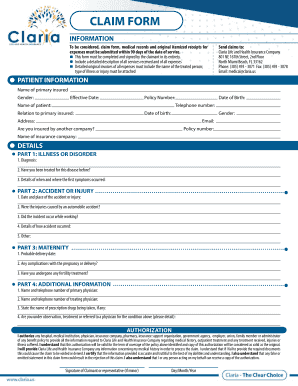

Claria Life and Health Insurance Form

What is the Claria Life and Health Insurance?

The Claria Life and Health Insurance provides coverage for various health-related expenses, including medical bills, hospital stays, and preventive care. This insurance is designed to offer financial protection against unexpected health issues, ensuring that policyholders can access necessary medical services without incurring overwhelming costs. Claria is recognized for its commitment to customer service and comprehensive coverage options, making it a trusted choice for individuals and families seeking health insurance solutions.

How to Use the Claria Life and Health Insurance

Using Claria Life and Health Insurance involves a straightforward process. Once you have selected a plan, you can begin utilizing your benefits by visiting a network provider or seeking medical services covered under your policy. It is essential to familiarize yourself with the specific terms of your plan, including covered services, copayments, and deductibles. Always carry your insurance card when seeking care to facilitate the billing process and ensure that your provider can verify your coverage.

Steps to Complete the Claria Life and Health Insurance

Completing the Claria Life and Health Insurance application involves several key steps:

- Gather necessary personal information, including identification and contact details.

- Review available insurance plans to determine which best meets your needs.

- Fill out the application form, providing accurate information to avoid delays.

- Submit the application online or via mail, depending on your preference.

- Await confirmation of your coverage and any additional information from Claria.

Legal Use of the Claria Life and Health Insurance

The legal use of Claria Life and Health Insurance is governed by federal and state regulations. It is crucial for policyholders to understand their rights and responsibilities under the insurance contract. This includes knowing how to file claims, the appeals process for denied claims, and the legal obligations of both the insurer and the insured. Adhering to these regulations helps ensure that you receive the full benefits of your policy.

Eligibility Criteria

Eligibility for Claria Life and Health Insurance typically depends on several factors, including age, residency, and health status. Most plans are available to individuals and families, but specific requirements may vary by state. It is advisable to review the eligibility criteria outlined in the policy documents or consult with a Claria representative to confirm your eligibility before applying.

Required Documents

When applying for Claria Life and Health Insurance, you will need to provide various documents to support your application. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Social Security number for all applicants.

- Income verification documents, like pay stubs or tax returns.

- Previous health insurance information, if applicable.

Form Submission Methods

Submitting the Claria Life and Health Insurance application can be done through multiple methods. Applicants may choose to submit their forms online via the Claria website, mail them to the designated address, or deliver them in person at a local office. Each method has its advantages, and choosing the right one can depend on your preference for convenience and speed of processing.

Quick guide on how to complete claria life and health insurance

Accomplish Claria Life And Health Insurance effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, alter, and eSign your documents swiftly without delays. Handle Claria Life And Health Insurance on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Claria Life And Health Insurance with ease

- Find Claria Life And Health Insurance and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of the documents or black out sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your updates.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow addresses all your document management needs within a few clicks from your preferred device. Edit and eSign Claria Life And Health Insurance to maintain excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claria life and health insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is claria insurance?

Claria insurance is a comprehensive insurance solution designed to provide tailored coverage for businesses. It aims to protect against a variety of risks while ensuring compliance with industry standards. By integrating claria insurance with airSlate SignNow, businesses can streamline their documentation processes for insurance needs.

-

How does claria insurance integrate with airSlate SignNow?

Claria insurance can be easily integrated with airSlate SignNow to enhance document management and eSigning capabilities. This integration allows for smooth transmission of insurance documents, ensuring that all necessary files are signed and stored securely. Using claria insurance with airSlate SignNow simplifies the workflow for clients and agents alike.

-

What are the benefits of using claria insurance with airSlate SignNow?

Utilizing claria insurance with airSlate SignNow offers numerous advantages, including reduced paperwork and faster turnaround times on insurance documents. The solution enhances collaboration by allowing multiple parties to eSign documents seamlessly. Ultimately, this combination ensures you have the right coverage while managing your documentation efficiently.

-

What types of coverage does claria insurance offer?

Claria insurance provides a wide range of coverage options tailored to meet the specific needs of various industries. From liability to property insurance, claria insurance ensures that your business is protected against unforeseen events. When combined with airSlate SignNow, clients can quickly sign and manage their coverage documents online.

-

How much does claria insurance cost?

The cost of claria insurance varies depending on coverage options and the type of business. Customizable plans allow businesses to select the coverage that fits their budget and needs. For specific pricing details, prospective customers can consult with a claria insurance representative or explore their website.

-

Can claria insurance accommodate my small business needs?

Absolutely! Claria insurance is designed to cater to both small and large businesses, providing essential coverage without breaking the bank. Through flexible plans and personalized consultations, small business owners can find the right insurance solutions tailored to their unique challenges.

-

What features does airSlate SignNow offer for managing claria insurance documents?

airSlate SignNow offers a variety of features for managing claria insurance documents, including easy eSigning, secure cloud storage, and customizable templates. These tools help reduce the time spent on paperwork while maintaining compliance with legal requirements. By using airSlate SignNow in conjunction with claria insurance, businesses can enhance efficiency.

Get more for Claria Life And Health Insurance

Find out other Claria Life And Health Insurance

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation