Sc8736 Form

What is the Sc8736 Form

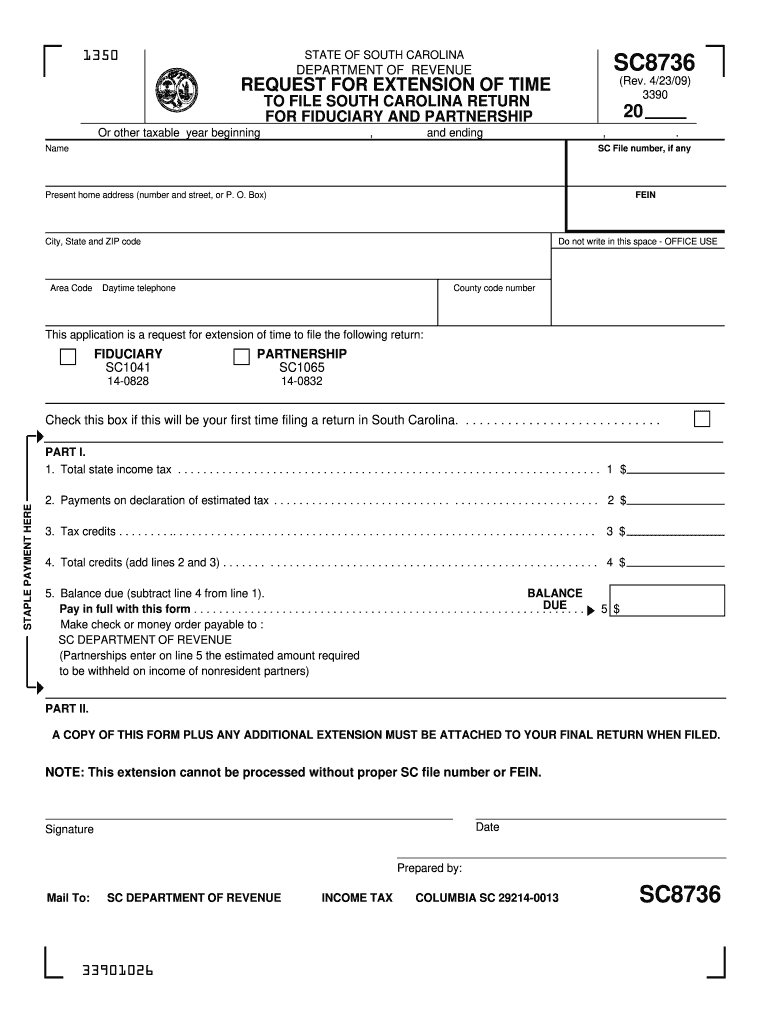

The Sc8736 Form is a document utilized primarily for tax-related purposes within the United States. It serves as a formal request for specific tax information or actions, often required by the Internal Revenue Service (IRS) or state tax authorities. Understanding the purpose of this form is crucial for individuals and businesses to ensure compliance with tax regulations and to facilitate accurate reporting.

How to use the Sc8736 Form

Using the Sc8736 Form involves several key steps to ensure it is completed accurately. First, gather all necessary information, including personal identification details and relevant financial data. Next, fill out the form carefully, ensuring that all sections are completed as required. Once the form is filled out, review it for accuracy before submission. It is also advisable to keep a copy for your records.

Steps to complete the Sc8736 Form

Completing the Sc8736 Form requires attention to detail. Follow these steps:

- Obtain the latest version of the Sc8736 Form from a reliable source.

- Read the instructions carefully to understand what information is required.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide any additional information requested, such as income details or deductions.

- Review the completed form for any errors or omissions.

- Sign and date the form where indicated.

Legal use of the Sc8736 Form

The Sc8736 Form is legally binding when filled out and submitted according to IRS regulations. To ensure its legal standing, it must be completed accurately and submitted within the designated time frames. Additionally, using a secure method for submission, such as e-signing through a trusted platform, can further validate the document's authenticity and compliance with legal standards.

Who Issues the Form

The Sc8736 Form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. These organizations provide the necessary guidelines and requirements for completing the form, ensuring that taxpayers have access to the correct resources for their tax obligations. It is essential to refer to official IRS publications or state resources for the most accurate and up-to-date information regarding the form.

Form Submission Methods

Submitting the Sc8736 Form can be done through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission via the IRS website or authorized e-filing services.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices or during tax assistance events.

Quick guide on how to complete sc8736 form

Prepare Sc8736 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Sc8736 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Sc8736 Form with minimal effort

- Find Sc8736 Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight relevant parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Sc8736 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc8736 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sc8736 Form?

The Sc8736 Form is a specific document used for various administrative purposes, often requiring e-signatures for verification. Utilizing airSlate SignNow allows you to fill, sign, and send the Sc8736 Form efficiently online. This eliminates the need for physical paperwork, ensuring a streamlined process for your business.

-

How does airSlate SignNow streamline the Sc8736 Form process?

With airSlate SignNow, you can upload, edit, and eSign the Sc8736 Form all in one place. Our user-friendly interface simplifies document management, allowing you to complete the Sc8736 Form faster and more accurately. Plus, automated reminders ensure that you're never late on submissions.

-

What are the pricing options for using airSlate SignNow for the Sc8736 Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it affordable to manage the Sc8736 Form. Whether you are a freelancer or a large corporation, you can choose a plan that fits your budget and meets your needs for e-signing documents. Sign up today to access a free trial and see how we can help you save time and money.

-

What features does airSlate SignNow provide for working with the Sc8736 Form?

airSlate SignNow comes with an array of powerful features designed to enhance the e-signing experience for the Sc8736 Form. These features include customizable templates, secure cloud storage, and multiple signing options. You'll also benefit from real-time tracking, ensuring every signature is promptly collected and documented.

-

Can I integrate airSlate SignNow with other applications for the Sc8736 Form?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easier to manage the Sc8736 Form alongside your favorite tools. Integrations with platforms like Google Drive, Dropbox, and Salesforce enhance your document workflow, allowing you to access and send the Sc8736 Form without switching between countless applications.

-

Why is it beneficial to use airSlate SignNow for the Sc8736 Form?

Using airSlate SignNow for the Sc8736 Form can greatly enhance productivity and efficiency within your organization. The ease of e-signing means you can eliminate delays caused by traditional paperwork. Additionally, the secure and compliant nature of our platform ensures that your sensitive information remains protected.

-

Is airSlate SignNow secure for managing the Sc8736 Form?

Absolutely! airSlate SignNow prioritizes your security and compliance when handling the Sc8736 Form. Our platform adheres to strict industry standards and best practices, employing encryption methods to safeguard your documents and signatures, providing peace of mind as you manage your e-signatures.

Get more for Sc8736 Form

Find out other Sc8736 Form

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself