Car Loan Application Form

What is the car loan application form?

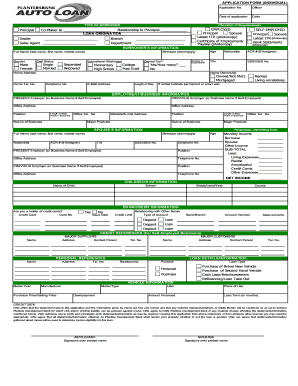

The car loan application form is a document that individuals complete to request financing for purchasing a vehicle. This form collects essential information about the applicant, including personal details, financial status, and the specifics of the vehicle being purchased. Typically, lenders use this information to assess creditworthiness and determine loan eligibility. The form may also require details about income, employment, and existing debts to evaluate the applicant's ability to repay the loan.

Steps to complete the car loan application

Completing a car loan application involves several key steps to ensure accuracy and completeness. First, gather necessary documents such as proof of income, identification, and details about the vehicle. Next, fill out the application form with accurate personal and financial information. Review the form for any errors or missing information before submission. Finally, submit the application either online, by mail, or in person, depending on the lender's requirements. Keeping copies of all submitted documents is advisable for your records.

Key elements of the car loan application

Several key elements are essential in a car loan application form. These include:

- Personal Information: Name, address, phone number, and Social Security number.

- Employment Details: Employer name, job title, and length of employment.

- Financial Information: Monthly income, existing debts, and other financial obligations.

- Vehicle Information: Make, model, year, and price of the vehicle being financed.

- Loan Amount Requested: The amount of money the applicant wishes to borrow.

Legal use of the car loan application

The legal use of the car loan application form is governed by various regulations, ensuring that both lenders and borrowers adhere to fair lending practices. In the United States, the Equal Credit Opportunity Act (ECOA) prohibits discrimination in lending based on race, color, religion, national origin, sex, marital status, or age. Additionally, lenders must comply with the Truth in Lending Act (TILA), which requires clear disclosure of loan terms and costs. Properly completing and submitting the car loan application form ensures that applicants are treated fairly and transparently throughout the loan process.

Required documents

When applying for a car loan, certain documents are typically required to verify the information provided in the application. Commonly requested documents include:

- Proof of Identity: A government-issued ID such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Credit History: Information about existing debts and credit scores may be requested by the lender.

- Vehicle Information: Title, bill of sale, or purchase agreement for the vehicle being financed.

Application process & approval time

The application process for a car loan typically involves several stages. After submitting the car loan application form, the lender will review the information and assess the applicant's creditworthiness. This process may include a credit check and verification of the provided documents. Approval times can vary based on the lender and the complexity of the application, but many lenders offer decisions within a few hours to a couple of days. Once approved, the lender will provide details about the loan terms, including interest rates and repayment schedules.

Quick guide on how to complete car loan application

Complete Car Loan Application effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Car Loan Application on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to edit and eSign Car Loan Application without hassle

- Locate Car Loan Application and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional handwritten signature.

- Verify the information and click on the Done button to save your updates.

- Choose your preferred method of sharing the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Car Loan Application while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the car loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a car loan application form?

A car loan application form is a document used by individuals to apply for financing when purchasing a vehicle. This form typically includes personal information, financial details, and information about the vehicle. By completing a car loan application form, applicants provide lenders with the necessary data to assess their creditworthiness.

-

How can I obtain a car loan application form using airSlate SignNow?

To obtain a car loan application form using airSlate SignNow, simply visit our website and access our document library. You can easily customize a car loan application form to suit your specific requirements. Our platform allows you to send, sign, and manage documents securely, making the process efficient.

-

What are the benefits of using airSlate SignNow for a car loan application form?

Using airSlate SignNow for your car loan application form offers numerous benefits, including a streamlined signing process and high-level security. You can expedite approvals, reduce paperwork, and enhance customer satisfaction. Our platform also provides real-time tracking of document status, ensuring you never miss an update.

-

Is there a fee associated with using airSlate SignNow for car loan application forms?

Yes, airSlate SignNow operates on a subscription-based model, offering various pricing tiers to fit different business needs. Each tier provides access to features that simplify the creation and management of car loan application forms. Be sure to check our pricing page for more details on plans and features.

-

Can I integrate airSlate SignNow with other software for my car loan application form?

Absolutely! airSlate SignNow supports integrations with a variety of applications, enhancing your car loan application form workflow. Popular integrations include CRM systems, payment gateways, and cloud storage solutions, allowing for seamless document management and data flow.

-

How secure is the car loan application form created with airSlate SignNow?

Security is a top priority at airSlate SignNow. The car loan application form you create is protected with end-to-end encryption and meets industry standards for data security. Additionally, our platform is compliant with various regulations, ensuring that your sensitive information is handled safely.

-

Can I track the status of my car loan application form with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your car loan application form. You'll receive notifications when recipients open and sign the document, allowing you to stay informed throughout the process. This feature streamlines communication and helps you manage submissions effectively.

Get more for Car Loan Application

Find out other Car Loan Application

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast