Official Form 106i 2015-2026

What is the Official Form 106i

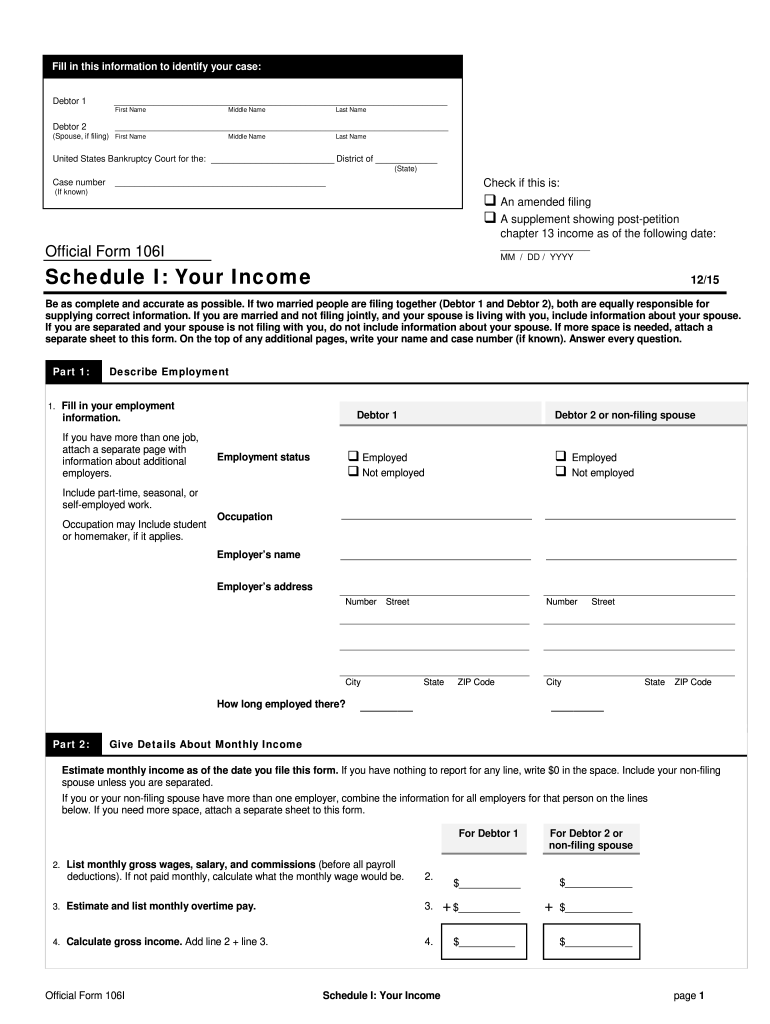

The official form 106i is a tax document used primarily for reporting income and expenses related to certain business activities. It is designed to help individuals and entities accurately calculate their taxable income and ensure compliance with IRS regulations. This form is essential for taxpayers who need to report specific income types, including self-employment income, rental income, and other earnings. Understanding the purpose and requirements of the official form 106i is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Official Form 106i

Using the official form 106i involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax records. Next, download the official form 106i fillable version from a reliable source. Fill in the required fields, ensuring that all information is accurate and complete. After completing the form, review it carefully for any errors or omissions. Finally, submit the form through the appropriate method, whether online, by mail, or in person, depending on your specific circumstances.

Steps to complete the Official Form 106i

Completing the official form 106i involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary documentation related to your income and expenses.

- Download the official form 106i fillable version.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Input your income details in the designated sections, ensuring you include all relevant sources.

- Document your expenses accurately, categorizing them as required.

- Review the completed form for any errors or missing information.

- Submit the form according to the guidelines provided by the IRS.

Legal use of the Official Form 106i

The official form 106i must be used in compliance with IRS regulations to ensure its legal validity. Taxpayers are required to use this form to report income accurately and to substantiate any deductions claimed. Failing to adhere to the guidelines set forth by the IRS can result in penalties, including fines or audits. It is essential to understand the legal implications of the information provided on this form and to maintain accurate records that support the entries made.

Filing Deadlines / Important Dates

Filing deadlines for the official form 106i are crucial for taxpayers to observe. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individuals. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website or consult a tax professional for the most current deadlines and any potential extensions that may apply.

Required Documents

To complete the official form 106i accurately, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for business expenses.

- Bank statements reflecting income and expenditures.

- Previous year’s tax returns for reference.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete official form 106i schedule i your income 1215 kywb uscourts

The simplest method to obtain and endorse Official Form 106i

Throughout the entirety of your organization, cumbersome procedures associated with paper approvals can consume substantial working hours. Endorsing documents such as Official Form 106i is an inherent aspect of operations across all sectors, which is why the effectiveness of each contract’s lifecycle signNowly impacts the overall productivity of the company. With airSlate SignNow, endorsing your Official Form 106i is as straightforward and quick as it can be. This platform provides you with the most recent version of nearly any document. Even better, you can endorse it instantly without needing to install external applications on your computer or printing any physical copies.

Steps to obtain and endorse your Official Form 106i

- Explore our repository by category or utilize the search option to find the document you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Select Get form to start modifying immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Official Form 106i.

- Choose the signing method that is easiest for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to conclude editing and proceed with document-sharing options as required.

With airSlate SignNow, you have everything necessary to handle your documents efficiently. You can search for, complete, modify, and even send your Official Form 106i all in one tab without any complications. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

-

After filling out Form 6, how many days does it require to get your voter ID? Should I download it online?

I think it takes 2-3 months to verify your application and further other process then will get registered as voter in electoral roll. Then the voter Id will dispatch to you through BLO of your part of constituency.If you fill the form 6 on nvsp.in then you can check or track the status of your application.You will not supposed to get the digital copy of your voter Id online.I hope this will help you…..

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

Create this form in 5 minutes!

How to create an eSignature for the official form 106i schedule i your income 1215 kywb uscourts

How to make an electronic signature for your Official Form 106i Schedule I Your Income 1215 Kywb Uscourts in the online mode

How to make an electronic signature for the Official Form 106i Schedule I Your Income 1215 Kywb Uscourts in Chrome

How to create an eSignature for putting it on the Official Form 106i Schedule I Your Income 1215 Kywb Uscourts in Gmail

How to make an electronic signature for the Official Form 106i Schedule I Your Income 1215 Kywb Uscourts from your smartphone

How to generate an electronic signature for the Official Form 106i Schedule I Your Income 1215 Kywb Uscourts on iOS devices

How to create an eSignature for the Official Form 106i Schedule I Your Income 1215 Kywb Uscourts on Android OS

People also ask

-

What features does the airSlate SignNow 106i offer?

The airSlate SignNow 106i provides a range of features such as document eSigning, templates, and real-time tracking of document status. Additionally, it allows users to create customizable workflows to streamline their document management process. With airSlate SignNow 106i, businesses can improve their efficiency and reduce turnaround times.

-

How much does the airSlate SignNow 106i cost?

The pricing for airSlate SignNow 106i is competitive and designed to cater to businesses of all sizes. Plans typically start at an affordable monthly rate, with discounts offered for annual subscriptions. This cost-effective solution ensures that even small businesses can access quality eSigning features.

-

What benefits does the airSlate SignNow 106i provide?

Using airSlate SignNow 106i helps businesses reduce paper usage, lower operational costs, and increase signing speed. It enhances the signing experience for customers, making transactions more straightforward and faster. Overall, the benefits contribute to improved customer satisfaction and streamlined business operations.

-

Does airSlate SignNow 106i integrate with other applications?

Yes, airSlate SignNow 106i seamlessly integrates with a variety of applications such as Google Drive, Salesforce, and Microsoft Office. This functionality enables teams to work within their preferred tools while leveraging the powerful eSigning capabilities of airSlate SignNow 106i. Integrations enhance productivity by simplifying workflows.

-

Is the airSlate SignNow 106i suitable for small businesses?

Absolutely! The airSlate SignNow 106i is designed with small businesses in mind, providing them with an effective eSigning solution. Its user-friendly interface and cost-effective pricing make it an ideal choice for small teams looking to streamline their document processes without breaking the bank.

-

How secure is the airSlate SignNow 106i?

Security is a top priority for airSlate SignNow 106i, which offers end-to-end encryption to protect your documents. Additionally, it adheres to compliance regulations such as GDPR and HIPAA, ensuring that sensitive information is handled securely. This focus on security helps businesses maintain trust with their customers.

-

Can I use airSlate SignNow 106i on mobile devices?

Yes, airSlate SignNow 106i is optimized for mobile devices, allowing users to send and eSign documents on the go. The mobile-friendly platform ensures that you can manage important documents anytime, anywhere, enhancing your efficiency. This flexibility is especially valuable for teams that require access outside the office.

Get more for Official Form 106i

- Dd form 2628

- Storyworks jr pdf form

- Applicant consent form for fingerprinting for justice center

- Turf removal application golden state water company form

- Tb 400a texas department of state health services dshs state tx form

- Caste validity form pdf in marathi

- How to fill out a request for payment forservicee or reimbursement for compenable expenses form

- Gv 110 771268048 form

Find out other Official Form 106i

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online