Form St 14

What is the Form St 14

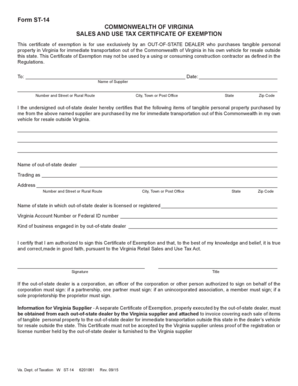

The Form St 14 is a tax form used in Virginia for the purpose of claiming a sales and use tax exemption. This form is typically utilized by organizations or individuals who qualify for tax-exempt status under specific categories, such as non-profit organizations, government entities, or certain educational institutions. Understanding the purpose and requirements of the Form St 14 is essential for ensuring compliance with state tax regulations.

How to use the Form St 14

Using the Form St 14 involves several steps to ensure it is filled out correctly. First, identify your eligibility for tax exemption and gather the necessary documentation to support your claim. Next, complete the form by providing accurate information, including your name, address, and the reason for the exemption. Once completed, submit the form to the appropriate vendor or service provider at the time of purchase to avoid being charged sales tax.

Steps to complete the Form St 14

Completing the Form St 14 requires careful attention to detail. Follow these steps for accurate submission:

- Review the eligibility criteria to confirm your status as a tax-exempt entity.

- Gather supporting documents, such as your organization’s tax-exempt certificate.

- Fill out the form with your organization’s information, including name and address.

- Clearly state the reason for the exemption in the designated section.

- Sign and date the form to validate your claim.

- Provide the completed form to the vendor at the time of purchase.

Legal use of the Form St 14

The legal use of the Form St 14 is governed by Virginia state tax laws. To ensure that the form is considered valid, it must be completed accurately and submitted at the time of the transaction. The form serves as a declaration of your tax-exempt status, and misuse or fraudulent claims can result in penalties. It is important to keep records of all transactions where the Form St 14 has been used to support your claims if audited.

Key elements of the Form St 14

Several key elements must be included in the Form St 14 for it to be valid:

- Entity Information: The name, address, and contact information of the tax-exempt entity.

- Reason for Exemption: A clear statement of the basis for claiming tax exemption.

- Signature: The form must be signed by an authorized representative of the entity.

- Date: The date the form is completed and submitted.

Who Issues the Form

The Form St 14 is issued by the Virginia Department of Taxation. This state agency is responsible for providing the necessary forms and guidelines for tax-exempt organizations. It is important for users to refer to the official resources provided by the Department of Taxation to ensure they are using the most current version of the form and complying with all relevant regulations.

Quick guide on how to complete form st 14 207111609

Complete Form St 14 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form St 14 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Form St 14 without any hassle

- Locate Form St 14 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Form St 14 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 14 207111609

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form st 14, and how is it used in airSlate SignNow?

The form st 14 is a specific document template that businesses can utilize within airSlate SignNow for compliance and signature tracking. This form streamlines the signing process, allowing users to quickly gather signatures and ensure compliance with state regulations.

-

How can I create a form st 14 using airSlate SignNow?

Creating a form st 14 in airSlate SignNow is straightforward. Simply select the template option within the platform, choose the form st 14, and customize it according to your needs to ensure it captures all necessary information for your clients.

-

What are the key benefits of using form st 14 with airSlate SignNow?

One of the primary benefits of using form st 14 with airSlate SignNow is the efficiency it brings to document management and signing. It enhances collaboration, reduces paperwork, and speeds up the processing time, ultimately benefiting your business operations.

-

Is airSlate SignNow affordable for businesses needing the form st 14?

Yes, airSlate SignNow offers competitive pricing plans that are suitable for businesses of all sizes needing the form st 14. With a range of features included, it provides signNow value for companies looking to streamline their document workflows.

-

What features does airSlate SignNow provide for handling form st 14?

airSlate SignNow includes features like document templates, custom branding, and real-time tracking for form st 14. These features enhance the user experience by providing a professional look and ensuring that you can monitor the status of your documents at all times.

-

Can form st 14 be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with various applications, allowing seamless use of form st 14 across different platforms. This capability helps maintain a cohesive workflow by connecting your existing tools with SignNow's eSigning solutions.

-

Is it secure to use airSlate SignNow for form st 14 documents?

Yes, airSlate SignNow prioritizes security for all documents, including form st 14. The platform employs advanced encryption and authentication protocols to ensure that your sensitive information remains protected throughout the signing process.

Get more for Form St 14

Find out other Form St 14

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now