PTT 172 2020-2026

What is the PTT 172?

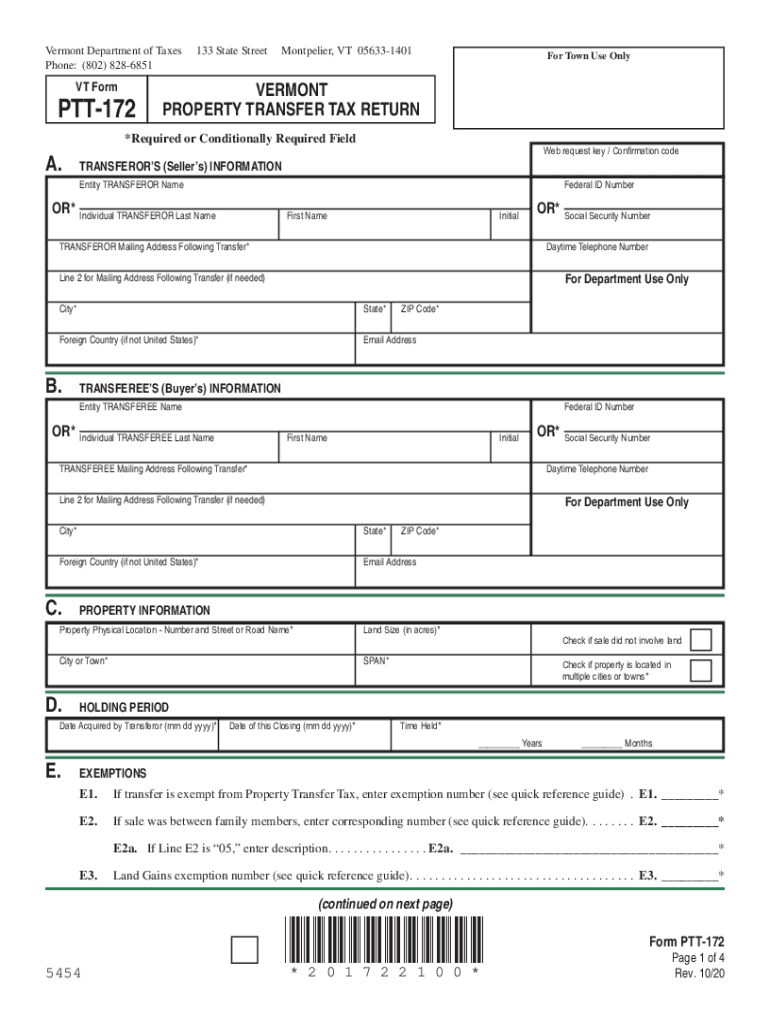

The PTT 172, also known as the Property Transfer Tax Return, is a form used in Vermont to report the transfer of property ownership. This form is essential for calculating the property transfer tax owed to the state. It is typically required when real estate is sold or transferred, ensuring that the state collects the appropriate tax revenue from property transactions. Understanding this form is crucial for both buyers and sellers involved in real estate transactions in Vermont.

Steps to complete the PTT 172

Completing the PTT 172 involves several key steps to ensure accuracy and compliance with state regulations. Follow these steps for a smooth process:

- Gather necessary information about the property, including the address, parcel number, and sale price.

- Identify the buyer and seller, providing their names and contact information.

- Complete the form by filling in all required fields, ensuring that all information is accurate and up to date.

- Calculate the property transfer tax based on the sale price using the tax rate applicable in Vermont.

- Review the completed form for any errors or omissions before submission.

Legal use of the PTT 172

The PTT 172 serves a legal function in property transactions. It must be filed to comply with Vermont law regarding property transfers. The form ensures that the state is informed of changes in property ownership and that the appropriate taxes are collected. Failure to file the PTT 172 can result in penalties or delays in the transfer process. It is important to understand the legal implications of this form and to complete it accurately to avoid any legal issues.

Required Documents

To complete the PTT 172, several documents may be required. These documents help substantiate the information provided on the form:

- Sales contract or agreement between the buyer and seller.

- Deed or any other legal documents related to the property transfer.

- Identification documents for both parties, such as driver's licenses or tax identification numbers.

Form Submission Methods

The PTT 172 can be submitted through various methods, providing flexibility for users. Options include:

- Online submission through the Vermont Department of Taxes website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state tax offices.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines for the PTT 172 to avoid penalties. Typically, the form must be filed within a specific timeframe after the property transfer occurs. Keeping track of these deadlines ensures compliance with state regulations and helps facilitate a smooth transaction process.

Quick guide on how to complete ptt 172

Complete PTT 172 effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage PTT 172 on any platform using airSlate SignNow's Android or iOS applications and ease any document-related processes today.

How to modify and eSign PTT 172 with ease

- Obtain PTT 172 and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your device of choice. Alter and eSign PTT 172 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptt 172

Create this form in 5 minutes!

How to create an eSignature for the ptt 172

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What are the ptt 172 instructions for using airSlate SignNow?

The ptt 172 instructions detail the processes for digitally signing and sending documents using airSlate SignNow. Users can easily create, edit, and manage their documents with clear guidance throughout each step. This ensures that even those new to e-signatures can quickly understand how to utilize the platform effectively.

-

Are there any costs associated with following the ptt 172 instructions?

airSlate SignNow offers various pricing plans that cater to different business needs, and the ptt 172 instructions can be followed regardless of the plan chosen. While there may be subscription fees, the ease of use and efficiency gained from following the instructions typically lead to substantial time and cost savings in document management.

-

What features do the ptt 172 instructions cover?

The ptt 172 instructions cover a range of features including document creation, e-signature options, and integration with other tools. By following these instructions, users can take full advantage of the platform's capabilities to streamline their document workflows. This makes it easier to manage legal paperwork electronically.

-

How can the ptt 172 instructions benefit my business?

By using the ptt 172 instructions with airSlate SignNow, businesses can enhance their efficiency in handling documents. The instructions help users avoid common pitfalls and ensure compliance with legal standards. This, in turn, saves time and reduces the chances of errors in document handling.

-

Do the ptt 172 instructions include information on integrating with other software?

Yes, the ptt 172 instructions provide guidance on how to integrate airSlate SignNow with various third-party applications. This integration allows users to connect their existing tools and automate workflows seamlessly, enhancing productivity and reducing manual tasks.

-

Can I access the ptt 172 instructions on mobile devices?

Absolutely! The ptt 172 instructions are accessible on mobile devices, allowing users to manage documents and e-signatures on the go. This flexibility is crucial for businesses that require remote access to document management and signing processes.

-

Is there customer support available for questions about the ptt 172 instructions?

Yes, airSlate SignNow offers robust customer support for any inquiries related to the ptt 172 instructions. Users can signNow out via chat, email, or phone to get assistance as they navigate the platform, ensuring a smooth experience as they implement e-signatures.

Get more for PTT 172

- Excavator contract for contractor arkansas form

- Renovation contract for contractor arkansas form

- Residential cleaning contract for contractor arkansas form

- Concrete mason contract for contractor arkansas form

- Demolition contract for contractor arkansas form

- Framing contract for contractor arkansas form

- Security contract for contractor arkansas form

- Insulation contract for contractor arkansas form

Find out other PTT 172

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy