Form W 8BEN E Form W 8BEN E 2 ING Emeklilik

What is the Form W-8BEN-E?

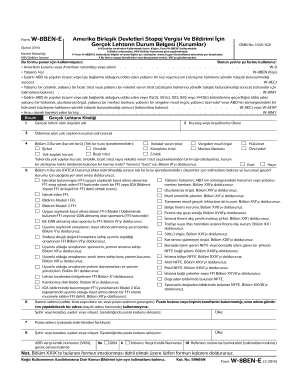

The Form W-8BEN-E is a tax form used by foreign entities to certify their foreign status and claim beneficial ownership of income received from U.S. sources. This form is essential for ensuring that the correct amount of withholding tax is applied to payments made to foreign entities. The W-8BEN-E is specifically designed for use by entities, such as corporations or partnerships, rather than individuals. It helps entities avoid or reduce U.S. withholding tax rates under applicable tax treaties.

How to Use the Form W-8BEN-E

To effectively use the Form W-8BEN-E, entities must complete the form accurately and submit it to the withholding agent or payer. The form requires detailed information about the entity, including its name, address, and taxpayer identification number. It also necessitates the disclosure of any relevant tax treaty benefits. Once filled out, the form should be kept on file by the withholding agent to validate the reduced withholding tax rate. It is crucial to ensure that the form is updated regularly, especially if there are changes in circumstances or tax status.

Steps to Complete the Form W-8BEN-E

Completing the Form W-8BEN-E involves several key steps:

- Provide the entity's legal name and address.

- Enter the entity's country of incorporation or organization.

- Include the entity's U.S. taxpayer identification number (if applicable) or foreign tax identification number.

- Indicate the type of entity (e.g., corporation, partnership).

- Claim any applicable tax treaty benefits by providing the relevant article and withholding rate.

- Sign and date the form, certifying that the information provided is accurate.

Legal Use of the Form W-8BEN-E

The legal use of the Form W-8BEN-E is governed by U.S. tax laws and regulations. It is crucial for foreign entities to submit this form to avoid higher withholding tax rates on U.S. income. Failure to provide a valid W-8BEN-E may result in the withholding agent applying the maximum withholding tax rate. The form must be completed in good faith, and any false information can lead to penalties or legal repercussions. Entities should also be aware of the expiration of the form, which typically occurs after three years unless circumstances change.

IRS Guidelines for the Form W-8BEN-E

The IRS provides specific guidelines for completing and submitting the Form W-8BEN-E. These guidelines include instructions on which sections to fill out based on the entity's classification and the type of income being received. The IRS also emphasizes the importance of maintaining accurate records and ensuring that the form is updated as necessary. Entities should refer to the IRS instructions for Form W-8BEN-E for detailed information on compliance and best practices.

Required Documents for the Form W-8BEN-E

When completing the Form W-8BEN-E, certain documents may be required to support the information provided. These documents can include:

- Proof of the entity's legal status, such as a certificate of incorporation.

- Tax identification numbers from the entity's home country.

- Documentation supporting the claim for any tax treaty benefits.

Having these documents ready can facilitate a smoother completion process and ensure compliance with IRS requirements.

Quick guide on how to complete form w 8ben e form w 8ben e 2 ing emeklilik

Effortlessly Prepare Form W 8BEN E Form W 8BEN E 2 ING Emeklilik on Any Gadget

The management of documents online has gained traction among companies and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your paperwork swiftly without interruptions. Manage Form W 8BEN E Form W 8BEN E 2 ING Emeklilik on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign Form W 8BEN E Form W 8BEN E 2 ING Emeklilik effortlessly

- Find Form W 8BEN E Form W 8BEN E 2 ING Emeklilik and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document editions. airSlate SignNow meets all your document management needs within a few clicks from your chosen device. Modify and eSign Form W 8BEN E Form W 8BEN E 2 ING Emeklilik and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben e form w 8ben e 2 ing emeklilik

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik?

The Form W 8BEN E Form W 8BEN E 2 ING Emeklilik is a form used by foreign entities to signNow their foreign status for U.S. tax purposes. It helps ensure appropriate handling of taxes on income sourced from U.S. businesses, making it essential for compliance. Understanding this form will aid in smoother transactions with U.S. financial institutions.

-

How do I fill out the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik?

Filling out the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik requires specific information about your foreign entity, including its name, address, and taxpayer identification number. Ensure accuracy to avoid delays in processing. If you're unsure, consulting a tax professional can provide guidance tailored to your situation.

-

What are the benefits of using the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik?

Using the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik allows foreign entities to claim tax treaty benefits and reduce withholding tax on U.S. income. This can result in signNow savings for your business. Furthermore, maintaining compliance with U.S. tax regulations can help foster stronger business relationships.

-

Is there a cost associated with using airSlate SignNow for the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik?

airSlate SignNow offers a cost-effective solution for electronic signatures, including the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik. Pricing varies based on your plan and usage, ensuring you only pay for what you need. Explore our pricing options to find the perfect fit for your business.

-

Does airSlate SignNow integrate with other software for handling the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing your workflow for managing the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik. Whether you use CRM systems or document management platforms, our integrations can simplify the process. Check our integration options to maximize efficiency.

-

Can I track the status of my Form W 8BEN E Form W 8BEN E 2 ING Emeklilik submissions?

Absolutely! airSlate SignNow provides real-time tracking for all document submissions, including the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik. You'll receive notifications and updates on the status, ensuring you're always informed about your documents. This feature enhances transparency in your business operations.

-

What security measures does airSlate SignNow have in place for the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure data storage to protect your information, including the Form W 8BEN E Form W 8BEN E 2 ING Emeklilik. You can trust that your sensitive documents are handled with the highest level of security.

Get more for Form W 8BEN E Form W 8BEN E 2 ING Emeklilik

Find out other Form W 8BEN E Form W 8BEN E 2 ING Emeklilik

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract