filing process. Additionally, our platform ensures that your documents are secure and compliant with legal standards.

-

What are the pricing options for using airSlate SignNow for form 668 w?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for managing documents like form 668 W. Our cost-effective solution ensures you get the best value for your eSigning needs.

-

Are there any integrations available for form 668 w with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications to enhance your workflow when handling form 668 W. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. These integrations help you save time and improve efficiency in your processes.

-

What features does airSlate SignNow offer for managing form 668 w?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders for form 668 W. These tools help ensure that your documents are completed on time and that all stakeholders are kept informed throughout the process. Our platform is designed to simplify document management.

-

Is airSlate SignNow secure for handling sensitive documents like form 668 w?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your form 668 W and other sensitive documents are protected. We use advanced encryption and secure storage solutions to safeguard your data, giving you peace of mind when managing important paperwork.

-

Can I access form 668 w on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage form 668 W on the go. Whether you're using a smartphone or tablet, you can easily fill out, sign, and send documents from anywhere. This flexibility enhances your productivity and responsiveness.

Get more for Information About Wage LeviesInternal Revenue Service

Find out other Information About Wage LeviesInternal Revenue Service

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word