Skv2002 Form

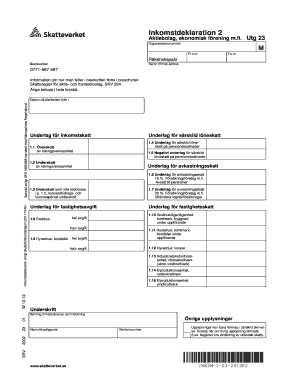

What is the Skv2002

The Skv2002 form, also known as the inkomstdeklaration 2, is a crucial document used for reporting income and tax obligations in the United States. This form is typically utilized by individuals who have multiple income sources or who are self-employed. It allows taxpayers to accurately declare their earnings, deductions, and credits, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the Skv2002 is essential for proper tax filing and avoiding potential penalties.

How to use the Skv2002

Using the Skv2002 form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax forms. Next, carefully fill out each section of the Skv2002, providing detailed information about your income and expenses. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and local regulations.

Steps to complete the Skv2002

Completing the Skv2002 form requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include any freelance or self-employment earnings.

- Detail any deductions you are eligible for, such as business expenses or educational costs.

- Review the form for accuracy, making sure all figures are correct and all required fields are completed.

- Submit the form electronically through a secure platform or mail it to the appropriate tax authority.

Legal use of the Skv2002

The Skv2002 form must be completed and submitted in compliance with applicable tax laws to be considered legally valid. This includes adhering to guidelines set forth by the Internal Revenue Service (IRS) and ensuring that all reported information is truthful and accurate. Using a reliable electronic signature tool, such as airSlate SignNow, can enhance the legal standing of the submitted form by providing a secure method for signing and storing documents. Compliance with eSignature laws, including the ESIGN Act and UETA, further solidifies the legality of the Skv2002.

Filing Deadlines / Important Dates

Timely filing of the Skv2002 form is essential to avoid penalties and interest on unpaid taxes. Generally, the deadline for submitting the Skv2002 is April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, which typically grants an additional six months to file. It is important to stay informed about any changes to filing deadlines that may occur due to legislative updates or natural disasters.

Required Documents

To complete the Skv2002 form accurately, several documents are typically required. These include:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or business-related purchases.

- Any prior year tax returns for reference and consistency.

Having these documents readily available will streamline the completion process and ensure that all information is accurately reported.

Quick guide on how to complete skv2002

Effortlessly prepare Skv2002 on any device

Managing documents online has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and eSign your documents without delays. Handle Skv2002 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Skv2002 effortlessly

- Locate Skv2002 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Skv2002 and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the skv2002

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the skv2002 feature in airSlate SignNow?

The skv2002 feature in airSlate SignNow enables users to seamlessly manage and sign documents electronically. This intuitive solution streamlines workflows and enhances productivity, making document management easier for businesses of all sizes.

-

How does airSlate SignNow pricing work for skv2002 users?

airSlate SignNow offers flexible pricing plans for users interested in the skv2002 feature. Depending on your business's needs, you can choose from monthly or annual plans, which provide cost-effective options tailored to your budget and requirements.

-

What benefits does using skv2002 in airSlate SignNow provide?

Using skv2002 in airSlate SignNow provides numerous benefits, such as increased efficiency in document handling and better collaboration among team members. This feature helps reduce delays in getting documents signed, ultimately improving your business's overall performance.

-

Can I integrate skv2002 with other software platforms?

Yes, airSlate SignNow, including the skv2002 feature, offers extensive integration options with popular software platforms. This includes CRM systems, cloud storage solutions, and other productivity tools, allowing for a seamless workflow across your business applications.

-

Is the skv2002 feature user-friendly for non-tech-savvy users?

Absolutely! The skv2002 feature in airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface allows even non-tech-savvy users to easily navigate the system and manage their document workflows without any hassle.

-

What types of documents can be signed using the skv2002 feature?

The skv2002 feature in airSlate SignNow supports a wide range of document types, including contracts, agreements, and approvals. This versatility ensures that your business can handle all your signing needs efficiently, regardless of the document format.

-

How does airSlate SignNow ensure the security of documents with skv2002?

Security is a top priority for airSlate SignNow, especially for the skv2002 feature. The platform employs advanced encryption and security protocols to protect your documents and ensure that only authorized users can access them, giving you peace of mind.

Get more for Skv2002

Find out other Skv2002

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors