1040 Tax Table Form

What is the 1040 Tax Table

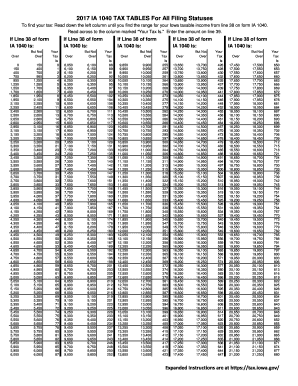

The 1040 tax table is a crucial resource provided by the IRS to help taxpayers determine their federal income tax obligations based on their taxable income. This table outlines the tax rates applicable to various income brackets, ensuring that individuals can accurately calculate how much they owe. The tax table is part of the Form 1040 package, which is the standard form used for individual income tax filing in the United States. Understanding the 1040 tax table is essential for anyone looking to file their taxes correctly and efficiently.

How to use the 1040 Tax Table

Using the 1040 tax table involves a few straightforward steps. First, taxpayers need to determine their filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Next, they should identify their taxable income, which is the income after deductions and exemptions. Once these figures are established, taxpayers can locate the appropriate section of the tax table that corresponds to their filing status and taxable income. By following the table, they can find the tax amount owed based on their income level.

Steps to complete the 1040 Tax Table

Completing the 1040 tax table requires careful attention to detail. Here are the steps involved:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Calculate your total income and determine your filing status.

- Subtract any deductions or exemptions to find your taxable income.

- Refer to the 1040 tax table to locate your tax liability based on your taxable income and filing status.

- Record the calculated tax amount on your Form 1040.

Legal use of the 1040 Tax Table

The 1040 tax table is legally recognized as a valid tool for calculating federal income tax liabilities. It is essential for ensuring compliance with tax laws and regulations. Taxpayers must use the most current version of the tax table, as the IRS updates it annually to reflect changes in tax law. Utilizing the correct table ensures that taxpayers meet their legal obligations and avoid potential penalties for incorrect filings.

IRS Guidelines

The IRS provides specific guidelines on how to use the 1040 tax table effectively. These guidelines include instructions on determining taxable income, understanding filing statuses, and the importance of using the correct tax year table. Taxpayers are encouraged to review these guidelines to ensure they understand their responsibilities and the implications of their tax calculations. Following IRS guidelines helps maintain compliance and reduces the risk of errors during the filing process.

Filing Deadlines / Important Dates

Filing deadlines are critical for taxpayers to keep in mind when using the 1040 tax table. Generally, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file. Missing these deadlines can result in penalties and interest on unpaid taxes, making it essential to stay informed about important dates.

Quick guide on how to complete 1040 tax table

Effortlessly Prepare 1040 Tax Table on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage 1040 Tax Table on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and eSign 1040 Tax Table with Ease

- Obtain 1040 Tax Table and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 1040 Tax Table and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 tax table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IRS tax tables?

IRS tax tables are tools used to determine the amount of tax owed based on taxable income. They provide a clear breakdown of tax brackets, allowing individuals and businesses to understand their tax liabilities better. Familiarity with IRS tax tables is essential for accurate tax planning and filing.

-

How can airSlate SignNow help with tax document management?

airSlate SignNow streamlines the process of managing tax-related documents by providing an easy-to-use, cost-effective solution for eSigning and sending documents securely. By simplifying document workflows, businesses can ensure adherence to IRS tax tables and maintain accurate records for tax purposes. Our platform helps reduce errors and save time during tax season.

-

Are there any integrations available with IRS tax software?

Yes, airSlate SignNow offers various integrations with popular IRS tax software, enabling seamless data sharing between systems. This integration simplifies the filing process by allowing users to access IRS tax tables directly within the platform. You can easily manage your documents while ensuring compliance with IRS requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, making it an affordable solution for document management. Each plan provides access to features that improve collaboration, such as eSigning and document templates. Investing in airSlate SignNow can lead to better organization around IRS tax tables and tax-related documents.

-

Can airSlate SignNow help me save time during tax season?

Absolutely! By using airSlate SignNow, businesses can signNowly reduce the time spent on document preparation and signing during tax season. Our platform automates many processes, improving efficiency and allowing users to focus on understanding IRS tax tables and their implications. You'll spend less time worrying about paperwork and more time on strategic financial planning.

-

Is airSlate SignNow secure for signing sensitive tax documents?

Yes, airSlate SignNow utilizes advanced security measures, including encryption and secure cloud storage, to protect sensitive tax documents. Our platform ensures that all signed documents are safe from unauthorized access, making it ideal for handling IRS tax tables and other confidential tax-related information. Rest assured that your data remains secure throughout the signing process.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features designed to simplify tax document management. These include customizable templates, automated workflows, and real-time tracking of document status. Utilizing our platform allows you to organize and manage all tax-related documents efficiently, ensuring compliance with IRS tax tables.

Get more for 1040 Tax Table

- Tc form download

- Framing inspection checklist 422059741 form

- Police report 76505341 form

- Form ps 31174 2

- Pmsby form

- Form cd410 ampquotnotice of intent to dissolveampquot georgia

- Chatham county georgia alarm registration fees annual renewal chathamcounty form

- Robeson county nc demo permit application form

Find out other 1040 Tax Table

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast