Scdor111 Form

What is the scdor111?

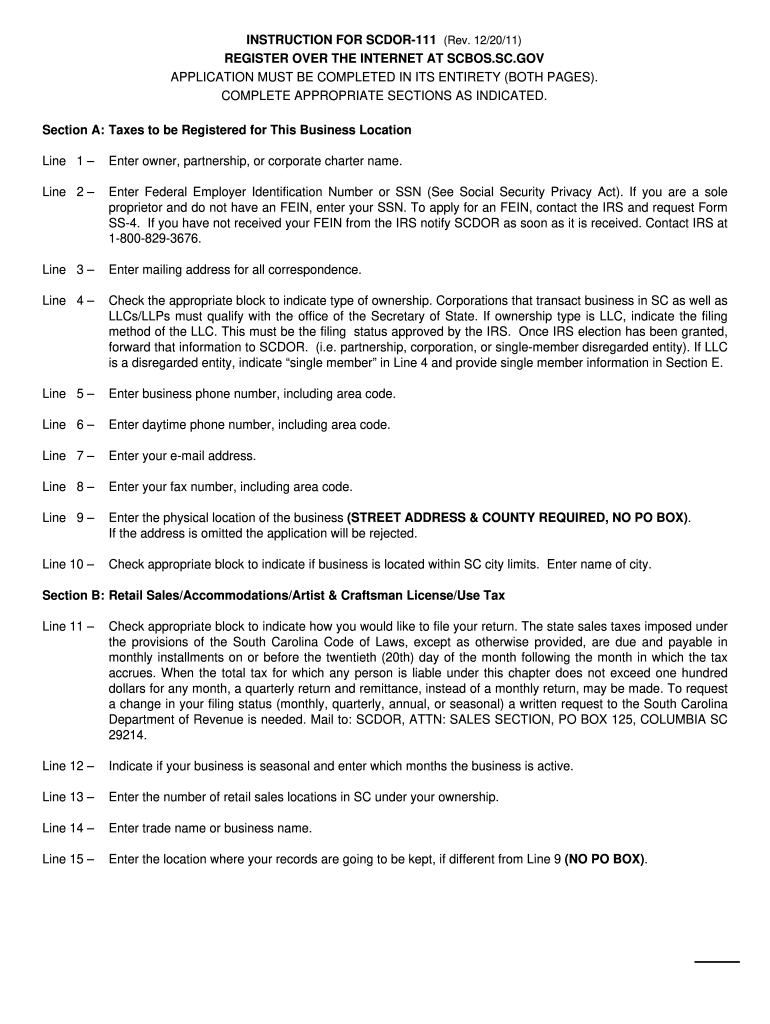

The scdor111 form is a crucial document used in the state of South Carolina for various tax-related purposes. It is primarily associated with the reporting of income and tax obligations for individuals and businesses. Understanding the scdor111 is essential for compliance with state tax laws and ensuring accurate reporting of financial information.

How to use the scdor111

Using the scdor111 form involves several key steps to ensure proper completion. First, gather all necessary financial information, including income statements and deductions. Next, accurately fill out the form, ensuring all details are correct to avoid delays. Once completed, the form must be submitted to the appropriate state tax authority, either electronically or via mail, depending on your preference and the specific instructions provided.

Steps to complete the scdor111

Completing the scdor111 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Calculate deductions and credits applicable to your situation.

- Review the form for accuracy before submission.

- Submit the completed form to the South Carolina Department of Revenue.

Legal use of the scdor111

The scdor111 form is legally binding when completed correctly and submitted in accordance with state regulations. It serves as an official record of your income and tax obligations. To ensure its legal standing, it is important to adhere to all guidelines set forth by the South Carolina Department of Revenue, including deadlines and submission methods.

Key elements of the scdor111

Several key elements must be included when filling out the scdor111 form. These include:

- Personal identification information, such as your name and Social Security number.

- Detailed income reporting from all sources.

- Applicable deductions and credits that can reduce your tax liability.

- Signature and date to validate the submission.

Form Submission Methods

The scdor111 form can be submitted through various methods. Taxpayers can choose to file online via the South Carolina Department of Revenue's website, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Quick guide on how to complete scdor111

Complete Scdor111 effortlessly on any device

Online document management has become increasingly popular with companies and individuals alike. It offers an optimal eco-friendly solution to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Scdor111 on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

The easiest way to modify and eSign Scdor111 without hassle

- Find Scdor111 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Scdor111 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the scdor111

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the scdor111 form and how does airSlate SignNow help with it?

The scdor111 form is a crucial document used in South Carolina for various business purposes. airSlate SignNow provides a seamless platform to eSign and manage the scdor111, ensuring that the process is efficient and legally binding.

-

Is there a free trial available for using airSlate SignNow for scdor111?

Yes, airSlate SignNow offers a free trial, allowing you to explore its features for managing the scdor111 without any commitment. During this trial, you can test the ease of sending and signing your documents electronically.

-

What are the pricing plans for airSlate SignNow when handling scdor111 forms?

airSlate SignNow offers various pricing plans tailored to different business needs, including options that focus on managing documents like scdor111. Customers can choose from monthly or annual subscriptions, depending on their requirements.

-

Can I integrate airSlate SignNow with other platforms for scdor111 processing?

Absolutely! airSlate SignNow allows easy integration with a wide range of platforms, making the scdor111 processing much more convenient. This integration streamlines workflows, saving you valuable time and resources.

-

What features does airSlate SignNow provide for managing scdor111 documents?

airSlate SignNow boasts features like template creation, document tracking, and secure storage, all of which enhance the management of scdor111 documents. These tools ensure that your eSigning experience is efficient and secure.

-

Are the electronic signatures from airSlate SignNow legally binding for scdor111?

Yes, the electronic signatures generated through airSlate SignNow are legally binding and comply with eSignature laws. This means your scdor111 documents signed with airSlate SignNow will be recognized in court and by government agencies.

-

How secure is my data when using airSlate SignNow for scdor111?

Data security is a top priority for airSlate SignNow. When you handle scdor111 forms and other documents, your information is protected with high-level encryption and security practices to ensure your data remains confidential.

Get more for Scdor111

Find out other Scdor111

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF