Md Form 505

What is the Md Form 505

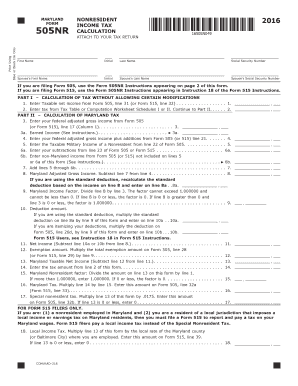

The Maryland Form 505 is a tax document specifically designed for non-residents who earn income in Maryland. This form allows individuals to report their Maryland-source income and calculate the appropriate tax owed to the state. The form is essential for those who do not reside in Maryland but have financial ties to the state, ensuring compliance with state tax laws.

How to use the Md Form 505

To use the Maryland Form 505, individuals must first determine their eligibility as non-residents earning income in Maryland. After confirming eligibility, taxpayers should gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income sources, deductions, and credits applicable to non-residents. Once completed, the form must be submitted to the Maryland Comptroller's Office by the specified deadline.

Steps to complete the Md Form 505

Completing the Maryland Form 505 involves several key steps:

- Gather all relevant income documentation, including any federal tax forms.

- Fill out personal information, including your name, address, and Social Security number.

- Report all Maryland-source income accurately on the designated lines.

- Calculate deductions and credits that apply to your situation as a non-resident.

- Review the form for accuracy and completeness before submission.

Legal use of the Md Form 505

The legal use of the Maryland Form 505 is crucial for ensuring that non-residents comply with state tax regulations. This form must be filled out accurately and submitted on time to avoid penalties. An eSignature can be used for online submissions, provided it meets the legal requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that the document is legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 505 typically coincide with federal tax deadlines. Non-residents must submit their forms by April 15 each year, unless an extension is filed. It is important to keep track of any changes to deadlines announced by the Maryland Comptroller's Office, especially during tax season.

Required Documents

When completing the Maryland Form 505, several documents are required to ensure accurate reporting:

- W-2 forms from employers indicating Maryland-source income.

- 1099 forms for any additional income received.

- Records of any deductions or credits that apply to non-residents.

- Previous year's tax returns may also be helpful for reference.

Quick guide on how to complete md form 505

Complete Md Form 505 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the required form and safely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents quickly without delays. Handle Md Form 505 on any device using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest way to modify and electronically sign Md Form 505 effortlessly

- Find Md Form 505 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Md Form 505 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the md form 505

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 505 Maryland used for?

The form 505 Maryland is primarily used for filing income tax returns for individuals and businesses in the state of Maryland. Utilizing airSlate SignNow, you can easily complete and eSign the form 505 Maryland, ensuring that your submissions are accurate and on time.

-

How does airSlate SignNow simplify the process of filing form 505 Maryland?

airSlate SignNow streamlines the entire process of filing the form 505 Maryland by allowing users to fill out the document electronically and eSign it securely. This reduces the chances of errors and saves time, making your tax filing process much more efficient.

-

Is there a cost associated with using airSlate SignNow for form 505 Maryland?

Yes, airSlate SignNow offers various pricing plans to cater to different business sizes and needs. By using airSlate SignNow for form 505 Maryland, you can access a cost-effective solution that simplifies document management and eSigning.

-

What features of airSlate SignNow are particularly beneficial for form 505 Maryland?

AirSlate SignNow provides features like customizable templates, real-time tracking, and secure eSigning, all of which enhance the experience of filing form 505 Maryland. These functionalities help ensure that you manage your documents efficiently and maintain compliance.

-

Can I integrate airSlate SignNow with other software while handling form 505 Maryland?

Absolutely! AirSlate SignNow can easily integrate with various CRM, document management, and productivity tools to provide a seamless experience when managing form 505 Maryland. This ensures you can work within your preferred ecosystem while maintaining high efficiency.

-

What security measures does airSlate SignNow have for form 505 Maryland?

Security is a priority for airSlate SignNow when eSigning and sending sensitive documents like form 505 Maryland. The platform uses high-level encryption, multi-factor authentication, and secure data storage to protect your information throughout the process.

-

How can airSlate SignNow help small businesses with form 505 Maryland?

AirSlate SignNow is designed to be an affordable option for small businesses managing form 505 Maryland. The platform simplifies the eSigning process, allowing small businesses to focus on growth rather than tedious paperwork, ultimately enhancing their productivity.

Get more for Md Form 505

Find out other Md Form 505

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself