Form 3911 Filled Out Example

What is the Form 3911 Filled Out Example

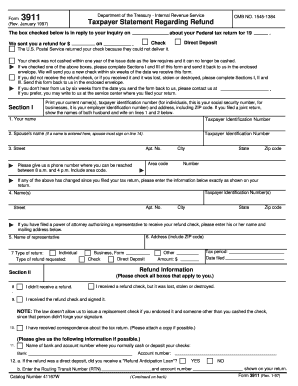

The Form 3911, also known as the Taxpayer Statement Regarding Refund, is a document used by taxpayers in the United States to inquire about the status of their tax refund. This form is particularly useful for individuals who have not received their expected refund within the standard processing time frame. The form allows taxpayers to provide necessary details that help the IRS track their refund status and resolve any issues that may have arisen during processing.

How to Use the Form 3911 Filled Out Example

Using the Form 3911 filled out example involves several straightforward steps. First, gather all relevant personal information, including your Social Security number, filing status, and the exact amount of the expected refund. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After completing the form, you can submit it to the IRS either by mail or electronically, depending on your preference and the options available.

Steps to Complete the Form 3911 Filled Out Example

Completing the Form 3911 requires attention to detail. Here are the steps to follow:

- Download the Form 3911 from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are inquiring about the refund.

- Provide details about the refund amount you are expecting.

- Sign and date the form to validate your request.

After ensuring all information is accurate, submit the form to the IRS for processing.

Legal Use of the Form 3911 Filled Out Example

The Form 3911 filled out example is legally recognized as a formal request to the IRS regarding your tax refund status. It is essential to ensure that all information provided is accurate and truthful, as submitting false information can lead to penalties. The IRS uses the details from this form to verify your identity and expedite the resolution of your refund inquiry.

Key Elements of the Form 3911 Filled Out Example

Several key elements must be included in the Form 3911 to ensure it is processed efficiently:

- Personal Information: Your name, address, and Social Security number.

- Tax Year: The specific year for which you are inquiring about the refund.

- Refund Amount: The exact amount you are expecting as a refund.

- Signature: Your signature and the date of submission to validate the request.

Form Submission Methods (Online / Mail / In-Person)

The Form 3911 can be submitted to the IRS through various methods. Taxpayers have the option to mail the completed form to the designated address provided by the IRS. Alternatively, electronic submission may be available, depending on the current IRS guidelines. In some cases, taxpayers may also inquire about their refund status in person at local IRS offices, although this method may require an appointment.

Quick guide on how to complete form 3911 filled out example

Complete Form 3911 Filled Out Example effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form 3911 Filled Out Example on any device using the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The easiest way to edit and electronically sign Form 3911 Filled Out Example without hassle

- Obtain Form 3911 Filled Out Example and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, SMS, invitation link, or download to your computer.

Say goodbye to lost or misplaced documents, tedious file searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 3911 Filled Out Example and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3911 filled out example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form 3911?

Form 3911 is used to inquire about the status of your tax refund. By completing form 3911, you can get updates directly from the IRS regarding your refund, ensuring you stay informed about its processing. This form is especially useful for those who have not received their expected tax refund within the standard timeframe.

-

How can airSlate SignNow help with submitting form 3911?

AirSlate SignNow allows you to easily eSign and send form 3911 securely from anywhere. With our platform, you can fill out the form digitally, add your eSignature, and quickly send it off, streamlining the entire process. This eliminates the need for printing and mailing, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for form 3911?

AirSlate SignNow operates on a subscription-based pricing model that offers various plans to suit different needs. Whether you're an individual or a business, you can choose a plan that allows you to eSign form 3911 and other documents affordably. The pricing is competitive, providing great value for the services offered.

-

What features does airSlate SignNow offer for form 3911?

AirSlate SignNow provides a user-friendly interface specifically designed for easy document management, including form 3911. Features such as templates, automated reminders, and secure cloud storage enhance your experience. Additionally, our platform ensures compliance with eSignature laws, giving you peace of mind while filing your taxes.

-

Can I track the status of my form 3911 submission using airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your form 3911 once it has been sent. You will receive notifications when the document is viewed and signed, ensuring you remain updated throughout the process. This tracking capability adds an extra layer of transparency to your submission.

-

Does airSlate SignNow integrate with other tools for filing form 3911?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage your documents, including form 3911, in conjunction with your other essential tools, creating a more efficient workflow for your tax-related tasks.

-

What are the benefits of using airSlate SignNow for document signing, including form 3911?

Using airSlate SignNow for signing documents like form 3911 offers numerous benefits, such as enhanced convenience and security. The platform enables you to sign and send documents instantly from any device at any time. Additionally, electronic signatures are legally binding, ensuring your submissions are valid and compliant with regulations.

Get more for Form 3911 Filled Out Example

- Form it 2663 i2014instructions for form it 2663 nonresident real property estimated income tax payment formit2663i tax ny

- Rpie 2012 form

- Signing the nvidia kernel module chapter 4 installing the form

- St 120 sample 2014 form

- 2013 it 201 x form

- Nys sales tax st 330 2011 form

- 2014 ny form 6961974

- St 125 2011 form

Find out other Form 3911 Filled Out Example

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself