Cdtfa 410 D 2018

What is the CDTFA 410 D?

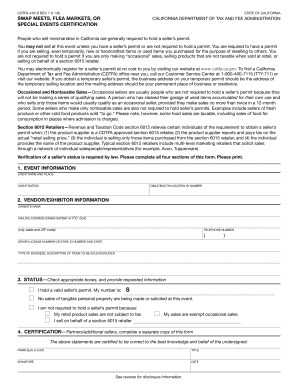

The CDTFA 410 D form is a tax-related document used in the state of California. It is primarily utilized for reporting and remitting use tax on purchases made from out-of-state retailers. This form is essential for businesses and individuals who have acquired taxable items but have not paid sales tax at the time of purchase. By completing the CDTFA 410 D, taxpayers ensure compliance with California tax laws and contribute to the funding of state and local services.

How to Use the CDTFA 410 D

Using the CDTFA 410 D form involves several key steps. First, gather all relevant information regarding your purchases, including dates, descriptions, and amounts. Next, accurately fill out the form, detailing the items purchased and the corresponding use tax owed. It is crucial to ensure that all entries are correct to avoid potential issues with the California Department of Tax and Fee Administration. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to Complete the CDTFA 410 D

Completing the CDTFA 410 D requires careful attention to detail. Follow these steps:

- Collect all necessary purchase information, including receipts and invoices.

- Access the CDTFA 410 D form through the California Department of Tax and Fee Administration website.

- Fill in your personal information, including name, address, and taxpayer identification number.

- List each item purchased, along with the purchase price and applicable use tax.

- Review the form for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal Use of the CDTFA 410 D

The CDTFA 410 D form is legally recognized as a valid means of reporting use tax in California. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Compliance with state tax regulations is essential, as failure to file or pay the appropriate use tax can result in penalties and interest charges. Utilizing a reliable eSignature solution can further enhance the legal validity of the document.

Form Submission Methods

Taxpayers have several options for submitting the CDTFA 410 D form. The form can be filed online through the California Department of Tax and Fee Administration's website, which offers a streamlined process for electronic submissions. Alternatively, individuals may choose to print the completed form and mail it to the appropriate address. In-person submissions are also accepted at designated California Department of Tax and Fee Administration offices, providing additional flexibility for taxpayers.

Required Documents

When completing the CDTFA 410 D form, certain documents may be necessary to support your claims. These typically include:

- Receipts or invoices for all taxable purchases.

- Any previous correspondence with the California Department of Tax and Fee Administration regarding use tax.

- Documentation of any exemptions that may apply to your purchases.

Having these documents on hand will facilitate a smooth completion of the form and ensure accurate reporting.

Quick guide on how to complete cdtfa 410 d

Manage Cdtfa 410 D effortlessly on any gadget

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Cdtfa 410 D on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Cdtfa 410 D with ease

- Obtain Cdtfa 410 D and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your preferred device. Edit and eSign Cdtfa 410 D and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 410 d

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 410 d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cdtfa 410 d form and its purpose?

The cdtfa 410 d form is a California Department of Tax and Fee Administration document used for reporting sales and use tax for businesses. It ensures compliance with state tax laws. Using airSlate SignNow, businesses can easily eSign and submit the cdtfa 410 d form electronically.

-

How does airSlate SignNow simplify the cdtfa 410 d submission process?

airSlate SignNow streamlines the cdtfa 410 d submission by allowing users to electronically sign and send documents within minutes. This eliminates the need for printing and mailing, saving time and enhancing productivity. Businesses can easily track the status of their submissions in real-time.

-

What are the pricing plans for using airSlate SignNow for cdtfa 410 d eSigning?

AirSlate SignNow offers several pricing plans that cater to different business needs for handling the cdtfa 410 d and other documents. Plans include features such as unlimited eSigning, templates, and integrations at competitive rates. You can choose a plan that fits your budget while ensuring compliance with the cdtfa 410 d requirement.

-

What features does airSlate SignNow provide for handling the cdtfa 410 d?

With airSlate SignNow, users benefit from features like customizable templates, automated workflows, and secure cloud storage, specifically for documents like the cdtfa 410 d. These features enhance the eSigning process, ensuring a seamless experience. Users can also collaborate with colleagues effectively and securely.

-

Can airSlate SignNow integrate with other software for cdtfa 410 d management?

Yes, airSlate SignNow easily integrates with various applications, enabling businesses to manage the cdtfa 410 d alongside other tools they use. This includes CRM systems, cloud storage services, and accounting software, creating a comprehensive workflow. Integration ensures that your tax documents are handled efficiently.

-

How secure is the eSigning process for the cdtfa 410 d with airSlate SignNow?

AirSlate SignNow prioritizes security with features like encryption, secure cloud storage, and audit trails for all eSigned documents, including the cdtfa 410 d. This means that your sensitive information is protected throughout the signing process. Users can trust that their submissions are handled with the utmost confidentiality.

-

What benefits can businesses expect when using airSlate SignNow for the cdtfa 410 d?

By using airSlate SignNow for the cdtfa 410 d, businesses can expect increased efficiency and reduced turnaround times for document processing. The platform’s user-friendly interface empowers team members to complete eSigning tasks quickly. Additionally, this cost-effective solution helps companies stay organized and compliant with tax regulations.

Get more for Cdtfa 410 D

Find out other Cdtfa 410 D

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free