the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their 2016

What is the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their

The Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their form is a crucial document used primarily for tax purposes in the United States. This form helps determine the eligibility of a student or spouse's children for certain benefits, including tax credits and deductions. Specifically, it clarifies who qualifies as a dependent based on the support provided by the student or their spouse. Understanding this form is essential for ensuring compliance with IRS regulations and maximizing potential tax benefits.

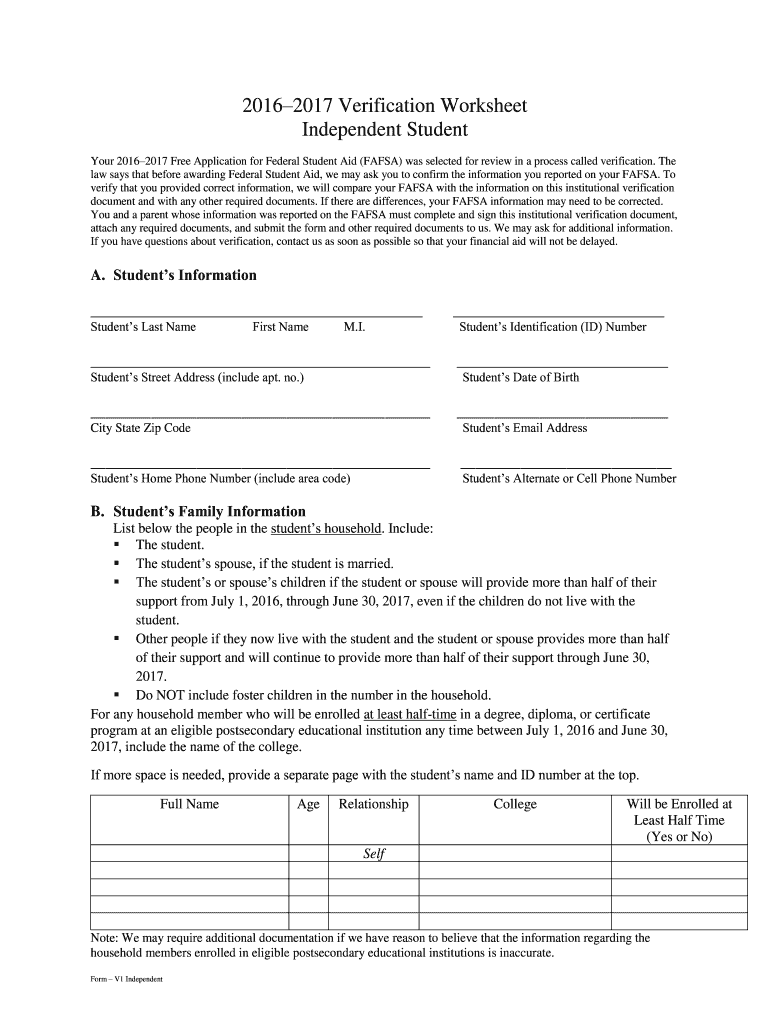

Steps to Complete the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their

Completing the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their form involves several key steps:

- Gather necessary information, including personal details of the student, spouse, and children.

- Determine the financial support provided by the student or spouse to the children.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign and date the form, confirming the accuracy of the information provided.

Legal Use of the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their

The legal use of the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their form is primarily tied to tax filings. It is essential for establishing the relationship between the student or spouse and the children, which can impact tax credits such as the Child Tax Credit. Misuse or incorrect information on this form can lead to penalties or disqualification from these benefits, making it vital to adhere to IRS guidelines.

Eligibility Criteria for the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their

To qualify for the benefits associated with the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their form, specific eligibility criteria must be met:

- The student or spouse must provide more than half of the financial support for the child.

- The child must meet age and residency requirements as defined by the IRS.

- The child must be a qualifying child or relative according to IRS definitions.

IRS Guidelines for the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their

The IRS provides clear guidelines regarding the completion and submission of the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their form. These guidelines include:

- Defining what constitutes financial support and how to calculate it.

- Outlining the necessary documentation required to substantiate claims of support.

- Providing instructions on how to report this information on tax returns.

