Tax Ri Form

What is the Tax Ri

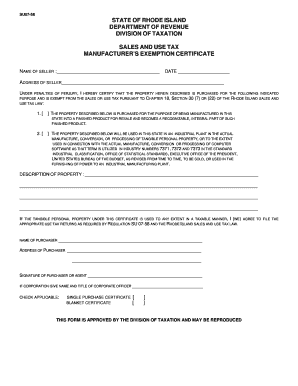

The Tax Ri form is a crucial document used in the United States for reporting specific tax-related information. It is primarily utilized by individuals and businesses to ensure compliance with federal tax regulations. This form collects essential data that helps the Internal Revenue Service (IRS) assess tax liabilities accurately. Understanding the purpose and requirements of the Tax Ri is vital for anyone involved in tax filing or financial reporting.

How to use the Tax Ri

Using the Tax Ri form involves several straightforward steps. First, gather all necessary financial documents, including income statements and expense records. Next, download the form from the IRS website or obtain a physical copy. Fill out the form carefully, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on the specific guidelines provided by the IRS.

Steps to complete the Tax Ri

Completing the Tax Ri form requires careful attention to detail. Follow these steps for effective completion:

- Review the form's instructions thoroughly to understand the requirements.

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and deductions accurately, ensuring all figures match your supporting documents.

- Double-check your entries for accuracy before finalizing the form.

Legal use of the Tax Ri

The legal use of the Tax Ri form is governed by IRS regulations. To ensure its validity, the form must be filled out truthfully and submitted by the appropriate deadlines. Failure to comply with these regulations may result in penalties or legal consequences. It is essential to maintain accurate records and documentation to support the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Ri form are critical for compliance. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is advisable to stay informed about any changes to deadlines, especially during tax season, to avoid unnecessary penalties.

Required Documents

To complete the Tax Ri form accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Any other relevant financial statements

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Tax Ri form can lead to significant penalties. These may include fines, interest on unpaid taxes, and even legal action in severe cases. It is crucial to submit the form on time and ensure all information is accurate to avoid these consequences.

Quick guide on how to complete tax ri

Complete Tax Ri effortlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly without delays. Manage Tax Ri on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Tax Ri without hassle

- Find Tax Ri and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Tax Ri and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Ri and how does it relate to airSlate SignNow?

Tax Ri refers to the tax regulation compliance that businesses must adhere to when managing contracts and documents. With airSlate SignNow, you can ensure that your electronic signatures are legally compliant, making it easier for businesses to stay on top of their Tax Ri obligations.

-

How does airSlate SignNow help with document management related to Tax Ri?

airSlate SignNow provides an intuitive platform for sending, signing, and managing documents, ensuring that all transactions are secure and compliant with Tax Ri regulations. Its streamlined workflow allows businesses to focus on their core operations without the hassle of tax-related paperwork.

-

Is airSlate SignNow cost-effective for businesses dealing with Tax Ri requirements?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective solution for managing Tax Ri compliance. By reducing the time and resources spent on paperwork, businesses can allocate funds more efficiently.

-

What features of airSlate SignNow aid in ensuring compliance with Tax Ri?

Key features of airSlate SignNow that aid compliance with Tax Ri include audit trails, customizable templates, and automated reminders. These tools ensure that every step of the signing process is documented and adheres to necessary tax regulations.

-

Can airSlate SignNow integrate with accounting software for Tax Ri purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to support businesses in managing their Tax Ri obligations. This integration helps automate data transfer, ensuring that all signed documents are easily accessible for tax filing and audits.

-

What benefits does airSlate SignNow offer for managing Tax Ri-related documents?

Using airSlate SignNow for Tax Ri-related documents offers numerous benefits, such as increased efficiency, enhanced security, and compliance assurance. Businesses can track their document’s journey and receive instant notifications when signatures are completed, which is critical for meeting tax deadlines.

-

Is airSlate SignNow suitable for all business sizes dealing with Tax Ri?

Yes, airSlate SignNow is designed to be scalable, making it suitable for businesses of all sizes dealing with Tax Ri compliance. Whether you are a small startup or a large corporation, the platform can adapt to your needs, ensuring smooth document management.

Get more for Tax Ri

- Currency and coin form

- Afpslai downloadable forms

- Buchanan hauling and rigging carrier setup form

- Nambawan savings and loan application form

- Foreclosure letter pdf form

- Past perfect exercises pdf macmillan form

- Irs form 1045 walkthrough application for tentative refund

- Form w 2 vi u s virgin islands wage and tax statement

Find out other Tax Ri

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free