Vermont Property Transfer Tax Form Pt 172 2020

What is the Vermont Property Transfer Tax Form Pt 172

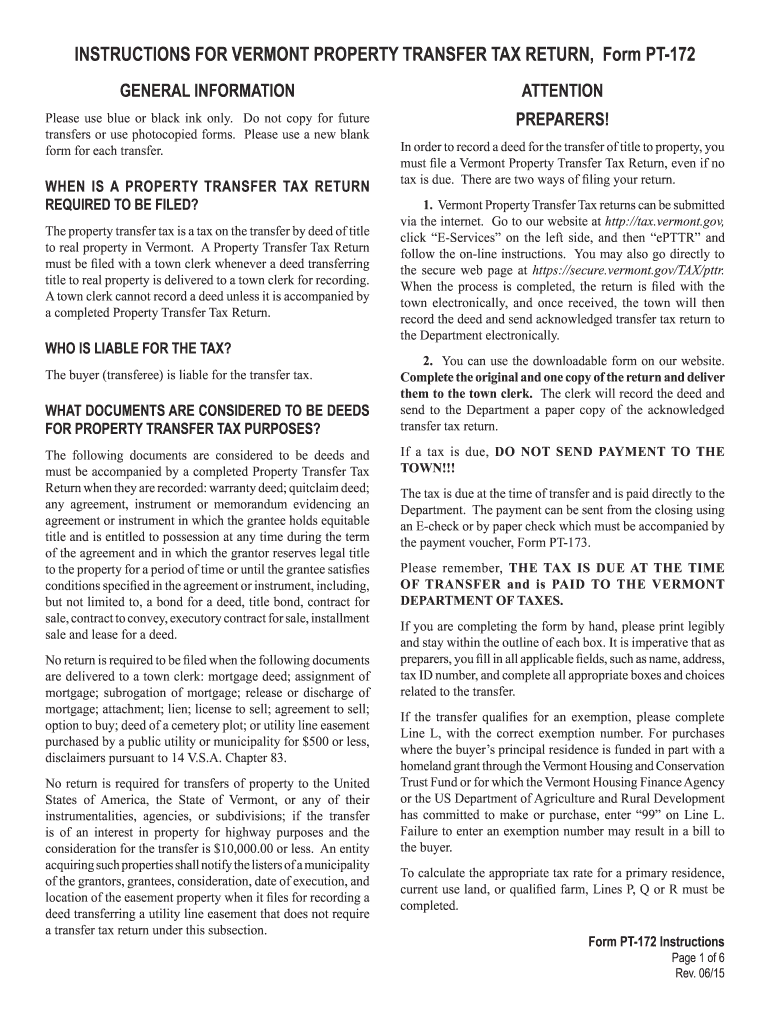

The Vermont Property Transfer Tax Form Pt 172 is a crucial document used in the transfer of real estate in Vermont. This form is designed to report the sale or transfer of property and calculate the associated property transfer tax. It is essential for both buyers and sellers to complete this form accurately to ensure compliance with state tax regulations. The form collects vital information, including the names of the parties involved, the property's address, and the sale price.

Steps to Complete the Vermont Property Transfer Tax Form Pt 172

Completing the Vermont Property Transfer Tax Form Pt 172 involves several key steps:

- Gather necessary information about the property, including its address and sale price.

- Provide the names and addresses of both the buyer and seller.

- Indicate any exemptions that may apply to the transaction.

- Calculate the total transfer tax based on the sale price.

- Sign and date the form to validate it.

Ensure that all information is accurate and complete to avoid delays in processing.

How to Obtain the Vermont Property Transfer Tax Form Pt 172

The Vermont Property Transfer Tax Form Pt 172 can be obtained through several channels. It is available online on the Vermont Department of Taxes website, where users can download the form in PDF format. Additionally, the form may be available at local town offices or through real estate professionals who assist with property transactions. It is important to use the most current version of the form to ensure compliance with state regulations.

Legal Use of the Vermont Property Transfer Tax Form Pt 172

The Vermont Property Transfer Tax Form Pt 172 is legally binding when completed correctly and submitted to the appropriate authorities. To ensure its legal validity, the form must be signed by the parties involved in the transaction. It is essential to comply with all state laws regarding property transfers, as failure to do so may result in penalties or delays in the transfer process. Using a reliable electronic signature solution can enhance the legal standing of the form.

Form Submission Methods

The completed Vermont Property Transfer Tax Form Pt 172 can be submitted through various methods:

- Online submission via the Vermont Department of Taxes website, if available.

- Mailing the form to the appropriate local tax office.

- In-person delivery to the local tax office or town clerk's office.

Choosing the right submission method can help ensure timely processing of the form.

Key Elements of the Vermont Property Transfer Tax Form Pt 172

Several key elements must be included in the Vermont Property Transfer Tax Form Pt 172:

- Identification of the buyer and seller, including their names and addresses.

- Property details, such as the address and parcel identification number.

- Sale price of the property, which is used to calculate the transfer tax.

- Any applicable exemptions that may reduce the tax liability.

- Signature of both parties to validate the form.

Ensuring these elements are correctly filled out is vital for the form's acceptance.

Quick guide on how to complete vermont property transfer tax form pt 172

Effortlessly prepare Vermont Property Transfer Tax Form Pt 172 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Vermont Property Transfer Tax Form Pt 172 across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Vermont Property Transfer Tax Form Pt 172 with ease

- Find Vermont Property Transfer Tax Form Pt 172 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Vermont Property Transfer Tax Form Pt 172 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont property transfer tax form pt 172

Create this form in 5 minutes!

How to create an eSignature for the vermont property transfer tax form pt 172

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont property transfer tax form PT 172?

The Vermont property transfer tax form PT 172 is a document required for real estate transactions in Vermont. It is used to report the sale of property and calculate the associated transfer tax. Completing this form accurately is crucial to ensure compliance with Vermont's tax regulations.

-

How can airSlate SignNow help with the Vermont property transfer tax form PT 172?

airSlate SignNow offers a seamless solution for completing and eSigning the Vermont property transfer tax form PT 172. With our user-friendly platform, you can easily fill out the form, add necessary signatures, and store the document securely in the cloud, simplifying the entire process.

-

What are the pricing options for using airSlate SignNow for the Vermont property transfer tax form PT 172?

airSlate SignNow provides cost-effective pricing plans tailored for businesses and individual users. Our plans include essential features that allow users to manage documents efficiently, including the Vermont property transfer tax form PT 172. Visit our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other applications to handle the Vermont property transfer tax form PT 172?

Yes, airSlate SignNow offers integration capabilities with various applications, enhancing your workflow when dealing with the Vermont property transfer tax form PT 172. Whether you use CRM systems or cloud storage services, our platform can connect seamlessly to streamline your document management process.

-

What features does airSlate SignNow provide for handling the Vermont property transfer tax form PT 172?

airSlate SignNow comes with a range of features specifically designed for handling documents like the Vermont property transfer tax form PT 172. These features include electronic signatures, templates for repeat use, and real-time collaboration tools to facilitate communication among all parties involved in the transaction.

-

Is airSlate SignNow secure for handling sensitive documents like the Vermont property transfer tax form PT 172?

Absolutely! airSlate SignNow prioritizes security and ensures that all documents, including the Vermont property transfer tax form PT 172, are protected with advanced encryption protocols. Our platform complies with industry standards to keep your data safe and secure during and after the signing process.

-

How quickly can I complete the Vermont property transfer tax form PT 172 using airSlate SignNow?

With airSlate SignNow's intuitive interface, you can complete the Vermont property transfer tax form PT 172 in just a matter of minutes. Our platform simplifies the process, allowing you to fill out the form efficiently, obtain signatures, and finalize your transaction without unnecessary delays.

Get more for Vermont Property Transfer Tax Form Pt 172

Find out other Vermont Property Transfer Tax Form Pt 172

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License