T2125 Turbotax Form

What is the T2125 Turbotax

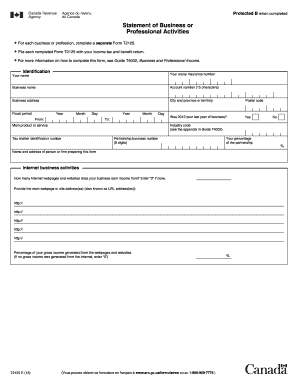

The T2125 form, often referred to in relation to TurboTax, is used by self-employed individuals in Canada to report their business income and expenses. This form is crucial for accurately calculating net income for tax purposes. It allows taxpayers to detail their earnings, deductible expenses, and other relevant financial information associated with their business operations. Understanding the T2125 is essential for anyone who operates a business as a sole proprietor or in a partnership.

How to use the T2125 Turbotax

Using the T2125 form within TurboTax involves several straightforward steps. First, ensure you have all necessary financial documents, including income statements and expense receipts. When you open TurboTax, navigate to the self-employment section where you can input your business details. TurboTax will guide you through entering your income and expenses, ensuring that you fill out the T2125 accurately. The software also provides prompts and suggestions to help maximize your deductions and ensure compliance with tax regulations.

Steps to complete the T2125 Turbotax

Completing the T2125 form in TurboTax requires a systematic approach:

- Gather all relevant financial documents, including income records and expense receipts.

- Open TurboTax and select the self-employment section.

- Input your business name and address, followed by your income details.

- Enter your business expenses, categorizing them appropriately (e.g., supplies, travel, utilities).

- Review the information for accuracy and completeness.

- Finalize the form and submit it through TurboTax, either electronically or via print.

Legal use of the T2125 Turbotax

The T2125 form must be completed in compliance with IRS regulations to be considered legally binding. This means ensuring that all reported income and expenses are accurate and supported by documentation. Using TurboTax helps facilitate this compliance by providing guidance on the necessary legal requirements and ensuring that the form is filled out correctly. Additionally, utilizing eSignature solutions can further enhance the legal standing of the completed form.

IRS Guidelines

The IRS provides specific guidelines for completing the T2125 form, emphasizing the importance of accurate reporting. Taxpayers should refer to the IRS publications related to self-employment income and expenses to understand what qualifies as deductible. TurboTax incorporates these guidelines into its software, ensuring that users are informed about current tax laws and any changes that may affect their filings.

Required Documents

To complete the T2125 form accurately, several documents are required:

- Income statements, such as invoices and sales receipts.

- Expense receipts for business-related costs, including utilities, supplies, and travel.

- Bank statements that reflect business transactions.

- Previous year's tax returns, if available, for reference.

Quick guide on how to complete t2125 turbotax

Complete T2125 Turbotax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your files quickly without any delays. Manage T2125 Turbotax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign T2125 Turbotax without hassle

- Find T2125 Turbotax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, and mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign T2125 Turbotax to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2125 turbotax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2125 form in TurboTax?

The t2125 form in TurboTax is used by self-employed individuals in Canada to report their business income and expenses. It allows users to detail their earnings, categorize their expenses, and calculate their net profit or loss. Using t2125 in TurboTax ensures accurate filing and may help maximize deductions.

-

How can I integrate t2125 TurboTax with airSlate SignNow?

Integrating t2125 TurboTax with airSlate SignNow is straightforward. You can easily upload your completed t2125 forms to airSlate SignNow, allowing you to send documents for eSignature quickly. This integration streamlines your workflow and enhances document management during tax season.

-

What are the benefits of using TurboTax for t2125 filings?

Using TurboTax for t2125 filings simplifies the process of filing your self-employment taxes. It provides step-by-step guidance, integrated forms, and helps you identify potential deductions and credits that could lower your tax bill. TurboTax ensures that your t2125 form is accurate and compliant with current tax regulations.

-

Is there a cost associated with using TurboTax for t2125 forms?

Yes, there is a cost associated with using TurboTax for t2125 forms, which varies based on the version of TurboTax you choose. Some versions include additional features and support that can be beneficial for self-employed users. It's essential to evaluate your needs to select the most suitable TurboTax option.

-

Can airSlate SignNow help with the eSigning process for t2125 TurboTax forms?

Absolutely! airSlate SignNow provides a user-friendly platform for electronically signing t2125 TurboTax forms. Once your forms are complete, you can quickly send them out for signatures, ensuring a secure and efficient signing process, ready for submission.

-

What features does TurboTax offer for t2125 preparation?

TurboTax offers several features for t2125 preparation, including user-friendly input fields for income and expense categorization, live chat support, and error checking. Additionally, it automatically calculates your tax owing based on the data entered, ensuring accuracy when filing your t2125 form.

-

How does airSlate SignNow enhance the t2125 TurboTax filing experience?

airSlate SignNow enhances the t2125 TurboTax filing experience by simplifying document management and eSigning. Users can efficiently prepare their t2125 form in TurboTax, send it for electronic signatures through airSlate SignNow, and seamlessly manage all tax-related documents in one platform.

Get more for T2125 Turbotax

Find out other T2125 Turbotax

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online