Form Submission Methods for the Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their

The Students or Spouses Children If the Student or Spouse Will Provide More Than Half of Their form can be submitted through various methods:

- Online submission via tax preparation software that supports the form.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices during tax season.

Quick guide on how to complete the students or spouses children if the student or spouse will provide more than half of their

The optimal method to obtain and endorse The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their

On a corporate scale, ineffective workflows related to document approval can consume signNow amounts of time. Signing documents such as The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their is an inherent aspect of business operations, which is why the efficiency of each agreement’s lifecycle has a substantial impact on the overall performance of the company. With airSlate SignNow, endorsing your The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their can be as straightforward and rapid as possible. This platform allows you to access the most recent version of nearly any form. Even better, you can sign it instantly without having to install external software on your computer or printing physical copies.

How to obtain and endorse your The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their

- Browse our library by category or utilize the search bar to locate the form you require.

- View the form preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to start editing right away.

- Fill out your form and include any essential details using the toolbar.

- Once finished, click the Sign tool to endorse your The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their.

- Select the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete your edits and proceed to document-sharing options as necessary.

With airSlate SignNow, you have everything required to handle your documentation efficiently. You can find, complete, modify, and even send your The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their in a single tab with no trouble. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct the students or spouses children if the student or spouse will provide more than half of their

FAQs

-

Do doctor’s ever write excuses for their children, or spouses if they are “out sick” How does the educator or employer view this type of excuse writing?

Thanks for the A2AI have written thousands of “work notes” in my career, but never for my own family. I have, like any parent, called my kids out from school when they are too sick to go (fever, pinkeye, etc) but I’d like to think my threshold for doing that is probably a lot higher than most parents.In a brief, informal survey of a few other docs sitting around the ER right now, no one has ever written a note for a spouse. One guy said he did it for his girlfriend when they were dating. Everyone says it would be too obvious if you did it, and the employer would likely see right through it. I tend to agree.With school, though (at least through highschool) parents can call their children in sick and, as far as I know, you don’t need to provide a doctor’s note. My kids are still in gradeschool, so I’m not 100% sure on that, but usually when parents bring their kids to the ER, they ask for notes for themselves (for work, since they had to come to the ER with their kid) but not for their child.

-

Can a first year BHMS student fill NEET UG Form? If yes then how will they get their original documents for counseling. Do they need to have TC from honopathic college or TC of school will work.

You can apply for the exam without any original documents. At the time of admission, You can provide your affidavit of appearing in BHMS.Your application will be accepted for the admission. You will need to provide TC of homeopathic college to get admission in 2018 counselling process.

-

If a student works more than 120 full days or 240 half days in a year in Germany, what are the consequences that one has to face? Is it allowed or is there severe punishment for the violation of the rule?

Let's see.While you are a full-time student you get certain benefits - for instance, you have to pay way less for your health insurance and you aren't taxed as harshly.During the semester, you can't work more than 20 hours per week. During the Semesterferien (semester breaks) you can work as much as you want.If you exceed those limits you will no longer be considered a full time student and lose your benefits - there will, most likely, be a rather hefty bill from your public insurance company and you will have to pay quite a lot of back taxes.See here for details: http://de.wikipedia.org/wiki/Wer... (note that the english version links to something completely different -_-)Assuming that you have spaced out your working days sensibly (i.e. no more than two full work days per week during the semester, more during breaks), you should be fine. If you worked your ass off during the semester and accumulated your working hours in one block, there might be problems.EDIT: Oh, and if you are subject to a Familienversicherung (...if you are insured via your parents and don't have to pay for your own health insurance) you can't earn more than 4740€ per year (in the "old federal states") or 4020€ per year (in the "new federal states") or you will have to insure yourself as a student (which costs about 72€ per month).

-

If an L-1A visa is granted to an individual in 2018, what is the status of their children if they want to study in the US? Will it be an international student profile, or local?

They need to apply for student visa

-

Is the Earth much closer to the inner edge of the habitable zone now than when it first formed 4.6 billion years ago? What will happen if the Earth finally moves out of the habitable zone or more accurately, the habitable zone moves away from Earth?

The sun is getting hotter as it ages. The inner edge of the habitable zone is slowly moving outwards and will eventually pass Earth’s orbit. Estimates vary as to how long that will be, but hundreds of millions of years from now.In the shorter term, all the polar ice will have melted for the last time. (Us human beings may be the imminent cause of that — global warming). After then, the planet’s surface temperature will stabilize, because more sun evaporates more water, which condenses into more clouds, which reflect more sunlight away. So the planet gets cloudier, not hotter, as the edge of the habitable zone approaches.But once the cloud cover signNowes close to 100%, the end is nigh. Water vapour is a greenhouse gas. So when no more cloud cover can form, the temperature rises, which creates more water vapour, which causes the temperature to rise, which adds more water vapour … until the planet ends up as a somewhat cooler version of Venus. Life becomes extinct.

-

You are in an empty room with a transparent glass of water. The glass is a right cylinder and appears to be half full. How can you accurately figure out if the glass is half full, more than half full, or less than half full?

Carefully tilt the cylindrical glass until the surface of water just touches the upper brim of the glass. Make sure no water spills out of it. Now check whether the surface of water also touches the brim of the bottom surface of the glass. If it does, then the glass is exactly half full. If the surface of water is just above the bottom brim, then glass is more than half empty and otherwise it is less than half empty.Source: Internet.Thanks to Pranav Kumar for suggesting it.

-

I'm a first year engineering student at SJBIT. At the end of my engineering program, if my aggregate is more than 8.5, will I get to attend the placement interview for colleges like RVCE, BMSCE, or PESU?

You can only attend placement programs of your college.Your marks would just make you eligible to satisfy the eligibility criteria required to attend the recruitment drive of a certain company.In addition to this there is something called as ‘pool campus drives’ where certain colleges allow students from other colleges also to attend the placement activity!

Create this form in 5 minutes!

How to create an eSignature for the the students or spouses children if the student or spouse will provide more than half of their

How to make an electronic signature for the The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their in the online mode

How to generate an electronic signature for your The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their in Chrome

How to generate an electronic signature for putting it on the The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their in Gmail

How to generate an electronic signature for the The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their straight from your smartphone

How to make an electronic signature for the The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their on iOS

How to generate an eSignature for the The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their on Android OS

People also ask

-

What is airSlate SignNow's approach to eSigning documents for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

airSlate SignNow provides a streamlined eSigning experience tailored for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their. Our platform allows users to quickly send and sign documents while ensuring security and compliance. With user-friendly features, it enhances the overall efficiency of document transactions.

-

How much does airSlate SignNow cost for educational institutions focusing on The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

Our pricing model is highly competitive and designed to support educational institutions. For entities dealing specifically with The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their, we offer tailored plans that can fit various budgets. Visit our pricing page for specific plans and discounts available for non-profits and educational organizations.

-

What features does airSlate SignNow offer to facilitate document signing for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

airSlate SignNow includes features such as template management, customizable workflows, and secure cloud storage specifically for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their. These tools help users automate their document processes and reduce the time spent on manual tasks, ensuring a smoother experience.

-

Can airSlate SignNow integrate with other software for education-related documentation including The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

Yes, airSlate SignNow seamlessly integrates with various educational tools and platforms. This makes it easier for users handling The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their to manage documents across different systems. Popular integrations include Google Workspace, Salesforce, and Microsoft Office 365.

-

What benefits can businesses expect from using airSlate SignNow for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

Using airSlate SignNow drastically speeds up the document signing process for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their. Businesses can expect enhanced productivity, reduced paper usage, and improved customer satisfaction. Our platform ensures that all documents are signed securely and in compliance with regulations.

-

Is there customer support available for users focusing on The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

Absolutely! We offer dedicated customer support for all users, including those focused on The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their. Our support team is available via chat, email, and phone to assist with any questions or technical issues.

-

How secure is airSlate SignNow for handling documents related to The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their?

Security is a top priority for airSlate SignNow, particularly for sensitive documents concerning The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their. Our platform employs advanced encryption and compliance with regulations such as GDPR and HIPAA to protect your information and ensure secure transactions.

Get more for The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their

Find out other The Students Or Spouses Children If The Student Or Spouse Will Provide More Than Half Of Their

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online