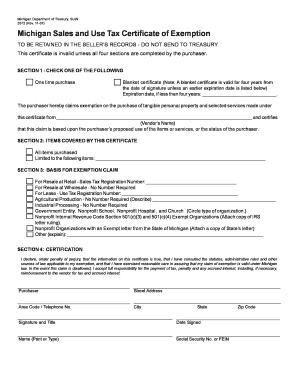

Sales Tax License Michigan Form

What is the Sales Tax License Michigan

The sales tax license in Michigan, also known as the Sales Tax Permit, is a legal document that allows businesses to collect sales tax on taxable sales. This license is essential for retailers, wholesalers, and service providers who engage in selling goods or services subject to sales tax. It ensures compliance with state tax laws and facilitates the proper remittance of collected taxes to the Michigan Department of Treasury.

How to obtain the Sales Tax License Michigan

To obtain a sales tax license in Michigan, businesses must complete the application process through the Michigan Department of Treasury. This involves filling out the appropriate form, which can be submitted online or via mail. Applicants need to provide essential information, such as business name, address, and type of business entity. It is important to ensure all details are accurate to avoid delays in processing.

Steps to complete the Sales Tax License Michigan

Completing the sales tax license application involves several key steps:

- Gather necessary information about your business, including legal structure and ownership details.

- Access the Michigan Department of Treasury website to find the sales tax license application form.

- Fill out the form accurately, providing all required information.

- Submit the application online or mail it to the designated address.

- Await confirmation from the state regarding your license approval.

Legal use of the Sales Tax License Michigan

The sales tax license must be used in accordance with Michigan tax laws. This includes collecting the correct amount of sales tax from customers, filing regular sales tax returns, and remitting the collected taxes to the state. Failure to comply with these regulations can result in penalties, including fines and potential loss of the sales tax license.

Required Documents

When applying for a sales tax license in Michigan, certain documents may be required to support your application. These typically include:

- Proof of business registration, such as Articles of Incorporation or a business license.

- Identification documents for business owners, like a driver's license or Social Security number.

- Any additional forms that may be specific to your business type or industry.

Form Submission Methods

Businesses in Michigan can submit their sales tax license application through various methods:

- Online submission via the Michigan Department of Treasury's e-Services portal.

- Mailing the completed form to the appropriate address provided on the application.

- In-person submission at designated state offices, if applicable.

Penalties for Non-Compliance

Non-compliance with sales tax regulations in Michigan can lead to significant penalties. These may include:

- Fines for failing to collect or remit sales tax.

- Interest on unpaid taxes.

- Revocation of the sales tax license.

Quick guide on how to complete sales tax license michigan

Prepare Sales Tax License Michigan effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Sales Tax License Michigan on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Sales Tax License Michigan effortlessly

- Obtain Sales Tax License Michigan and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal value as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Sales Tax License Michigan and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax license michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sales tax license in Michigan?

A sales tax license in Michigan is a permit issued by the state that allows businesses to collect sales tax on taxable sales. Obtaining a sales tax license michigan is essential for compliance with state tax laws and helps businesses avoid penalties.

-

How do I apply for a sales tax license in Michigan?

To apply for a sales tax license in Michigan, you need to complete the Michigan Sales Tax License Application and submit it to the Michigan Department of Treasury. Once your application is processed, you will receive your sales tax license michigan, allowing you to begin collecting sales tax.

-

What are the benefits of having a sales tax license in Michigan?

Having a sales tax license in Michigan not only ensures compliance with the law but also enhances your business's credibility. This license allows you to collect sales tax to fund state services, which further contributes to a positive business environment in Michigan.

-

Is there a cost associated with obtaining a sales tax license in Michigan?

In Michigan, applying for a sales tax license is generally free, helping reduce the initial overhead costs for new businesses. However, businesses must also keep records and file sales tax returns regularly, which may have associated costs.

-

How long does it take to receive a sales tax license in Michigan?

The processing time for a sales tax license in Michigan can vary, but it typically takes around 2-4 weeks after your application is submitted. It's recommended to apply as early as possible to avoid any delays in your business operations.

-

Can I use airSlate SignNow to facilitate my sales tax license application?

Yes, airSlate SignNow can be a great tool to streamline the application process for your sales tax license in Michigan. With this easy-to-use solution, you can send and eSign your documents electronically, ensuring a quick and efficient submission.

-

What features does airSlate SignNow offer for handling sales tax license documents?

airSlate SignNow offers features like document templates, customizable workflows, and secure eSigning to manage your sales tax license documents effectively. These features enable businesses to save time and reduce errors in the application process.

Get more for Sales Tax License Michigan

- Tenant information

- Alarm system monitoring agreement sentrynet sentrynet form

- Traffic safety merit badge worksheet form

- Lista de cotejo para cuadro sinoptico form

- Itd 3204 100468803 form

- Janitorial supply order form s3 amazonaws com

- Application for naturalizationuscisform n400depar

- Department of homeland securityu s coast guardi form

Find out other Sales Tax License Michigan

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast