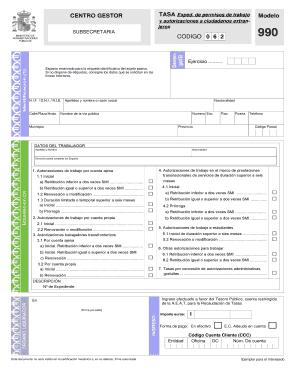

Modelo 990 Form

What is the Modelo 990

The modelo 990 is a tax form used primarily by certain nonprofit organizations in the United States to report their financial activities to the Internal Revenue Service (IRS). This form is essential for maintaining tax-exempt status and ensuring compliance with federal regulations. By providing detailed information about income, expenses, and program services, the modelo 990 helps the IRS assess whether an organization is operating within the guidelines of tax-exempt purposes.

How to use the Modelo 990

Using the modelo 990 involves several steps to ensure accurate reporting. Organizations must gather financial records, including income statements and balance sheets, to complete the form. It is important to categorize revenues and expenditures correctly, as this information reflects the organization's financial health. Once filled out, the modelo 990 must be submitted to the IRS, typically on an annual basis, to maintain compliance and transparency.

Steps to complete the Modelo 990

Completing the modelo 990 requires careful attention to detail. Here are the main steps:

- Gather all necessary financial documents, including income statements, expense reports, and previous tax filings.

- Fill out the form, ensuring that all sections are accurately completed, including revenue sources and program details.

- Review the completed form for accuracy and completeness, checking for any missing information.

- File the modelo 990 with the IRS by the designated deadline, ensuring that it is submitted electronically or via mail as required.

Legal use of the Modelo 990

The modelo 990 is legally binding and must be completed in accordance with IRS regulations. This form serves as a public document, allowing transparency regarding the financial activities of nonprofit organizations. Failure to file the modelo 990 or filing inaccurate information can result in penalties, including the loss of tax-exempt status. Organizations should ensure compliance with all relevant laws to maintain their standing.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing the modelo 990. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations with a fiscal year ending on December 31, the deadline would be May 15 of the following year. It is essential to keep track of these dates to avoid penalties and ensure timely compliance.

Required Documents

To successfully complete the modelo 990, several documents are required. These typically include:

- Financial statements, including income and balance sheets.

- Records of contributions and grants received.

- Expense reports detailing operational costs.

- Documentation of program services and activities.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the modelo 990 can lead to significant penalties. Organizations that fail to file the form on time may incur fines, and repeated failures can result in the automatic revocation of tax-exempt status. It is crucial for organizations to understand their responsibilities and ensure that they meet all filing obligations to avoid these consequences.

Quick guide on how to complete modelo 990

Effortlessly prepare Modelo 990 on any device

Digital document management has gained signNow traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Modelo 990 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Modelo 990 with ease

- Locate Modelo 990 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that reason.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Alter and electronically sign Modelo 990 and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the modelo 990

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the modelo 990 and how does it work with airSlate SignNow?

The modelo 990 is a specific form that businesses need for tax purposes. Using airSlate SignNow, you can easily eSign and send the modelo 990, ensuring secure and efficient handling of your tax documentation.

-

What are the key features of airSlate SignNow for managing modelo 990?

airSlate SignNow offers features like customizable templates, real-time tracking, and powerful integrations to streamline the workflow for modelo 990. These tools simplify document management and enhance efficiency when dealing with tax forms.

-

Is there a cost associated with using airSlate SignNow for modelo 990?

Yes, airSlate SignNow provides a range of pricing plans to accommodate businesses of all sizes. By choosing the appropriate plan, you can leverage its features to effectively manage the modelo 990 within your budget.

-

Can I integrate airSlate SignNow with other applications to handle modelo 990?

Absolutely! airSlate SignNow offers numerous integrations with popular applications such as Google Drive, Dropbox, and more. This means you can easily import, export, and manage your modelo 990 documents across different platforms.

-

What are the benefits of using airSlate SignNow for eSigning modelo 990?

Using airSlate SignNow for eSigning modelo 990 improves speed and accuracy. It allows you to sign documents securely online, reducing the likelihood of errors and ensuring quicker submission to the relevant authorities.

-

How does airSlate SignNow enhance the security of my modelo 990 documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with international regulations. This ensures that your modelo 990 documents are securely stored and transmitted, offering peace of mind during the signing process.

-

Is airSlate SignNow user-friendly for preparing modelo 990?

Yes, airSlate SignNow is designed with user experience in mind. Its intuitive interface allows users of all technical backgrounds to prepare and send modelo 990 documents without any hassle.

Get more for Modelo 990

Find out other Modelo 990

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe