Form 15h in Hindi Format No Download Needed

What is the Form 15g?

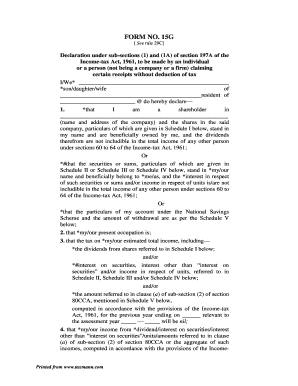

The Form 15g is a declaration form used in the United States primarily for tax purposes. It allows individuals to declare that their total income is below the taxable limit, ensuring that no tax is deducted at source on interest income. This form is particularly useful for those who earn below the taxable threshold and want to avoid unnecessary tax deductions on their savings interest or other income sources.

Key elements of the Form 15g

The Form 15g includes several important components that individuals must complete accurately. These elements typically consist of:

- Personal Information: This includes the name, address, and PAN (Permanent Account Number) of the individual submitting the form.

- Income Details: A declaration stating that the total income is below the taxable limit.

- Signature: The individual must sign the form to validate the declaration.

Completing these elements correctly is crucial for the form's acceptance by financial institutions and tax authorities.

Steps to complete the Form 15g

Completing the Form 15g involves several straightforward steps:

- Gather Information: Collect all necessary personal and income details.

- Fill Out the Form: Enter your information accurately in the designated fields.

- Review the Information: Double-check all entries for accuracy to avoid errors.

- Sign the Form: Provide your signature to validate the declaration.

- Submit the Form: Deliver the completed form to the relevant financial institution or tax authority.

Legal use of the Form 15g

The Form 15g serves a legal purpose by allowing individuals to declare their income status to avoid tax deductions. When used correctly, it is a legally binding document that protects the individual's rights regarding tax deductions on interest income. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies can lead to penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 15g may vary based on the financial institution's requirements and the individual's tax situation. Generally, it is advisable to submit the form at the beginning of the financial year or whenever interest income is expected. Staying aware of these deadlines helps ensure that tax deductions are avoided effectively.

Form Submission Methods

The Form 15g can be submitted through various methods, depending on the institution's policies:

- Online Submission: Many institutions allow for electronic submission through their websites.

- Mail: The form can be printed and sent via postal service to the relevant department.

- In-Person: Individuals may also submit the form directly at their bank or financial institution.

Quick guide on how to complete form 15h in hindi format no download needed

Complete Form 15h In Hindi Format No Download Needed effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 15h In Hindi Format No Download Needed on any device with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to modify and electronically sign Form 15h In Hindi Format No Download Needed with ease

- Locate Form 15h In Hindi Format No Download Needed and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Form 15h In Hindi Format No Download Needed and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15h in hindi format no download needed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 15H in Hindi PDF format?

Form 15H in Hindi PDF format is a declaration form used by senior citizens in India to ensure that no TDS (Tax Deduction at Source) is deducted from their income. This form can be filled out in Hindi, allowing for easier understanding and usage by Hindi-speaking individuals.

-

How can I download Form 15H in Hindi PDF format?

You can easily download Form 15H in Hindi PDF format from various government websites or directly through services like airSlate SignNow. Simply navigate to the appropriate page, select the Hindi PDF version, and save it to your device for easy access.

-

What are the benefits of using airSlate SignNow for Form 15H in Hindi PDF format?

Using airSlate SignNow to fill out Form 15H in Hindi PDF format streamlines the submission process. It provides easy editing and signing features, ensuring that your form is correctly filled out and submitted on time without hassle.

-

Is airSlate SignNow free to use for signing Form 15H in Hindi PDF format?

While airSlate SignNow offers a free trial, there are subscription fees for long-term use. However, the cost is justified by the extensive features, making it a cost-effective solution for managing forms like Form 15H in Hindi PDF format efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 15H in Hindi PDF format?

Yes, airSlate SignNow offers various integrations with popular applications, allowing you to manage Form 15H in Hindi PDF format seamlessly alongside your other tools. This integration helps streamline your workflow and enhances document management efficiency.

-

What features does airSlate SignNow provide for creating Form 15H in Hindi PDF format?

airSlate SignNow provides features like customizable templates, electronic signatures, and cloud storage specifically for documents like Form 15H in Hindi PDF format. These features ensure ease of use while maintaining compliance and security.

-

How secure is airSlate SignNow when handling Form 15H in Hindi PDF format?

Security is a top priority at airSlate SignNow. When dealing with Form 15H in Hindi PDF format, your documents are protected with advanced encryption and strict access controls, ensuring that sensitive information remains safe throughout the signing process.

Get more for Form 15h In Hindi Format No Download Needed

Find out other Form 15h In Hindi Format No Download Needed

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free