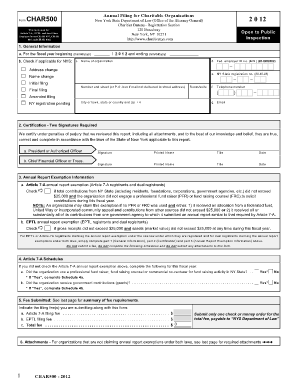

Char500 Nys Form

What is the Char500 Nys Form

The Char500 Nys Form is a crucial document used by nonprofit organizations in New York State to report their financial activities and maintain their tax-exempt status. This form is essential for compliance with state regulations and provides transparency regarding the organization's operations. It is typically required to be filed annually, ensuring that the state has up-to-date information about the nonprofit's income, expenses, and overall financial health.

How to use the Char500 Nys Form

Using the Char500 Nys Form involves several steps to ensure that all necessary information is accurately reported. Organizations must gather financial statements, including income and expense reports, and any relevant documentation that supports their claims. Once the form is completed, it can be submitted electronically or by mail, depending on the organization's preference and the specific filing requirements set by the state.

Steps to complete the Char500 Nys Form

Completing the Char500 Nys Form requires careful attention to detail. Here are the key steps:

- Gather all financial documents, including bank statements, receipts, and previous tax filings.

- Fill out the form with accurate figures, ensuring that all income and expenses are accounted for.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the appropriate state portal or mail it to the designated address.

Legal use of the Char500 Nys Form

The Char500 Nys Form serves a legal purpose by ensuring that nonprofit organizations comply with state laws governing their operations. Filing this form is a legal requirement for maintaining tax-exempt status, and failure to do so can result in penalties or loss of that status. Organizations must understand the legal implications of their filings and ensure that all information provided is truthful and accurate.

Filing Deadlines / Important Dates

Nonprofit organizations must adhere to specific deadlines when filing the Char500 Nys Form. Typically, the form is due within four and a half months after the end of the organization’s fiscal year. It is crucial for organizations to mark these dates on their calendars to avoid late fees and maintain compliance with state regulations.

Required Documents

To successfully complete the Char500 Nys Form, organizations need to prepare several key documents, including:

- Financial statements, such as balance sheets and income statements.

- Detailed records of all income sources and expenditures.

- Documentation supporting any claims made in the form, such as grant agreements or contracts.

Form Submission Methods (Online / Mail / In-Person)

The Char500 Nys Form can be submitted through various methods, providing flexibility for organizations. They can choose to file online via the New York State Department of State website, which often expedites processing times. Alternatively, organizations may opt to mail the completed form to the appropriate address or, in some cases, submit it in person at designated state offices. Each method has its own guidelines and timelines, so organizations should select the one that best fits their needs.

Quick guide on how to complete char500 nys form

Complete Char500 Nys Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Manage Char500 Nys Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Char500 Nys Form seamlessly

- Locate Char500 Nys Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to store your changes.

- Select how you would like to share your form, via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Char500 Nys Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the char500 nys form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Char500 Nys Form?

The Char500 Nys Form is a financial report required by the New York State Attorney General from certain charitable organizations. This form provides transparency about an organization's financial activities and ensures compliance with state laws. By using the Char500 Nys Form, organizations can maintain their charitable status while keeping donors informed.

-

How can airSlate SignNow help with the Char500 Nys Form?

airSlate SignNow offers an efficient solution for electronically signing and submitting the Char500 Nys Form. With user-friendly features, organizations can easily prepare, send, and eSign the form quickly. This helps streamline the submission process, ensuring timely compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Char500 Nys Form?

Yes, there is a pricing structure for using airSlate SignNow, which provides cost-effective solutions for managing documents like the Char500 Nys Form. Different plans are available based on features and user needs, ensuring that all organizations can find a plan that fits their budget while maintaining compliance.

-

What features does airSlate SignNow offer for the Char500 Nys Form?

airSlate SignNow provides features such as document templates, collaborative editing, and secure eSigning for the Char500 Nys Form. These tools enhance efficiency and ensure that all necessary information is captured accurately. Additionally, the platform supports tracking and reminders to keep submissions on schedule.

-

Can I integrate airSlate SignNow with other software for managing the Char500 Nys Form?

Absolutely! airSlate SignNow offers integration capabilities with popular software solutions like CRM systems and cloud storage. This flexibility allows organizations to streamline their workflow for the Char500 Nys Form, automating data entry and ensuring that all documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the Char500 Nys Form?

Using airSlate SignNow for the Char500 Nys Form enhances efficiency, ensuring compliance with deadlines and state requirements. The platform reduces paperwork and allows for faster processing times. Organizations also benefit from improved document security and easier collaboration among team members.

-

Is airSlate SignNow user-friendly for completing the Char500 Nys Form?

Yes, airSlate SignNow is designed with user experience in mind, making it incredibly easy to complete and submit the Char500 Nys Form. The intuitive interface guides users through each step of the signing process. Whether you are tech-savvy or a novice, you can navigate the platform with ease.

Get more for Char500 Nys Form

- Referee statement form electrical

- Discretionary housing payment form malvern hills district council

- Santa clara county tb risk assessment form

- Works cited form

- Cut0165 1s form

- Https form

- Form to assist in the recover of lost belongings

- Issaquahwa govdocumentcenterviewpicnic shelter rental request application page 1 form

Find out other Char500 Nys Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation