Property Transfer Tax Payment Voucher Form Deeds Com 2017

Understanding the Property Transfer Tax Payment Voucher Form

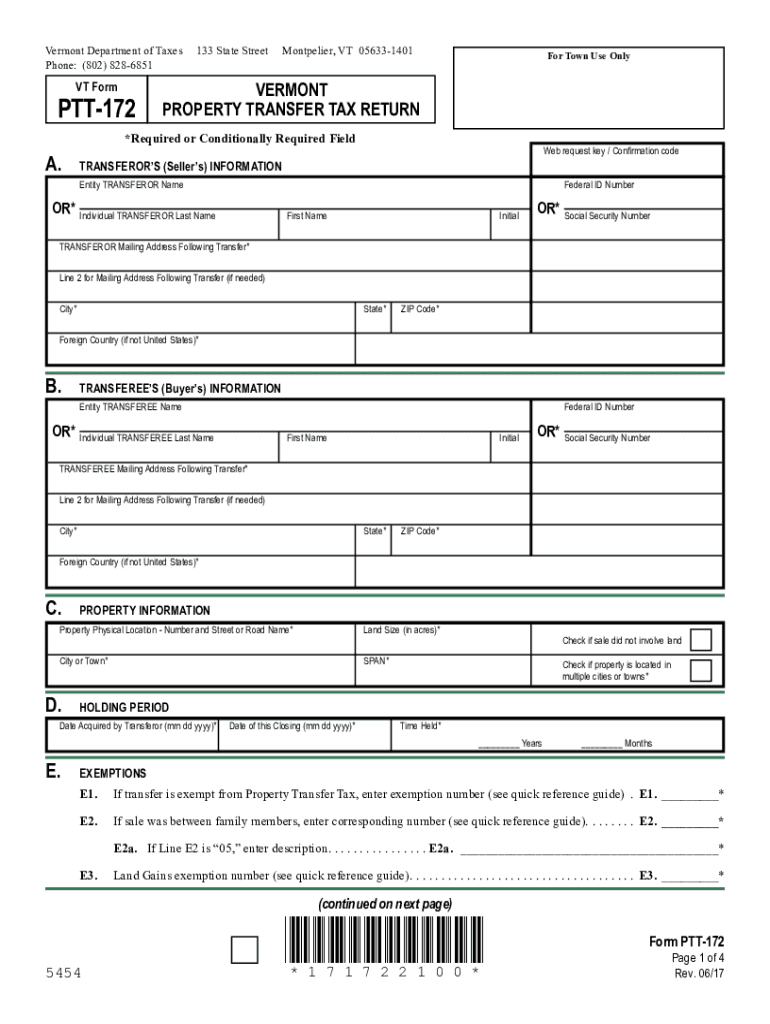

The Property Transfer Tax Payment Voucher Form, commonly referred to as the pt 172, is essential for individuals and businesses engaging in real estate transactions in Vermont. This form is used to report and pay the property transfer tax associated with the transfer of real estate. It ensures compliance with state tax regulations and helps facilitate the legal transfer of property ownership.

Steps to Complete the Property Transfer Tax Payment Voucher Form

Completing the pt 172 form involves several key steps to ensure accuracy and compliance. Start by gathering necessary information about the property, including the address, the names of the grantor and grantee, and the sale price. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form along with the payment to the appropriate state department, either online or via mail, depending on your preference.

Legal Use of the Property Transfer Tax Payment Voucher Form

The pt 172 form holds legal significance in Vermont as it documents the payment of property transfer taxes. This form must be filed to validate the transfer of property ownership and to comply with state tax laws. Failure to submit this form can result in penalties and complications in the property transfer process. It is crucial to understand the legal implications of this form to ensure that all transactions are conducted lawfully.

Filing Deadlines and Important Dates

Timely submission of the pt 172 form is critical to avoid penalties. In Vermont, the filing deadline typically coincides with the closing date of the property transaction. It is advisable to check for any specific deadlines that may apply to your situation, as these can vary based on the nature of the transaction. Being aware of these deadlines ensures that you remain compliant with state regulations and avoid unnecessary fees.

Required Documents for Submission

When completing the pt 172 form, certain documents are required to support your submission. These may include a copy of the purchase and sale agreement, proof of payment for the property transfer tax, and any additional documentation that may be relevant to the transaction. Ensuring you have all necessary documents ready will facilitate a smoother submission process and help avoid delays.

Penalties for Non-Compliance

Failure to file the pt 172 form or pay the associated property transfer tax can result in significant penalties. The state may impose fines or interest on unpaid taxes, which can accumulate over time. Additionally, non-compliance can complicate the legal transfer of property ownership, potentially leading to disputes or legal challenges. Understanding these consequences highlights the importance of timely and accurate submission of the form.

Quick guide on how to complete property transfer tax payment voucher form deedscom

Finish Property Transfer Tax Payment Voucher Form Deeds com effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the needed form and securely manage it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Property Transfer Tax Payment Voucher Form Deeds com on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Property Transfer Tax Payment Voucher Form Deeds com with ease

- Find Property Transfer Tax Payment Voucher Form Deeds com and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or censor sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Property Transfer Tax Payment Voucher Form Deeds com and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property transfer tax payment voucher form deedscom

Create this form in 5 minutes!

How to create an eSignature for the property transfer tax payment voucher form deedscom

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is pt 172 in the context of e-signatures?

PT 172 refers to a specific feature within airSlate SignNow that enhances the electronic signature process. It allows users to streamline document management and ensure compliance with e-signature laws. Understanding pt 172 can help businesses leverage electronic signatures effectively.

-

How does the pt 172 feature improve document workflows?

The pt 172 feature in airSlate SignNow automates the entire process of sending, signing, and managing documents. This reduces delays and increases efficiency, enabling users to focus on their core business activities. Furthermore, pt 172 ensures that all documents are tracked and secured.

-

What are the pricing options for the pt 172 feature?

Pricing for accessing the pt 172 feature in airSlate SignNow varies based on the subscription plan chosen. Typically, users can select from multiple tiers that cater to different business sizes and needs. It’s essential to evaluate the plans to find the best fit based on your use of pt 172.

-

Can pt 172 integrate with other software solutions?

Yes, pt 172 is designed to integrate seamlessly with various software applications like CRMs and project management tools. This integration allows for a more cohesive workflow, automating tasks and enhancing efficiency. Users can easily connect pt 172 with their existing systems to improve document handling.

-

What benefits does pt 172 provide for remote teams?

PT 172 offers signNow advantages for remote teams by facilitating efficient document signing anywhere, anytime. With airSlate SignNow's electronic signature capabilities, remote workers can collaborate effectively without being physically present. This flexibility helps maintain productivity regardless of location.

-

Is pt 172 compliant with e-signature regulations?

Absolutely, pt 172 complies with all major e-signature regulations, including ESIGN and UETA. This compliance ensures that signed documents are legally binding, providing peace of mind to businesses and individuals using airSlate SignNow. Trusting pt 172 means you can be confident in the legality of your electronic agreements.

-

Does pt 172 enhance security for document signing?

Yes, pt 172 signNowly enhances the security of document signing processes within airSlate SignNow. It includes encryption and secure access protocols, ensuring that all sensitive information is protected. By utilizing pt 172, users can rest assured that their documents remain confidential and secure.

Get more for Property Transfer Tax Payment Voucher Form Deeds com

Find out other Property Transfer Tax Payment Voucher Form Deeds com

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free